Bet on This Biotech Before Earnings

The firm will report its third-quarter earnings next week

The firm will report its third-quarter earnings next week

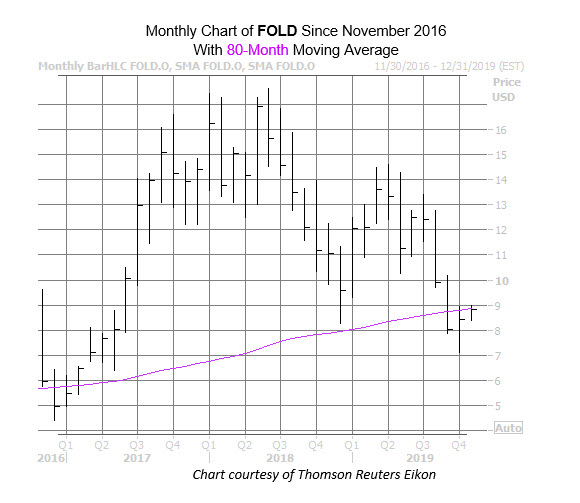

Biopharmaceutical name Amicus Therapeutics, Inc. (NASDAQ:FOLD) is expected to disclose its third-quarter earnings report before the open next Monday, Nov. 11. The stock is inching higher ahead of the event, up 1.3%, at last check. What's more, a long-term sign of technical support has just emerged, too, by way of FOLD stock's 80-month moving average.

Specifically, Amicus Therapeutics shares are within one standard deviation of their 80-month moving average, after spending a lengthy stretch north of the trendline. In fact, during the past 15 years, FOLD has made similar retreats to this trendline five other times, per data from Schaeffer's Senior Quantitative Analyst Rocky White. Three months out, FOLD was higher each time, averaging a whopping 21.35% return. At its current perch of $8.80, a similar increase would put the equity at $10.68 -- a level the stock hasn't reached since early August.

However, it should be noted that earnings history favors the bears. In the last two years, the equity has seen only one positive next-day earnings reaction, and has averaged a 5.3% post-earnings swing, regardless of direction. This time around, the options market is pricing in an even bigger next-day move of 9.8%.

Regardless, analyst sentiment has been quite optimistic, with 10 of the 11 in coverage calling Amicus a "strong buy." Plus, the consensus 12-month target price sits all the way up at $17.95, which is more than double FOLD's current levels, and represents a region not touched on the charts since 2015.

Options traders have been incredibly bullish too, with an eyebrow-raising 24.5 calls purchased for every put during the past 10 days at the the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio stands higher than 81% of all other readings from the past year, suggesting that this heavy preference for calls is unusual. However, it should be noted that FOLD's options volume runs very light on an absolute basis.

Lastly, while short interest has started to unwind, these pessimistic positions still make up 11.8% of the stock's available float. What's more, at FOLD's average pace of trading, it would take over seven days to buy back all these bearish bets, which could put some wind at the equity's back, should even more of these shorts start to jump ship.