Bet On Lowe's Stock To Go Higher Soon

Lowe's pullback last week could have bullish implications

Lowe's pullback last week could have bullish implications

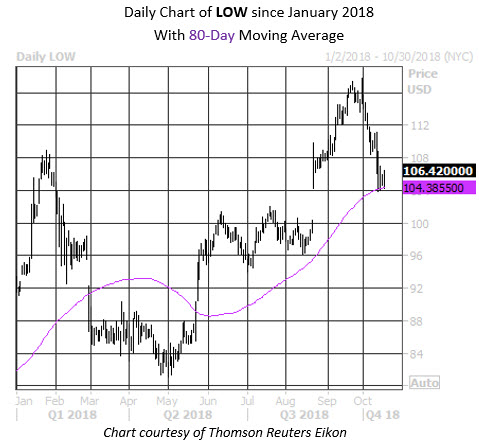

Last week, Lowe's Companies, Inc. (NYSE:LOW) moved 3.9% lower with the broad market sell-off, extending its weekly losing streak to three. In the aftermath of Hurricane Michael, though, home repair supplies could be in high demand, which would drive the stock higher. As such, the recent pullback puts LOW in territory of a trendline with historically bullish implications.

More specifically, LOW is now within one standard deviation of its 80-day moving average, after a lengthy stretch above this trendline. In the last three years, there have been six other signals of this kind, after which the shares were up an average of 4.39% a month after, per data from Schaeffer's Senior Quantitative Analyst Rocky White. At last check, Lowe's stock was up 1.8% at $106.42, so a similar rebound would have the equity erasing its losses from the past week.

The home improvement retailer raced to a record high of $117.70 on Sept 28, and boasts a 30% lead year-over-year. As of yesterday, the stock's 14-day Relative Strength Index (RSI) sat at 32 -- on the cusp of oversold territory, suggesting today's bounce may have been in the cards. Not to mention, the stock historically tends to outperform in the fourth quarter.

Short-term options traders, meanwhile, have been more put-skewed than usual, per LOW's top-heavy Schaeffer's put/call open interest ratio (SOIR) of 1.39 -- in the 100th annual percentile. An unwinding of pessimism in the options pits could also fuel further gains.

Those wanting to bet on the rebound for Lowe's may want to consider a premium-buying options strategy. The stock's Schaeffer's Volatility Scorecard (SVS) reading arrives at a lofty 96 out of a possible 100, which shows the equity has tended to make larger-than-expected moves on the chart, compared to what the options market has priced in.