Bond Market Bear Creating Gold BullMarket / Commodities / Gold and Silver 2018

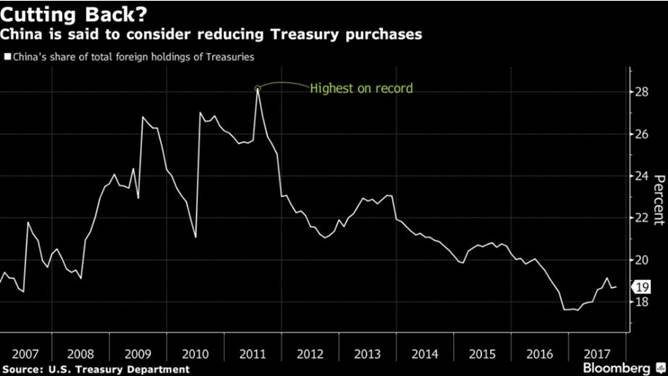

Gold is climbing as bond yields rise andthe dollar falls, over speculation that China is pulling back on buying USTreasuries and Japan signals it is winding down its quantitative easingprogram. Meanwhile, US debt continues to grow after the Republicans underPresident Trump pusheda trillion dollars worth of tax cuts through the Senate, that the Congressional Budget Office thinks will add$1.7 trillion to the deficit over the next decade.

Gold is climbing as bond yields rise andthe dollar falls, over speculation that China is pulling back on buying USTreasuries and Japan signals it is winding down its quantitative easingprogram. Meanwhile, US debt continues to grow after the Republicans underPresident Trump pusheda trillion dollars worth of tax cuts through the Senate, that the Congressional Budget Office thinks will add$1.7 trillion to the deficit over the next decade.

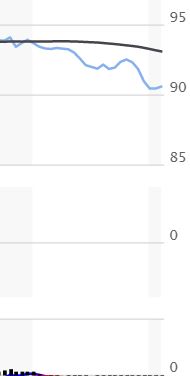

The dollar, 10 year yields and goldsprice

It’s all good news for gold which thriveson the spectre of high government debt leading to more money-printing (aka theFederal Reserve buying Treasuries) and inflation.

Today’sFederal Debt is $20,493,401,574,964.07.

Theamount is the gross outstanding debt issued by the United States Department ofthe Treasury since 1790 and reported here.

But, itdoesn’t include state and local debt.

And, itdoesn’t include so-called “agency debt.”

And, itdoesn’t include the so-called unfunded liabilities of entitlement programs likeSocial Security and Medicare.

FederalDebt per person is about $62,805.

usgovernmentdebt.us

Inflation, of course, diminishes the valueof the currency and hikes gold prices, since the US dollar and gold normallymove in opposite directions.

Gold is seen as a hedge against inflation.

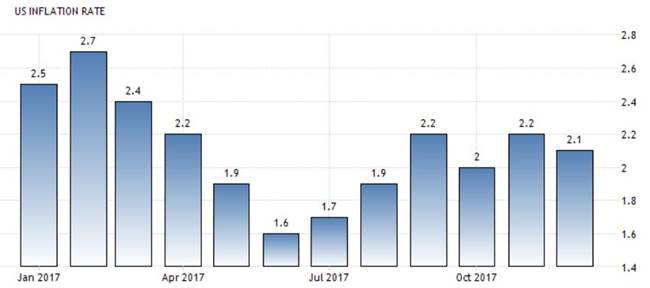

Consumer prices in the United Statesincreased 2.1 percent year-on-year in December of 2017... Figures came belowmarket expectations of 2.2 percent amid a slowdown in gasoline and fuel prices.Still, core inflation edged up to 1.8 percent and the monthly rate increased to0.3 percent, the highest in eleven months. tradingeconomics.com

China Treasury purchases in doubt

Last week was very interesting for the bondmarkets which are a key determinant of the US dollar and therefore gold prices.On Friday, January 12, spot gold hit $1,337.40, having enjoyed a three-day runof $21.40 following an announcement from the Chinese that they could eitherslow or halt their purchase of US Treasuries. China holds $1.3 trillion worthof US debt, the most of any country.

