BHP resumes expansion plans, says not waiting for prices to recover

Andrew Mackenzie says BHP won't wait for prices to recover, and insists the giant miner continues to drive down costs. (Image from archives)

World's largest mining company BHP Billiton (ASX, NYSE:BHP) (LON:BLT) has decided to resume investing in projects aimed to boost production capacity, particularly in copper and oil, even if commodity prices have not fully recovered yet.

Speaking at the Global Metals, Mining and Steel Conference in Miami, chief executive Andrew Mackenzie said the company will work towards making costs fall to half the level of five years ago and targeted a further $3.6 billion in productivity gains by the end of 2017.

The growth plan represents a major strategic shift from the miner's austere approach of the last four years brought on by a sustained rout in commodity prices.

"Although we remain confident in the long term outlook for commodities, we are not waiting for prices to recover,'' Mackenzie said in the presentation.

"We have everything we need in our portfolio right now to significantly increase the value of the company," he added.

Source: Andrew Mackenzie's presentation, May 10, 2016.

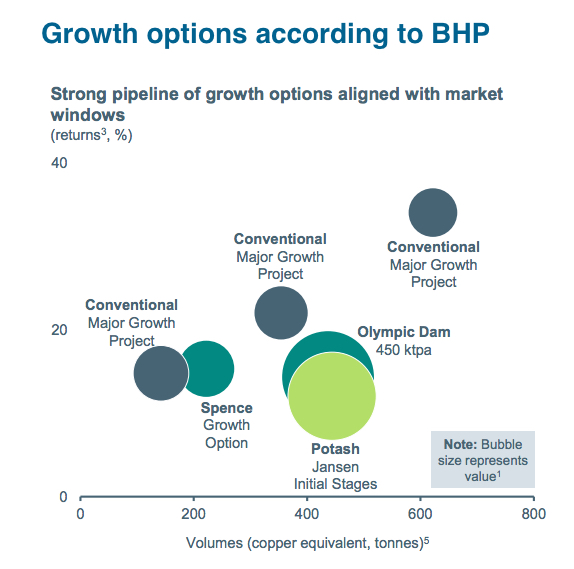

By investing in mining assets, Mackenzie said that BHP could add "over one million tonnes of copper equivalent capacity at a total capital cost of less than $1.5bn, or more that 10% of the company's current output."

BHP also plans to make an investment decision on its Mad Dog 2 and Spence oil and gas projects within 18 months.

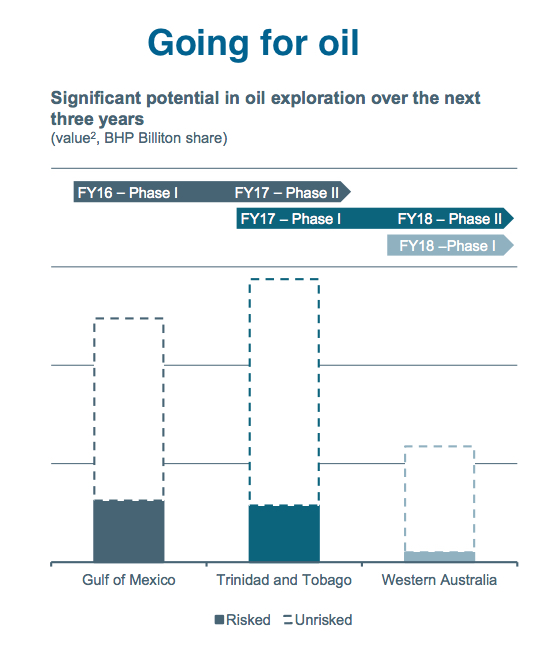

"We are increasing our exploration activity to take advantage of falling costs as others pull back," Mackenzie noted, adding the firm has embarked upon one of its "most significant" oil exploration programs, accelerating activity in its three priority basins - Gulf of Mexico, Trinidad and Tobago, and Western Australia.

Source: Andrew Mackenzie's presentation, May 10, 2016.

BHP's market capitalization is down to $70bn, less than one-third of its level at the peak of the commodities boom. Its fresh commitment to growth seeks to gain back the confidence of investors, who had to deal with a 46% drop in the price of BHP's London-listed shares over the past 12 months, while it also cut its dividend at its interim results in February, ending 15 years of steady or increasing payouts.

The strategic shift comes as rival Rio Tinto (LON:RIO) has also put expansions back on the agenda, recently committing to $7.2 billion in new projects.