Bears in view

We have been bogged down a bit this week at INK with administration combined with staff holidays. As a result, we have not been posting as much as we would like. But, I want to keep the ball rolling. Below is an excerpt from our US market insider sentiment commentary we provided to INK subscribers Wednesday. It is turning out to be timely.

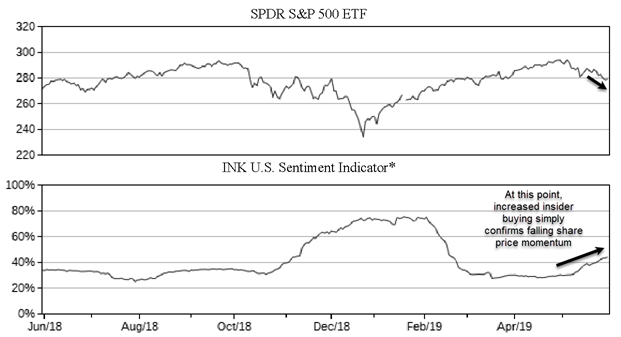

Last week our US sentiment indicator was trying to establish a low-level peak around 40% at which point there would be two stocks with key insider buying for every 5 with selling. However, the indicator continued to climb higher. An indicator peak would have signaled a period of upward momentum for stocks. Instead, we are left contemplating just the opposite. Instead of peaking, our INK US Indicator continued to move higher which suggests that broad downward momentum for share prices remains in full force.

As such, we have the US market back on watch for a downgrade to overvalued. While there will inevitably be some rallies over the next few weeks, we will be unconvinced of their durability until we see our indicator clearly peaking.

On the positive side, at the industry level our US Pharma Indicator has peaked suggesting a key level of support for the group is being formed. We are also keeping an eye on the Oil and Gas Exploration & Production (E&P) group. Insider buying is soaring, but we have not yet seen it put in a peak. That said, we appear to be nearing a potential bullish turning point for E&P stocks.

The full version of this report appeared on INKResearch.com.