The Chinese buy Treasuries - effectivelylending money to the US government - so that the US can keep buying Chinesegoods and China can keep selling their products, earning enough dollars toconvert into Chinese yuan to pay workers and suppliers. The People’s Bank ofChina buys US dollars from exporters, accumulating large forex reserves, andsells them yuan, to keep the dollar higher against the yuan. This gives China acompetitive trade advantage.

From November 2016 to November 2017 China’strade surplus with the US was $416 billion, with the bulk of those earnings inUS dollars, SouthChina Morning Post pointed out in an editorial on Monday. Exports rose 10.9% in December.

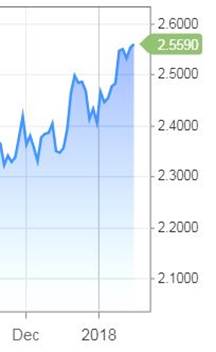

Whether or not the Chinese follow through(officials later denied the rumour), bond investors got spooked at the prospectof the world’s largest T-bill holder losing faith in US debt, and by extension,the US economy. A large selloff ensued, with the 10-year US Treasury billhitting its highest yield in 10 months at 2.59% (bond prices and yields areinversely related: when prices drop, yields go up).

The move up was also influenced by the Bankof Japan, which on Jan. 9 trimmedits purchases of Japanese bonds by about $20 billion. The Japanese cutback fueled speculation that the BOJ would endquantitative easing, just as the Federal Reserve did last September; the yenrose immediately by half a percent, as did Japanese bond yields.

Gold-bond yield correlation is weak

While rising bond yields are typically badfor gold, since they increase the opportunity cost of owning gold which pays noincome for holding the metal, the present lift in gold prices, even though bondyields are rising, means the correlation is weaker than normal, according to analystsquoted by Kitco.

Thehead of commodity strategy at TD Securities said that gold is benefiting fromuncertainty given that the US dollar is weaker as bond yields push higher.

“Thistells me that markets don’t have a lot of confidence in the U.S. at themoment,” [Bart Melek] told Kitco. Vince Lanci, founder of Echobay Partners,said that the fact that gold can rally in a higher bond environment is furtherproof that the yellow metal has entered a new phase of its bull market. “Chinabuying or not buying Treasuries in the short term is not the big factor… thefact that gold rallied on it means the path of lesser resistance, for now, isup,” he said.

A bear market in bonds

Still, the fact that bond yields are risingis a strong signal to gold investors that: 1/ the demand for US Treasuries isfalling and 2/ that the stage is being set for a higher inflationaryenvironment which would mean higher interest rates and increased stock marketvolatility.

According to a 2017 report from Bank ofAmerica Merrill Lynch, whengold prices and bond yields rise in tandem, the stock market tends to move theother way. The report notes both the stock marketcrashes of 1973 and Black Monday in 1987 were preceded by three quarters ofrising bond yields and rising gold. That’s because when both investmentvehicles rise, it signals higher inflation, and that leads to rises in interestrates, which are generally bad for stock markets. When stock markets fail,investors turn to more concrete safe havens Ie. gold.

Coupling the current 10-year benchmarkTreasury rise, with the fact that a slew of maturing government debt hit themarket last week - $32 billion of 10- and 30-year US bonds were sold, alongwith 4 billion euros of German bonds - “bond King” Bill Gross declared a bear marketfor bonds. QuotesBloomberg:

“Bond bearmarket confirmed,” Gross said in a Twitter posting [last] Tuesday,noting that 25-year trend lines had been broken in five- and 10-year Treasurymaturities. The billionaire fund manager at Janus said last year that 10-yearyields persistently above 2.4 percent would signal a bear market...

What about inflation?

