Brexit Drama Is Supporting Gold

More uncertainty over Brexit is keeping gold buoyant.

Yet gold's currency factor is keeping the metal's price locked in a range.

Ultimately, rising safety demand will allow gold's recovery to continue.

Gold is consolidating its gains from its November-February rally and remains in a well-defined holding pattern. Pundits remain divided as to whether this holding pattern represents a pause in an ongoing bull market or a topping process. As I'll argue in today's comments, however, the combined testimony of investor sentiment and market momentum still supports the intermediate-term (3-9 month) bullish case for gold.

Gold remains sensitive to the twists and turns of the Brexit saga and has been at the mercy of a highly news-driven market. On Tuesday, the British Parliament voted against Prime Minister Theresa May's plan to exit the European Union. The move is widely expected to delay Brexit and could possibly shelf it. With just over two weeks before the deadline for leaving the EU remaining, Parliament remains divided in its sentiments and uncertain on how to proceed. Perhaps Prime Minister May said it best when she stated:

There is only one certainty if we do not pass this vote tonight. And that is that uncertainty will continue for our citizens and our businesses."

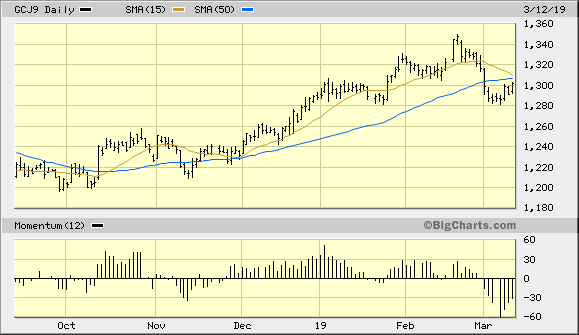

The trepidation which has resulted from the Brexit drama is at once a help and a hindrance for gold. The April gold futures price (below) is a reflection of this sentiment-related volatility over Brexit. The gold price is clearly being supported by the geopolitical uncertainty in spite of a lively U.S. dollar, yet there isn't enough clarity to justify a rally to a new recovery high just yet.

Source: BigCharts

At the same time, however, the April gold futures remains below two of its benchmark trend lines. As of Mar. 12, gold hasn't been able to muster a close above either the 15-day or 50-day moving averages. Based on the mechanical rules of my trading discipline, this means that gold's short-term trend is neutral-to-bearish. We need to see a weekly close above the 50-day MA in order for the bulls to regain control over gold's intermediate-term trend. Moreover, a 2-day higher close above the 15-day MA would give bulls a decided advantage in controlling gold's immediate-term (1-4 week) trend. Until this happens, about the best we can expect for now is a continuation of gold's lateral trading range as safe-haven demand for gold remains high, while the dollar is keeping a lid on the metal's rallies.

Although the dollar remains firm, it has suffered a setback recently in the face of U.S. economic news. Data from the Labor Department show that U.S. consumer prices rose for the first time in four months in February. The Consumer Price Index (CPI) increased 0.2 percent last month thanks to higher gas and food prices, as well as higher rents. Yet the annual gain in the CPI was the smallest in almost two-and-a-half years. This likely explains the relatively small amount of the dollar's recent losses.

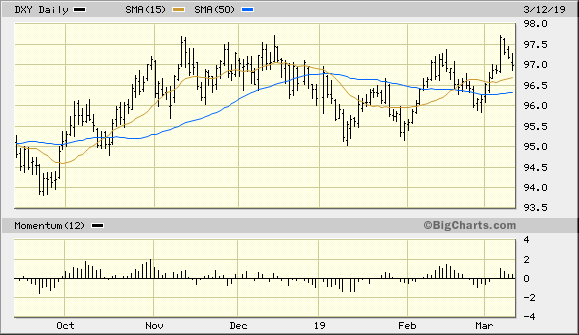

Gold's currency component, however, remains a trouble spot for the precious metal. While the U.S. dollar index (DXY) has declined in the last few trading sessions, it remains above its 15-day and 50-day moving averages. This confirms that the dollar's dominant interim trend remains up, in turn creating a headwind for gold prices. The dollar's recent progression can be seen in the following chart.

Source: BigCharts

The safety factor for gold remains intact, however. Gold prices are not only being supported by Brexit uncertainties, but also by uncertainty over the U.S.-China trade war. As one recent article pointed out, participants remain unsure over the exact terms and timeline of the latest tariff truce. Gold demand has increased in the last few days in response to these mounting concerns, as evidenced by the recent increase in demand for gold exchange-traded funds. According to the latest data, gold holdings of the SPDR Gold Trust (GLD), the world's largest gold ETF, rose 0.4 percent to 769.53 tons earlier this week.

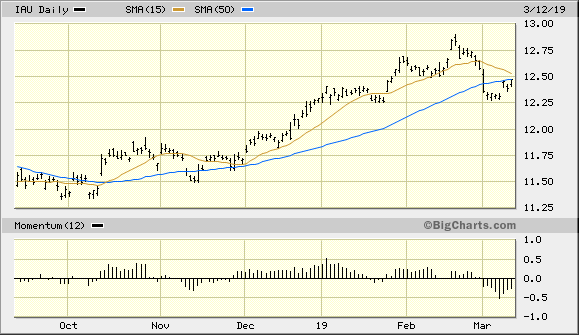

Speaking of ETFs, my favorite gold-tracking fund, the iShares Gold Trust (IAU) is still below its 15-day and 50-day moving averages after closing the latest week below both trend lines. As I previously explained, this means that the intermediate-term and immediate-term trends must be classified as neutral-to-bearish for the gold ETF for now. However, with gold ETF demand on the upswing again - and with gold's fear factor still strong - I anticipate that IAU will at least be able to stay above its $12.25 level while its holding pattern continues. In the meantime, we're still waiting for IAU to close two days higher above its 15-day MA. This will technically confirm an immediate-term bottom per the rules of my trading discipline. For now, I recommend that we remain in a cash position until we have confirmation that strength has returned to the precious metals market.

Source: BigCharts

In conclusion, the gold price is caught in a cross-current of strong safety-related demand and a still-weakened currency factor thanks to the U.S. dollar's recent rise. Gold's important fear component, however, remains strong and should keep the yellow metal price buoyant and within its trading range of the last several weeks. Fears over the global economic outlook will almost certainly persist, which in turn will lead to renewed safe-haven purchases of the metal once the dollar rally has ended.

On a strategic note, participants should continue to keep their powder dry while we wait for the gold price to bottom and for the U.S. dollar to weaken. Gold ETF traders, meanwhile, should remain in a cash position.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts