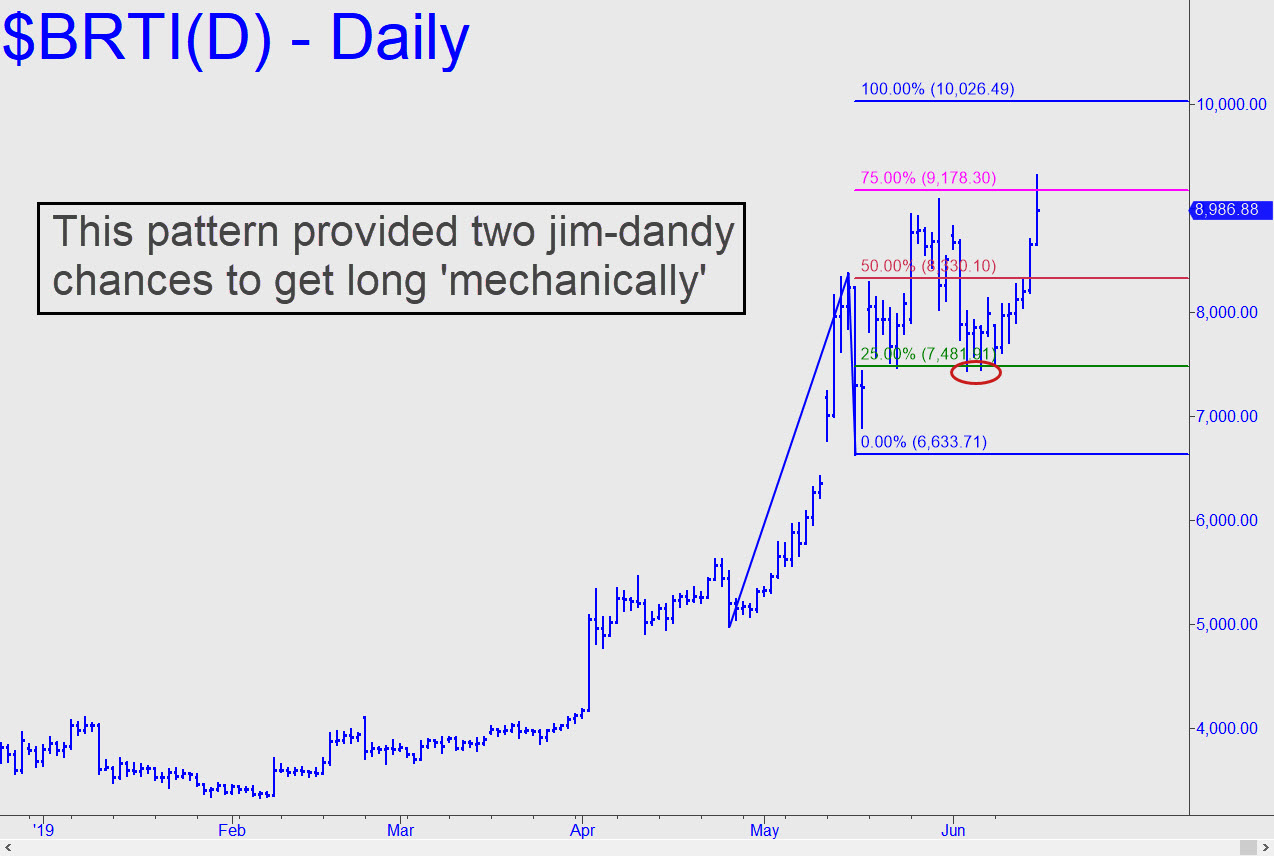

Bitcoin Is Back! Here Are Targets to Shoot At

Click Chart to enlarge

I am resuming bitcoin coverage and will treat it as nothing special, since that's the best way to be objective when reading its charts. The one shown provided two good opportunities to get long 'mechanically' at 7481, so we'll assume that its target at 10,026 will prove just as useful as a minimum upside objective. We'll talk about buying a pullback to the red line (p=8330) if it should occur, but for now just keep in mind that 'mechanical' set-ups are well suited to trading vehicles that move as violently as this one. Not to get cryptocurrency fans all excited, but the weekly chart implies that 11492 will be reached and that 19850 would be in play if the lower number, a Hidden Pivot resistance, is exceeded decisively. (Note: The $BRTI symbol is a CME trading product that reflects the tightest bid/asked spreads for bitcoin in real time.)

Start a free two-week trial subscription by clicking here. Make the Trading Room and Coffee House your first stops. There you will meet veteran traders from around the world.