Bonds tend to sell off when investorsbelieve that more inflation is coming. That’s because the yield gets eaten awayby inflation (Eg. you own a 10-year Treasury bill that pays 3%. If inflation is2%, your real return is only 1%.)

Data last Friday showed that USinflation is now above 2%, with most analystsbelieving that more rate hikes (an anticipated three more interest rate risesby the Fed this year) have been priced into the inflation rate. Rates couldeven go higher. In a WallStreet Journal article, Boston Fed President EricRosengren said he expected “more than three” rate hikes in 2018 because itwants to get ahead of inflation and not tighten too quickly.

The rise in the two-year Treasury bill -the benchmark Treasury most sensitive to Federal Reserve rate hikes - pushedabove 2% last week for the first time since the collapse of Lehman Brothers in2008, the start of the financial crisis.

The two-year note now provides more incomethan dividends on the S&P 500 Index. Could this be the harbinger of thenext stock market crash?

More debt will hike interest rates, sink the dollar

Meanwhile the elephant in the room is theballooning US debt. In under a decade, mostly under the Obama Administration,the amount of debt doubled from US$10 trillion to $20 trillion. The chiefeconomist at Goldman Sachs recently revised his deficit projections from below$500 billion in 2018 to over $1 trillion in 2019 due mainly to the Trump taxcuts which will require an additional $200 billion in each of the next fouryears. How will Congress get the funds? By issuing more Treasuries. Goldmanexpects net borrowing to go from $488 billion in 2017 to $1.03 trillion thisyear, and the same amount in 2019. Importantly, under this forecast the debt toGDP ratio rises from 3.7% in 2018 to 5% in 2019, which increases borrower risk.To compensate, and attract T-bill buyers, the Fed is likely to offer higherinterest rates. ZeroHedgequotes future Fed chair Jay Powell predicting that is exactly what is going tohappen, in a 2012 Fed meeting:

“I think we are actuallyat a point of encouraging risk-taking, and that should give us pause. Investorsreally do understand now that we will be there to prevent serious losses. It isnot that it is easy for them to make money but that they have every incentiveto take more risk, and they are doing so. Meanwhile, we look like we areblowing a fixed-income duration bubble right across the credit spectrum thatwill result in big losses when rates come up down the road. You can almost saythat is our strategy.”

The “big losses” Powell refers to “down theroad”, which is actually now, is the extra interest the US government will beforced to pay on its Treasury bills, as the yield curve continues to climb.This will start a vicious cycle that goes something like this: Higher interestrates boost the cost of borrowing for businesses and individuals, therebyslowing the economy. This necessitates more government borrowing, thus pushingup the debt to GDP ratio which makes US T-bills more risky and less attractiveto investors. If demand for Treasuries drops, so will the dollar, meaningforeign bond holders get paid in US dollars that are worth less, furtherslowing demand for them. Finally, as the dollar continues to fall, the USgovernment will have to pay exorbitant amounts of interest on the Treasuriesupon maturity, increasing its risk of defaulting on the loans once they becomedue.

From this brief analysis, it’s easy to seethat debt is good for gold. Bullion investors don’t have to worry about thegovernment defaulting on the piece of government debt they own, nor should theybe concerned about the value of the currency falling when the T-bill plusinterest matures. As long as the gold is in the form of physical metal bullionit’s a safer bet than a T-bill.

Dollar is withering

Ina recent post I wrote about howChina is hoping to reduce the hegemony of the US dollar, which most commodities are priced in, throughthe launch of a new oil futures contract. The yuan-denominated oil futures willallow exporters like Russia and Iran to buy and sell their oil through China,thus avoiding US economic sanctions and circumventing the US dollar. Moreover,the yuan will be fully convertible into gold on exchanges in Shanghai and HongKong.

This is justthe latest move on behalf of China to usurp the economic might of the UnitedStates. Between them, Russia and China are moving to kill the dollar. If thatever happens, it will make US-Chinese military conflicts in the South China Sealook like petty squabbles.

