BHP urges miners to create global body to oversee tailings dams

BHP, the world's largest mining company, has urged peers to create an independent international body in charge of overseeing the construction, integrity and operations of tailings dams, which storage mining waste, following the second collapse of a dam in Brazil in the past three years.

"As an industry, we now have to redouble our efforts to make sure events like this simply cannot happen," Chief Executive Officer Andrew Mackenzie said Tuesday during a conference call after BHP reported half-year results.

CEO Andrew Mackenzie said it was too early to determine the impact Vale's recent tailings dam disaster will have on efforts to restart BHP and the Brazilian miner's jointly owned Samarco mine.Mackenzie said it was too early to say what impact the recent Vale tailings dam disaster in the Brazilian town of Brumadinho would have on efforts to restart BHP and Vale's jointly owned Samarco mine, shut down since November 2015 after a dam collapse killed 19 people.

The dam burst at C??rrego do Feij??o left nearly 170 people dead and at least 140 missing. Both dams were built using the "upstream" system, the cheapest but generally regarded as the riskiest method, which has long been banned in earthquake-prone mining countries such as Chile and Peru because tailings are used to gradually build the embankment walls, making a dam susceptible to damage and cracks.

In response, Brazil has banned new upstream mining dams and ordered the decommissioning of upstream waste dams by August 15, 2021.

"In this way, [Ag??ncia Nacional de Minera????o (ANM)] proposes some measures that will safeguard the Brazilian society from possible ruptures of these structures, allowing mining to continue playing a vital role for the development of society and the many mining municipalities that we have in the country," Brazil's mining agency said in a statement.

What BHP says now is that it doesn't have capacity to raise shipments into the global iron ore market, which has been thrown into turmoil by the tragedy.

"We don't have any additional capacity to put into this market," Mackenzie said. "We've been very clear as a company that we maximize the production from what we have already installed, we are not holding anything back."

Profit drop

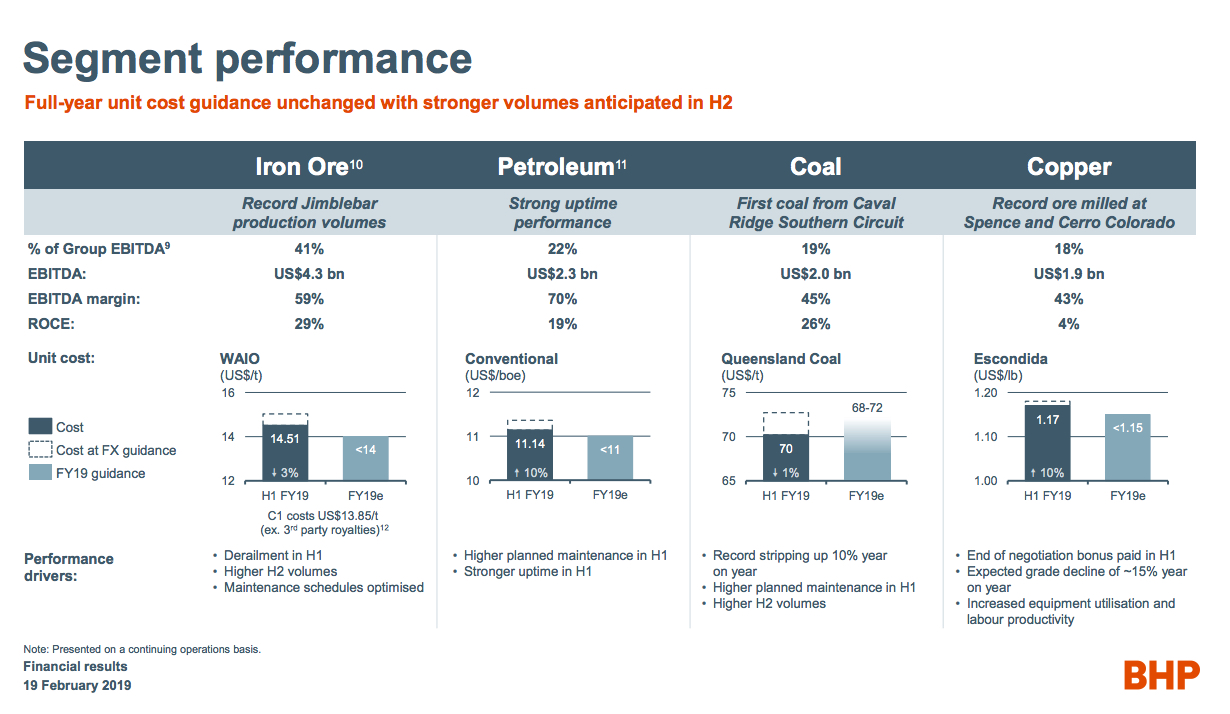

BHP's comments came on the same day the mining giant reported first-half 2018 profit had fallen as a decline in copper earnings and a series of operational issues boosted costs and resulted in missed opportunities for cost savings.

Underlying attributable profit from continuing operations fell to $4.03 billion for the first half of 2018, down 8% from $4.4 billion for the first half of 2017. This was weaker than the $4.2 billion expected by analysts.

BHP revealed a $835 million-hit during the December half related to a series of unplanned operational issues.Total revenue was flat and it made a $300 million loss after it sold its US oil and gas business to energy giant BP for $10.4 billion last year.

BHP revealed a $835 million-hit during the December half related to unplanned production outages at its Olympic Dam facility in South Australia, an iron ore train derailment at its West Australia operations, and fires at its Spence plant in Chile and its Nickel West smelter.

The effect of those events was partially offset by the build-up of inventory levels during the outages, worth about $160 million, as well as record volumes at Jimblebar and South Walker Creek, the company said.

Iron ore still the king

BHP's biggest revenue generator, iron ore, continued to the miner's top money earner, with a rise in revenue to $7.2 billion.

Prices for the steel-making material have climbed more than 17% in the wake of Brazil's dam disaster as a crackdown by regulators is expected to severely impact Vale's iron ore output.

BHP said it cut net debt to $9.9 billion during the period, below its $10 to $15 billion target and said it'd give shareholders an interim dividend of $0.55 per share, the same as last year.

From: BHP's half year ended 2018 results presentation.

Click here for complete coverage of the dam burst at Vale's C??rrego do Feij??o mine.