Beware, Gold Bulls - That's the Beginning of the End / Commodities / Gold and Silver 2021

Strong words, I know. Can I back them up? Well,what we see now – looking at various markets – does indeed look like the startof gold’s end

Strong words, I know. Can I back them up? Well,what we see now – looking at various markets – does indeed look like the startof gold’s end

– The Oracle in Matrix Revolutions, 2003

The counter-trend rally has probably justended, and the final big downswing has probably just started. This “beginning”of the final downswing is, in my opinion, the beginning of the final part ofthe prolonged sideways trend in gold that started in 2011. In the case ofsilver and mining stocks, that’s likely the final part of the decline thatstarted back then.

These are strong words – I know. Let’ssee if I can back them up.

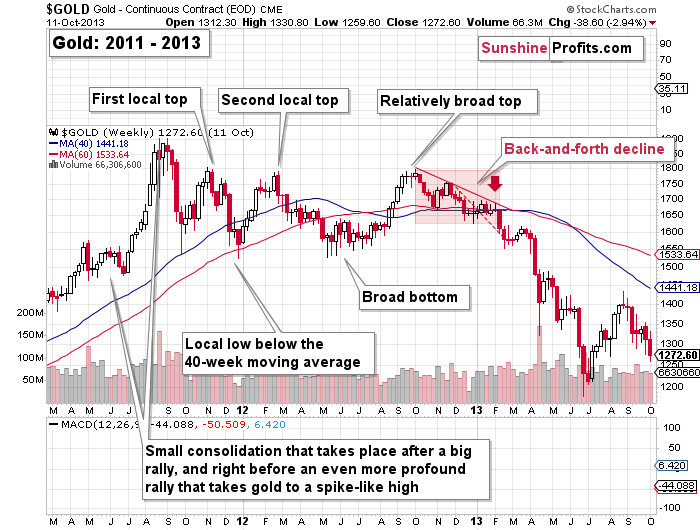

First of all, I’ve been writing about theanalogy between 2013 and now for many weeks now, and you can read about theseanalogies in thisweek’s flagship analysis. This key link remains intact. The chartsgiven below confirm that from the short-term point of view.

In yesterday’s analysis, I commented onthem in the following way:

Goldjumped to its 40-week moving average and to the declining red line based on theprevious short-term highs. Let’s check the context – what happened in 2013?

Rightbefore moving to its previous medium-term lows, gold moved to its declining redresistance line that was also very close to its 40-week moving average. Imarked this situation with a red arrow on both charts.

Asyou can see, nothing changed. The link between 2013 and now remains completelyintact and its implications remain very bearish.

On a very short-term basis (yesterday’ssession), silver outperformed gold and moved above its declining resistance line.

While gold moved higher by 0.18%, silvermoved higher by 1.32%. I wrote this numerous times, and I’m going to writeabout this again today – silver’s very short-term outperformance of gold is nota bullish sign but a bearish one, and being aware of that is one of the moreuseful goldtrading tips.

As far as silver’s “breakout” isconcerned, it’s nothing bullish either. When you look at the August top, you’llsee that it also happened after a small, short-term breakout. The same with theearly-September high. We’re seeing the same thing once again, and theimplications are, once again, bearish.

On the bottom part of the above chart,you can see the HUI Index – a proxy for goldstocks. It moved notably higher recently, and it even moved aboveits March low, but it’s still far from its November 2020 low. So, taking abroader point of view, gold stocks are still the weakest part of the preciousmetals sector right now.

Moreover, please note that gold failed tohold its tiny move back above $1,800 – it was quickly invalidated. At themoment of writing these words, gold is trading at about $1,785.

Also, speaking of mining stocks, let’stake a look at what the juniors did.

They rallied profoundly, which by itselfmight not be the most exciting thing you read today, especially given our shortpositions in them (let’s keep in mindthat we took profits from the previous short position in the junior miners onSep. 28, just one day before the bottom), but it is quite interesting whenyou consider how high the RSI is right now, and when in the past both the RSIand the GDXJ itself were trading at today’s levels.

That was in late February 2020. Backthen, juniors were after a short-term rally from below $40, and they toppedabove $44. The RSI approached 70 — just like what we see today. And then theGDXJ declined below $20 in less than a month. I think the decline will takeplace longer this time, but the outlook is still extremely bearish.

By the way, the last time when the RSIwas as high as it is right now was… right at the 2020 top. That’s yet anotherindication for goldthat signals that the top is in or at hand.

But why shouldn’t gold, silver, andmining stocks rally even higher before turning south? Not only are theyoverbought on their own, but they actually have a good reason to reverse, whichis coming from the USD Index.

The USD Index moved back to its previous2021 lows and its rising support line, and then it moved back up. It’s alsobeen moving higher in today’s pre-market trading.

This tells us that the corrective flagpattern might already be over and – sincethe support held – the next move higher is quite likely just about tostart, or it’s already underway.

Even though the USD’s move higher is so far verytiny, gold and silver are down by about 0.5% today. Is the top in the PMs in?This seems quite likely to me. What we see right now – especially in light ofthe analogy to Feb. 2020 in the GDXJ – doesindeed look like the beginning of the end.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’dlike to read those premium details, we have good news for you. As soon as yousign up for our free gold newsletter, you’ll get a free 7-day no-obligationtrial access to our premium Gold & Silver Trading Alerts. It’s really free– sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.