BHP to sell Chile's Cerro Colorado copper mine to equity fund EMR

World's No.1 miner BHP (ASX:BHP) is selling its Cerro Colorado mine, its smallest Chilean copper operation, to EMR Capital Advisors Pty, an Australian private equity firm that invests in natural resources in a cash deal worth $230 million.

The Melbourne-based mining giant said in addition to the cash, it will receive $40 million in proceeds from the post-closing sale of the mine's copper inventory and a contingent payment of up to $50 million to be paid in the future, depending on copper price performance.

Cerro Colorado runs out of ore in 2023, but BHP has said the asset has options to expand its lifespan for decades.BHP decided to offload its Cerro Colorado mine in May last year, as part of chief executive Andrew Mackenzie's bid to focus on large assets in commodities such as iron ore, copper and oil.

Cerro Colorado, which is expected to fetch at least $800 million, runs out of ore in 2023, the same year its environmental licence expires.

The operation, located in Chile's far north, produced about 65,000 tonnes of copper in the year to June 2017. BHP's flagship mine Escondida, located in the same country, yields more than 10 times that amount annually.

The asset has options that could potentially expand its lifespan for decades, but analysts agree it makes more sense for another owner to take it over and put in the work to extend its life, as BHP focuses only on major operations across its key commodities.

EMR is not foreign to mining. Last year, it bought the Lubambe copper mine in Zambia and in March partnered with Indonesia's PT Adaro Energy on a $2.3 billion deal for Rio Tinto's Kestrel coal operation in Australia.

The deal is expected to close in the fourth quarter of 2018.

Copper supply crunch to benefit EMR

The new owner of Cerro Colorado could benefit from a looming market deficit, which will drive prices higher early next decade on the back of increasing demand.

The higher demand is expected to come from a global push towards green energy, which will need small-scale electricity generation units to be connected to the grid and so be able to support an expanding electric vehicles market.

Data released by the International Copper Association (ICA), an industry-funded body, shows more than 40 million charging ports will be needed over the next decade, consuming an extra 100,000 tonnes of copper a year by 2027.

From those stations, at least 3 million will be built in China by 2030, according to the study.

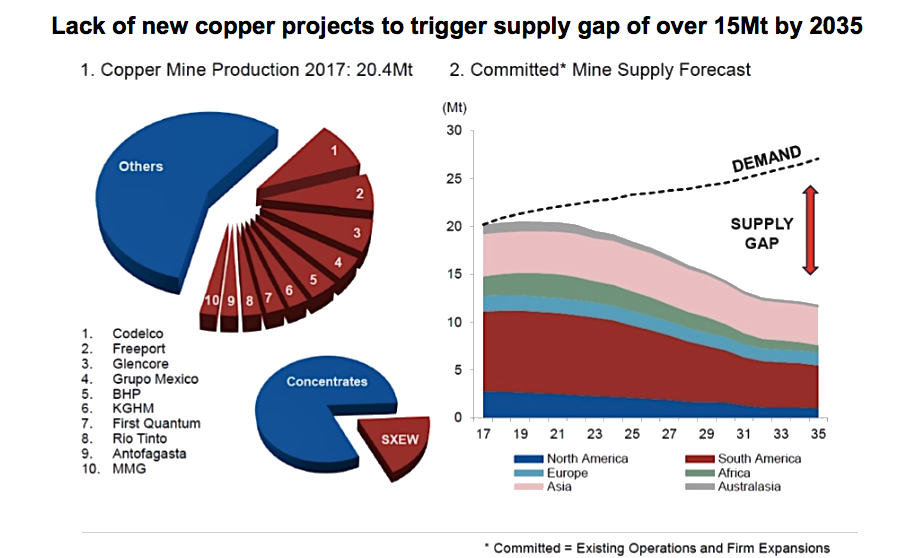

Graph courtesy of Hamish Sampson | Analyst at CRU's Copper Team.

Consumption from the car industry will also weigh on demand, but later. An average gasoline-powered car uses about 20 kg of copper, mainly as wiring. A hybrid needs about 40 kg and a fully electric car has roughly 80 kg of copper (176 pounds).

It means that, in the next decade, global copper demand will increase between 3 and 5 million tonnes, experts predict. Once electric vehicles become popular, they estimate demand to reach 11,000,000 tonnes of new copper for EV's alone

The supply deficit could be of over 900,000 tonnes in 2021 and 2022, Colin Hamilton, managing director of commodities research at BMO Capital Markets told MINING.com earlier this year. He attributed the expected shortfall to a slow growth in supply due to deteriorating ore grades in major producing countries, lack of new significant discoveries and very low investment in exploration.