Being a Gold Bull Is Now Far Too Easy - Don't Be Deceived / Commodities / Gold and Silver 2021

Easy choices lead to a hard life (or atleast losses), and because gold’s downside move is delayed, it’s extremely easyto be bullish on gold right now.

It’s easy to get carried away by theday-to-day price action, and it’s even easier to feel the emotions that othermarket participants are feeling while looking at the same short-term priceaction. Right now, it’s tempting to be bullish on gold. It’s “easy” to bebullish on gold while looking at what happened in the last 1.5 months. Butwhat’s easy is rarely profitable in the long run.

“Easy choices – hard life. Hard choices –easy life” – Jerzy Gregorek

Let’s get beyond the day-to-day priceswings. The Fed has been keeping the interest rates at ultra-low levels formany months, and it has just pledged to keep them low for a long time. Theworld is enduring the pandemic, and the amount of money that entered the systemis truly astonishing. The savings available to investors skyrocketed. The USDIndex has been beaten down from over 100 to about 90. And yet, gold is not atnew highs. In fact, despite the 2020 attempt to rally above its 2011 high,gold’s price collapsed, and it invalidated the breakout above theseall-important highs. It’s now trading just a few tens of dollars higher than ithad been trading in 2013, right before the biggest slide of the recent years.

Something doesn’t add up with regard togold’s bullish outlook, does it?

Exactly. Gold is not yet ready to soar,and if it wasn’t for the pandemic-based events and everything connected tothem, it most likely wouldn’t have rallied to, let alone above its 2011 highsbefore declining profoundly. And what happens if a market is practically forcedto rally, but it’s not really ready to do so? Well, it rallies… For a while. Orfor a bit longer. But eventually, it slides once again. It does what it wassupposed to do anyway - the only thing that changes is the time. Everythinggets delayed, and the ultimate downside targets could increase, but overall,the big slide is not avoided.

Let’s say that again. Not avoided, butdelayed.

And this is where we are right now. Inthe following part of the analysis, I’m going to show you how the situation inthe USD Index is currently impacting the precious metals market, and how it’slikely to impact it in the following weeks and months.

Riding investors’ emotional rollercoaster, the love-hate relationship between financial markets and the USD Indexis quite absurd. However, with alternating emotions often changing like theseasons, the greenback’s latest stint in investors’ doghouse could be nearingits end. Case in point: with the most speculative names in the stock market enduring a springtime massacre, beneath the surfacelaughter has already turned into tears. And while gold, silver and miningstocks have been buoyed by the intense emotional high that’s only visible onthe surface, it’s only a matter of time before the veneer is lifted.

To that point, while I won’t romanticizethe USD Index’s recent underperformance, it’s important to remember thatextreme pessimism is often the spark that lights the USD Index’s fire.

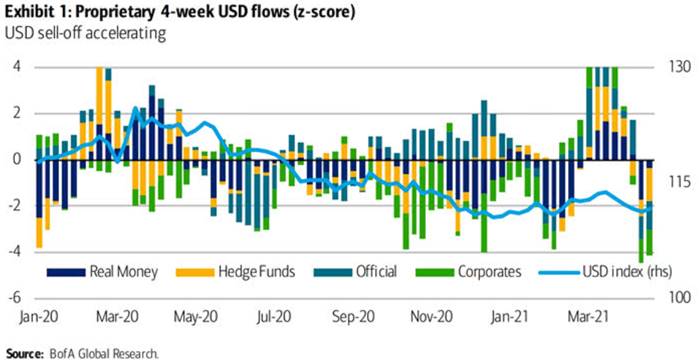

Please see below:

To explain, the bars above track variousmarket participants’ four-week allocations to the U.S. dollar, while thehorizontal light blue line above tracks the USD Index. If you analyze the rightside of the chart, you can see that fund flows have fallen off of a cliff inrecent weeks. However, if you analyze the behavior of the USD Index nearJan-20, Jan-21 and Mar-21, you can see that extremely pessimistic fund flowsare often followed by short-term rallies in the USD Index. As a result, withthe latest readings already breaching -4 (using the scale on the left side ofthe chart), USD-Index bears have likely already offloaded their positions.

What’s more, not only did the USD Indexend last week up by 0.10%, but the greenback invalidated the breakdown belowits head & shoulders pattern – which is quite bullish – and alsoinvalidated the breakdown below its rising dashed support line (the black linebelow). Moreover, while the greenback fell below the latter again on May 14,the short-term weakness is far from a game-changer as the breakdown is notconfirmed.

Please see below:

On top of that, with the USD Indexhopping in the time machine and setting the dial on 2016, a similar patterncould be emerging. To explain, I wrote on May 11:

Whilethe self-similarity to 2018 in the USD Index is not as clear as it used to be(it did guide the USDX for many weeks, though), there is also anotherself-similar pattern that seems more applicable now. One of my subscribersnoticed that and decided to share it with us (thanks, Maciej!).

Here’sthe quote, the chart, and my reply:

Thankyou very much for your comprehensive daily Gold Trading Reports that I am gladly admitting I enjoy a lot. While I was analyzingrecent USD performance, (DX) I have spotted one pattern that I would like tovalidate with you if you see any relevance of it. I have noticed the DX Indexperforming exactly in the same manner in a time frame between Jan. 1, 2021 andnow as the one that started in May 2016 and continued towards Aug. 16. Theinteresting part is not only that the patterns are almost identical, but alsotheir temporary peeks and bottoms are spotting in the same points.Additionally, 50 daily MA line is almost copied in. Also, 200 MA locationversus 50 MA is almost identical too. If the patterns continue to copythemselves in the way they did during the last 4 months, we can expect USD togo sideways in May (and dropping to the area of 90,500 within the next 3 days)and then start growing in June… which in general would be in line with youranalysis too.