At the end of2015 the Russian Central Bank made the yuan an official reserve currency, andin 2017, the RCB opened its first office in Beijing. The closer cooperation wasa result of US sanctions on Russia after the crisis in the Ukraine, and the oilprice slump that hit the Russian economy. The two countries have also issuedgovernment bonds denominated in each other’s currencies, which are designed tocompete with US Treasuries.

Since thentrade between Russia and China has been increasing, following in the footstepsof landmark energy deals that have taken place over the last decade. Theseinclude the $456 billion gas deal that Russian state-owned Gazprom signed withChina in 2014, a $25-billion oil swap agreement Russian oil giant Rosneftsigned with Beijing in 2009, and a doubling of oil supplies from Rosneft toChina in 2013, valued at $270 billion.

Russia and China are also increasingly sharing technology withpossible militaryapplications. The US Congress’ US-China Economic Security and ReviewCommission reported the export of Russian aerospace technology to China was“challenging US air superiority and posing problems for US, allied, and partnerassets in the region.”

Anotherinteresting development is the joint trade in gold between China and Russia.The idea is to create a link between the two gold-trading hubs, Shanghai andMoscow, in order to facilitate more gold transactions.

QuotesZeroHedge:

“In otherwords, China and Russia are shifting away from dollar-based trade, to commercewhich will eventually be backstopped by gold, or what is gradually emerging asan Eastern gold standard, one shared between Russia and China, and which mayone day backstop their respective currencies.”

Soundfamiliar? What they’re talking about is the kind of monetary system thatexisted before the 20th century - when banks were constrained in their loans byhow much gold was in their vaults. The US went off the gold standard in 1971,thereby severing the linkage between the world’s major currencies and gold.Soon afterward, the US dollar became the leading reserve currency.

Trade conflicts: throwingfuel on the fire

WhilePresident Trump under his “Make America Great Again” banner has pressured keytrading partners including China, Canada and Mexico, the reality is thatpassing protectionist measures and ripping up existing trade agreements likeNAFTA is likely to depress the dollar - further alienating foreign investorswho would otherwise flock to the greenback, and hurting the US economy to boot.

For exampleduring NAFTA negotiations last fall, currency strategist Jens Norvig was askedwhat would happen should NAFTA fall apart. The result he said would not only bedramatic declines in the values of the Mexican peso and the Canadian dollar,but also appreciation of the yuan and the euro versus the dollar.

“In fact, Ithink over the medium-term, [euro] and [Chinese yuan] would benefit from theU.S. “America First” policy, as it has to make the [dollar] a less attractivereserve currency,” CNBCquoted Nordvig saying. The benefactor,again, will be gold.

Conclusion

Gold rose12.5% in value last year, shaking off US rate hikes, the frenzied introductionof bitcoin, and record-setting highs on the Dow and S&P 500 exchanges.While some investors have exited the precious metals space to chase alternativerealities, aka the crypto world, gold has been, and will continue to be, asolid investment especially during times of economic and political upheavalwhen the metal functions as a safe haven.

Are thereother basic, more fundamental reasons to buy gold? Well, read this excellentarticlefrom Bloomberg, ‘Disastrous' dealssideline gold-mining M&A as metal rises’ posted on Mining.com.

For thosewho follow economic trends, the latest turbulence in the bond markets is apretty bullish signal for gold. While there will be daily fluctuations, theshort term trend seems to be one of a sustained rally, especially if bondyields continue to rise and the dollar keeps slumping.

Thecorrelation between the bond markets, the dollar and gold is an importantdeterminant of future gold prices. These relationships are something every goldinvestor should track, to determine ideal entry and extra points for bothbullion and gold stocks.

I have bondmarket trends on my radar screen, and due diligence, which I freely share, onexceptional quality gold exploration juniors on my to do list. Do you?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2018 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.