BHP Billiton to slash copper production costs, increase output

BHP and Rio Tinto's Escondida copper mine in Chile's Atacama Desert is the world's largest copper-producing mine.

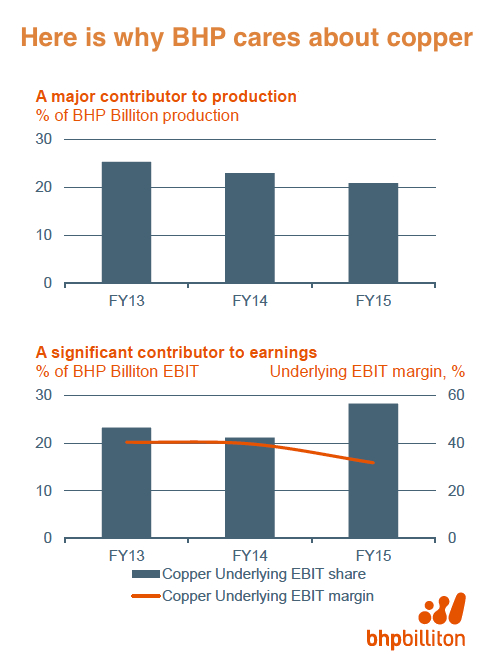

BHP Billiton (ASX:BHP), the world's largest mining company, is making a bold bet on copper by deciding to ramp up output while slashing production costs.

The company's copper boss, Daniel Malchuk, said Tuesday that BHP expects to lower production costs to $1.08 per pound during the 2017 financial year, from a projected $1.21 per pound in the year ending June 2016.

Reaffirming the miner's optimism when it comes to the long-term future of the industrial metal, Malchuk noted that while near-term oversupply is weighing on current prices, BHP counts on attractive long-term fundamentals that continue to support a positive outlook for copper..

"Over this period, the release of latent capacity across the portfolio will also help annual group copper production grow to approximately 1.7 million tonnes at very low cost," he said in a presentation to analysts as BHP hosts a three-day tour of its Chile copper assets.

Source: Presentation by Daniel Malchuk, BHP Billiton Copper President.

The executive added that BHP trusts that its copper business will gain momentum over the next two years with lower costs and higher production across its major assets, such as the Escondida mine in Chile, the world's largest copper producing mine, and its Olympic Dam in Australia.

"At Escondida, no major investment is required to sustain an average 1.2 million tonnes per annum of production capacity for the decade from the 2016 financial year, and the asset is expected to generate strong free cash flow through the cycle," said Malchuk.

He added that unit costs at the Olympic Dam are expected to fall 48% by the end of the 2017 financial year to US$1.00 per pound, which would reposition the asset at the low end of the cost curve.

Copper prices cratered in November by more than 10%, the steepest monthly loss since January, and have fallen about 27% so far this year.