BHP Billiton jumps on the electric car bandwagon

World's largest mining company BHP Billiton (ASX, NYSE: BHP) (LON:BLT) sees electric cars as a major ally in boosting demand for copper, by far the poorest performer this year on the London Metal Exchange.

The conventional internal combustion engine used in motor vehicles typically contains about 20 kilograms of copper, about half the total used in a hybrid vehicle, Vicky Binns, vice president, marketing minerals writes. But an electric vehicle (EV) doubles that again, to about 80kgs.

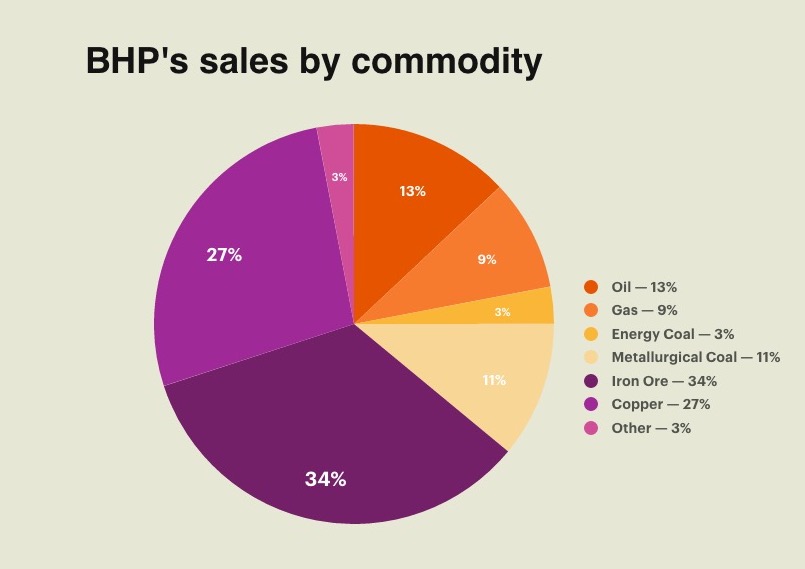

It means that an additional 8.5 million tonnes of copper will be needed each year by 2035, the company estimates. This is great news for BHP, as copper accounts for 27% of its commodity sales, second after iron ore at 34%.

"As a company, we have made no secret of our liking for copper in the medium to longer term," Binns says. "We anticipate it will be the first mineral commodity in our portfolio to return to fundamental market balance."

Source: BHP Billiton's website.

Today, there are about 1.1 billion light vehicles globally and about 1 million of those are EVs, BHP estimates. According to the miner, there will be about 140 million EVs on the roads, or 8% of the total fleet of 1.8 billion by 2035.

"As a powerful offset to substitution, copper is superbly placed to benefit from expanded end use demand on the back of observed trends in technology, which we expect will become material from around the middle 2020s," Binns predicts in her post.

She believes the while the combination of market size, diversified demand and long-term supply constraints should especially benefit copper; nickel, manganese and cobalt should also see significant volume growth. Aluminum, in turn, will continue to benefit from the push to make cars lighter.

While other industrial metals and steelmaking raw materials have jumped in value in 2016, copper has only advanced 4% this year. The copper price hit six-year lows in January following a 26% decline in 2015, though it touched a one-month high Tuesday, with futures exchanging hands for $2.2170 per pound ($4,887 a tonne).