BofA-Merrill Lynch: Buy This Shoe Stock Before Earnings

The brokerage firm thinks the retailer can rally another 26%

The brokerage firm thinks the retailer can rally another 26%

Deckers Outdoor Corp (NYSE:DECK) is trading up 3.6% at $144.20, after BofA-Merrill Lynch upgraded the retail stock to "buy" from "neutral," and boosted its price target by $30 to a Street-high $180. Not only is this new target price a 26% premium to last night's close, but it's the highest on Wall Street.

The brokerage firm said, "Despite the significant appreciation in DECK shares over the last two years, we still see upside risk to consensus [earnings per share] EPS and an attractive valuation." Additionally, BAML believes the retailer will beat the per-share consensus estimate by 20 cents when it unveils its fiscal fourth-quarter results after the market closes this Thursday, May 23.

This bullish outlook runs counter to the overall outlook held among analysts, with the majority of the eight in coverage maintaining a lukewarm "hold" rating. Plus, the average 12-month price target of $149.75 is a slim 1.5% premium to DECK stock's current price.

The retail shares are heavily shorted, too. Although short interest declined 5.6% in the most recent reporting period, the 3.1 million shares still sold short account for 10.8% of the stock's available float. It would take more than eight days to cover these bearish bets, at Deckers Outdoors' average pace of trading.

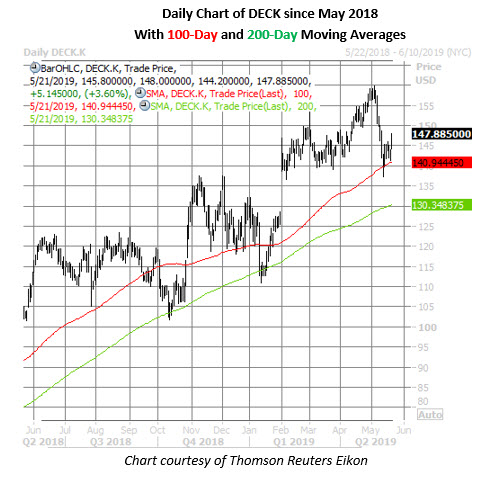

It's somewhat surprising to see so much skepticism priced into a stock that's put in an impressive performance on the charts. DECK shares are boasting a 41% year-over-year lead, bouncing higher atop their 100-day and 200-day moving averages. The former trendline is currently housed in the $140 region, home to an early February post-earnings bull gap and Deckers' fourth-quarter highs.

Plus, Deckers Outdoors has a history of positive earnings reactions, having closed higher the day after earnings in seven of the past eight quarters. In addition to a 10.5% single-day surge on Feb. 1, the shares jumped 18.8% the day after the retailer reported earnings in May 2017. Another post-earnings pop could spark a fresh round of bullish brokerage notes for DECK, or have shorts continuing to cover.