Bed Bath & Beyond Bull Gap Sparks Heavy Options Trading

BBBY shorts may be using calls to guard against any more upside risk

BBBY shorts may be using calls to guard against any more upside risk

The shares of Bed Bath & Beyond Inc. (NASDAQ:BBBY) are soaring today, after the Wall Street Journal said three activist investors -- Legion Partners Asset Management, Macellum Advisors, and Ancora Advisors -- are preparing to launch a proxy fight against the retailer's board of directors. The investor group, which collectively owns a roughly 5% stake in BBBY, reportedly wants to replace the board, as well as CEO Steven Temares, who's been at the helm since 2003.

The report pointed to several concerns from this group, including rising costs and shrinking margins -- the latter of which has been the catalyst behind a recent bevy of bear notes. This morning, though, Bed Bath & Beyond stock has been upgraded at Raymond James (to "strong buy"), KeyBanc (to "sector weight"), and Loop Capital (to "hold"), with the latter expressing its belief that "the activist investment will serve as a positive catalyst for BBBY."

In reaction, BBBY stock is up 25.5% at $17.40. Options traders are in overdrive, too, with roughly 19,000 calls and 11,000 puts on the tape, almost 19 times what's typically seen at this point in the session.

The weekly 3/29 19-strike calls are seeing a lot of activity in early trading, and it looks like new positions are being purchased here for a volume-weighted average price of $0.22. If this is the case, breakeven for the call buyers at the close this Friday, March 29 -- when the weekly options expire -- is $19.22 (strike plus premium paid), a level not surpassed on a weekly closing basis since mid-July.

Given how heavily shorted BBBY is, it's possible shorts are using these out-of-the-money calls to hedge against any additional upside risk. The 43.31 million shares currently sold short represent 33.6% of the stock's available float, or 15.1 times the average daily pace of trading.

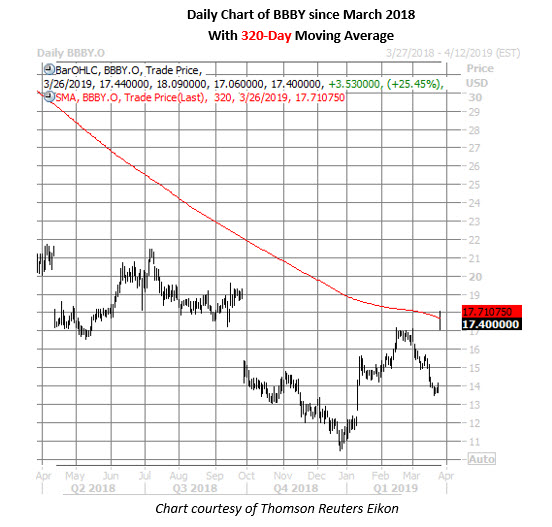

It's been a steady slide for Bed Bath & Beyond shares in recent years, with the retail stock well off its early 2015 highs near $80. And while today's bull gap has BBBY pacing for its best day since March 30, 2000, when the shares surged 30.2%, it's running out of steam near $18 -- home to its late-September pre-bear gap level and its 320-day moving average.