BHP brands Elliott's overhaul proposals as flawed, costly

BHP Billiton (ASX: BHP) (LON:BLT) has come up with a detailed response to activist investor Elliott Management, which issued a 10-page letter on Monday calling for major changes at the world's largest mining company.

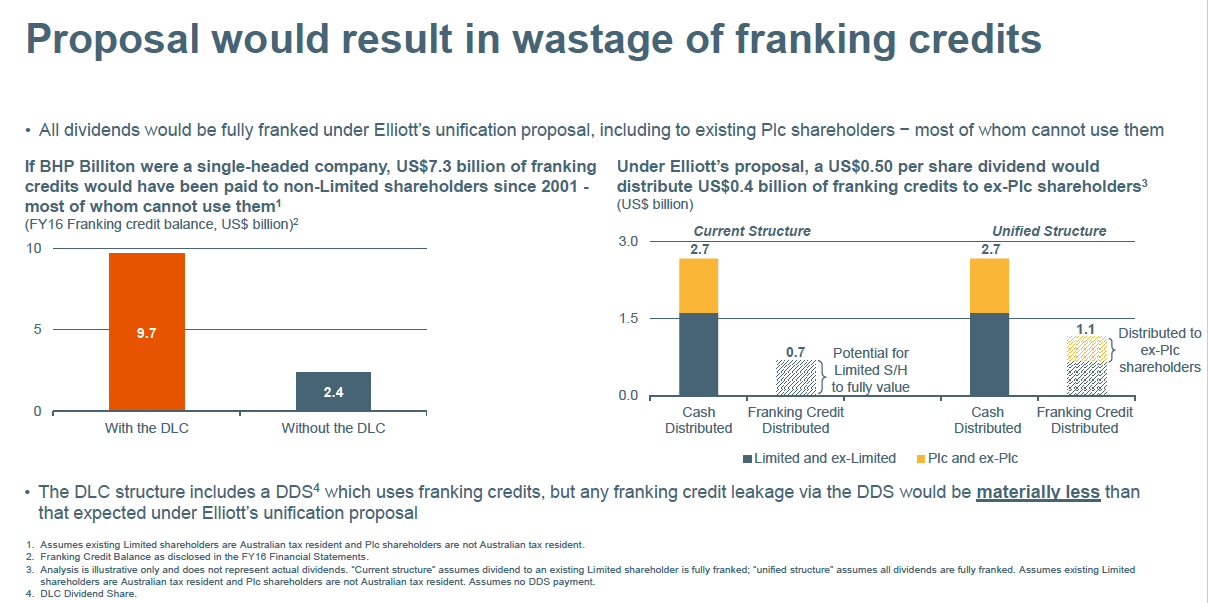

In its extensive presentation, the Melbourne-based miner said the minor shareholder's proposal to overhaul BHP's structure and spin off its US petroleum division was flawed and would involve costs far beyond any benefits.

Elliott's proposals to break up BHP are riddled with "major flaws" and could end up costing far more to implement than they would save, the company said."The elements of the Elliott proposal as described to the board would not be in the long-term interest of shareholders," chief executive Andrew Mackenzie said in a statement Wednesday.

"I cannot overstate my strong belief that BHP Billiton is on the right track," he noted on a webcast with analysts.

BHP's response offered no counter proposal to unlock shareholder value, saying the figure in Elliott's proposal was exaggerated. The hedge fund manager had said that spinning off about $22 billion of BHP's US oil assets and listing them in New York, could lift the value of the Australia-based investors by 48.6% and by 51% for UK-based shareholders.

The miner, instead, highlighted that oil was a "core" element in the company's strategy. In the past year, BHP has in fact been injecting money into its oil division. In October, BHP announced plans to invest as much as $5 billion in its petroleum business and also said it was considering additional investments of as much as $2.5 billion to expand existing projects and to possibly acquire new assets.

In February, the company revealed it had swung from loss to a $3.2 billion profit in the first half of the 2017 financial year. It also announced it was rewarding investors with an interim dividend of 40 US cents a share, higher than the 30 cents a share mandated by its policy.

You can read BHP's detailed response to Elliott's here.

Source: BHP Billiton's review of Elliott proposals, April 12, 2017.