Big mining's age of austerity far from over

While precious metals (with the exception of palladium) have suffered a deep sell-off since the surprise outcome of the US presidential elections, the rally in industrial metals appear intact.

In a new report BMI Research, a unit of Fitch, says the gains in metal prices this year is set to continue in 2017 thanks to infrastructure spending in China and to some extent in the US and the UK, but at a much more modest pace.

With limited access to capital, companies will try to improve their liquidity and financial standing, as well as look towards alternative sources of financeDespite its relatively sanguine view on metals prices BMI expects the world's largest diversified miners to continue to tighten their belts.

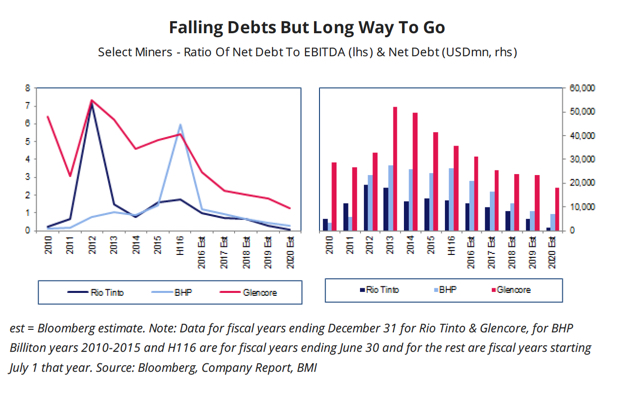

Top miners built up massive debts through the boom years and while most have been successful in reducing debt "there is still a long way to go to reduce debt to healthy levels" says BMI:

Miners like Glencore have outperformed others in this task, while BHP has underperformed. Additionally, as the risk of default has increased, banks are only extending trade and long-term financing at an increased cost to those mining and metals companies with sufficient security to back the debt.

With limited access to capital, companies will try to improve their liquidity and financial standing, as well as look towards alternative sources of finance. Although commodity prices have now bottomed, volatility will continue gripping the sector especially as the world's largest consumer and producer of most metals and ores, China, tries to balance economic growth with reforms in its oversupplied sectors.

As such, miners will focus on maximising their free cash flows in order to bolster themselves from unexpected price and demand movements. This will be done by reducing costs, dividend cuts, and lower capital expenditures going forward.

While paying down debt will remain a priority BMI expects the asset sales undertaken by a large proportion of top tier mining companies over the past couple of years to end. BMI says miners have already shed their non-core assets by FY2016 and higher revenues from improving commodity prices will incentivise less disposal of assets forward.

Freeport Mcmoran Inc has announced in October 2016 that the company will no longer sell their mining assets. Similarly, Vale and Anglo American will also be holding back asset sales unless they fetch attractive prices thanks to better commodity prices reducing pressure on balance sheets.