BlueRock Counts Cost of Coronavirus

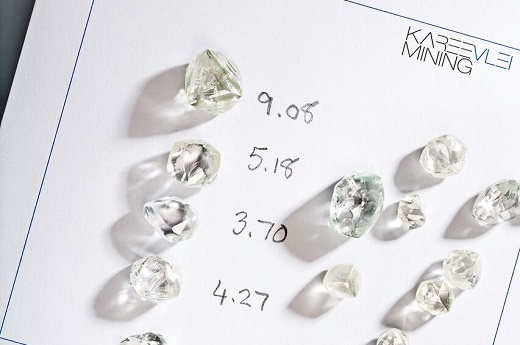

RAPAPORT... The coronavirus cost BlueRock Diamonds GBP 550,000 ($690,000) as sales slumped and the closure of its Kareevlei mine added to its expenses, the company reported Monday.The amount includes an estimated GBP 100,000 ($125,000) of lost revenue, with the weak market forcing the company to withdraw its rough goods from a tender in March, and offer a 15% discount in June, it explained. It also factors in costs of GBP 150,000 ($187,200) from keeping the Kareevlei deposit in South Africa on care and maintenance during the lockdown. To limit the rise in expenses, BlueRock reduced board salaries and deferred payments to certain service providers.Meanwhile, restarting mining operations set the company back GBP 300,000 ($375,400), as all suppliers demanded full payment of outstanding bills.BlueRock paused production on March 26 due to a national lockdown in South Africa, and recommenced output in May after the government allowed the mining sector to reopen."The full effect of Covid-19 on profits is still uncertain and depends upon how quickly diamond prices recover, the possibility of a further shutdown, and how soon we will now be able to implement our delayed expansion plans," the company said.Revenue almost tripled to GBP 4.1 million ($5.1 million) in 2019 from GBP 1.4 million ($1.8 million) in 2018 as the company hiked production at the mine. However, the March 2020 sale attracted "speculative buyers only," while the June tender saw the company sell the available goods to a private buyer for $290 per carat - 15% below pre-pandemic prices.Image: Rough diamonds. (BlueRock)

RAPAPORT... The coronavirus cost BlueRock Diamonds GBP 550,000 ($690,000) as sales slumped and the closure of its Kareevlei mine added to its expenses, the company reported Monday.The amount includes an estimated GBP 100,000 ($125,000) of lost revenue, with the weak market forcing the company to withdraw its rough goods from a tender in March, and offer a 15% discount in June, it explained. It also factors in costs of GBP 150,000 ($187,200) from keeping the Kareevlei deposit in South Africa on care and maintenance during the lockdown. To limit the rise in expenses, BlueRock reduced board salaries and deferred payments to certain service providers.Meanwhile, restarting mining operations set the company back GBP 300,000 ($375,400), as all suppliers demanded full payment of outstanding bills.BlueRock paused production on March 26 due to a national lockdown in South Africa, and recommenced output in May after the government allowed the mining sector to reopen."The full effect of Covid-19 on profits is still uncertain and depends upon how quickly diamond prices recover, the possibility of a further shutdown, and how soon we will now be able to implement our delayed expansion plans," the company said.Revenue almost tripled to GBP 4.1 million ($5.1 million) in 2019 from GBP 1.4 million ($1.8 million) in 2018 as the company hiked production at the mine. However, the March 2020 sale attracted "speculative buyers only," while the June tender saw the company sell the available goods to a private buyer for $290 per carat - 15% below pre-pandemic prices.Image: Rough diamonds. (BlueRock)