Boeing, Verizon Fuel Big Gains for Dow

Boeing popped on positive trade headlines, while subscriber growth boosted Verizon

Boeing popped on positive trade headlines, while subscriber growth boosted Verizon

Positive U.S.-China trade headlines fueled a risk-on session today, with negotiators extending talks to a third day. The Dow climbed 256 points, boosted by a strong gain for trade-sensitive stock Boeing (BA). Verizon (VZ) also created tailwinds for the blue-chip index, thanks to impressive subscriber growth. This helped offset struggling bank stocks and anxiety surrounding tonight's prime-time appearance from President Donald Trump, who is expected to address funding for a border wall as the partial government shutdown heads toward a 19th day.

Continue reading for more on today's market, including:

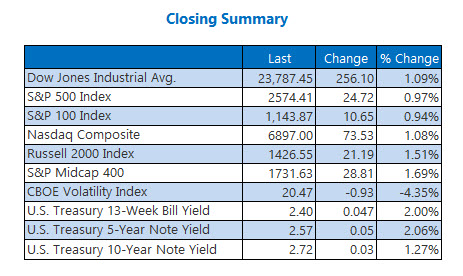

The best stocks to own during a government shutdown.Bed Bath & Beyond stock flashes warning signs before earnings.Why Procter & Gamble stock could keep climbing.Plus, time to take profits on Clovis Oncology; one chip stock swings lower; and this weed stock soared on a bull note.The Dow Jones Industrial Average (DJI - 23,787.45) was up 333 points at its intraday peak before settling with a 256.1-point, or 1.1%, gain. Twenty-six Dow stocks closed higher, led by a 3.8% pop for Boeing. On the losing side, Travelers (TRV), Goldman Sachs (GS), and Chevron (CVX) shed 0.4% apiece, while JPMorgan Chase (JPM) gave back 0.2%.

The S&P 500 Index (SPX -2,574.41) tacked on 24.7 points, or 1%, while the Nasdaq Composite (IXIC - 6,897.00) added 73.5 points, or 1.1%.

The Cboe Volatility Index (VIX - 20.47) found support near its 80-day moving average, paring its loss to 0.9 point, or 4.4%.

5 Items on our Radar Today

The shares of Sears Holdings were down 50% at their session low today, after the embattled retailer's independent board of directors rejected a $4.4 billion buyout bid from Chairman and CEO Eddie Lampert's hedge fund, ESL Investments. However, the penny stock was up 30% at the close, on news a bankruptcy judge approved a potential $121 million lifeline. (MarketWatch)BP said it discovered 1 billion barrels of oil at its Thunder Horse field and 400,000 barrels at its Atlantis field in the Gulf of Mexico. The energy firm also said it will spend $1.3 billion to develop the next phase at the latter site, with production expected to begin in 2020. (CNBC)History suggests it's time to take profits on Clovis Oncology.This chip stock erased early gains after running into familiar resistance.This weed stock soared almost 16% after a bull note at Cowen.

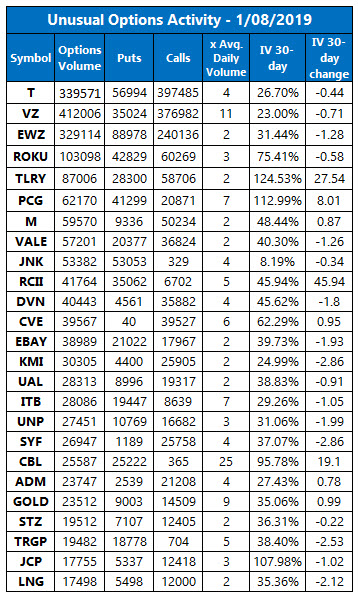

Data courtesy of Trade-Alert

Oil Climbs on OPEC Output Cuts

Oil closed higher for a seventh straight day -- its longest daily win streak since July 2017 -- after data showed oil production from the Organization of the Petroleum Exporting Countries (OPEC) hit a six-month low in December. February-dated crude rose $1.26, or 2.6%, to settle at $49.78 per barrel.

Gold prices were pressured today by a surging stock market and strengthening U.S. dollar. At the close, gold for February delivery was down $4, or 0.3%, at $1,285.90 an ounce.