Pleasenote the below indices comparison (the lower represents the period betweenMay-Dec 2016 and higher Jan – May 2021). I am very much interested in youropinion.

Thankyou in advance.

Andhere’s what I wrote in reply:

Thanks,I think that’s an excellent observation! I read it only today (Monday), so Isee that the bearish note for the immediate term was already realized more orless in tune with the self-similar pattern. The USDX moved a bit lower, but itdoesn’t change that much. The key detail here would be that the USDX isunlikely to decline much lower, and instead, it’s likely to start a massiverally in the next several months - that would be in perfect tune with my othercharts/points.

Iwouldn’t bet on the patterns being identical in the very near term, though,just like the late June 2016 and early March 2021 weren’t that similar.

Assoon as the USD Index rallies back above the rising support line, the analogyto 2016 will be quite clear once again –the implications will be even morebullish for the USDX and bearish for the precious metals market for the next several months.

Please note that back in 2016, there wereseveral re-tests of the rising support line and tiny breakdowns below it beforethe USD Index rallied. Consequently, the current short-term move lower is notreally concerning, and forecastinggold at much higher levels because of it might be misleading. I wouldn’tbet on the silverbullish forecast either. The white metal might outperform at the very endof the rally, but it has already done so recently on a very short-term basis,so we don’t have to see this signal. And given the current situation in thegeneral stock market – which might have already topped – silver and miningstocks might not be able to show strength relative to gold at all.

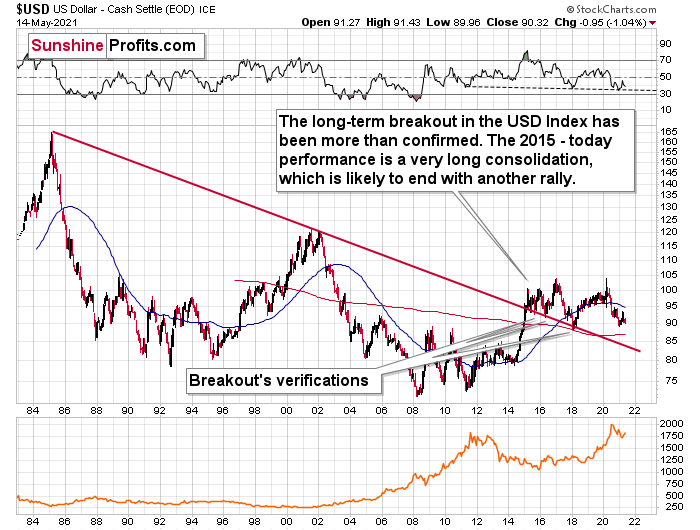

If that wasn’t enough, the USD Index’s long-term breakout remainsintact . And when analyzing from a bird’s-eye view, the recent weakness islargely inconsequential.

Please see below:

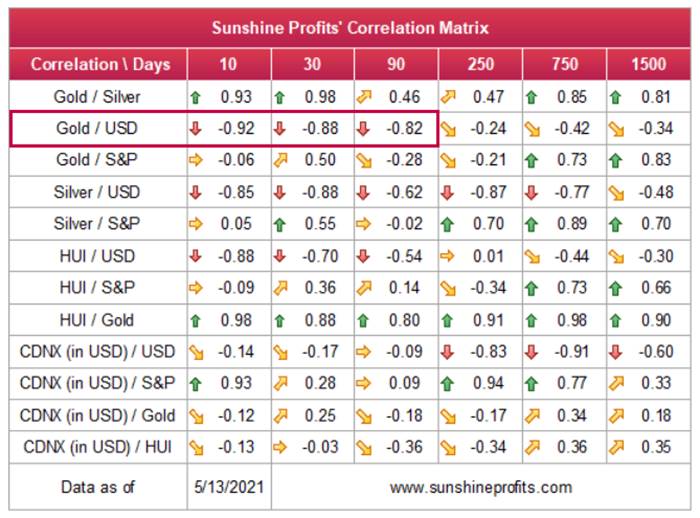

Moreover, please note that the correlationbetween the USD Index and gold is now strongly negative (-0.92 over thelast 10 days) and it’s been the case for several weeks now. The same thinghappened in early January 2021 and in late July – August 2020. These were majortops in gold.

The bottom line?

After regaining its composure , ~94.5 is likely the USD Index’s firststop. In the months to follow, the USDX will likely exceed 100 at some pointover the medium or long term.

Keep in mind though: we’re not bullish onthe greenback because of the U.S.’ absolute outperformance. It’s because theregion is doing (and likely to do) better than the Eurozone and Japan, and it’sthis relative outperformance thatmatters , not the strength of just one single country or monetary area.After all, the USD Index is a weighted average of currency exchange rates andthe latter move on a relative basis.

In conclusion, with investors and the USDIndex likely headed toward reconciliation, the greenback’s medium-termprospects remain robust. With macroeconomic headwinds aligning with technicalcatalysts, investors’ risk-on inertia is already showing cracks in itsfoundation. And with the USD Index considered a safe-haven currency, a reversalin sentiment will likely catapult the USD Index back into the spotlight.Moreover, with gold, silver and mining stocks often moving inversely to theU.S. dollar, the mood music will likely turn somber across the precious metalsmarket. The bottom line? With the metals’ mettle likely to crack under theforthcoming pressure, their outlook remains profoundly bearish over the nextfew months.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the target for gold that could be reached in the nextfew weeks. If you’d like to read those premium details, we have good news foryou. As soon as you sign up for our free gold newsletter, you’ll get a free7-day no-obligation trial access to our premium Gold & Silver TradingAlerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.