Brexit: Gold, metals, markets react as Britain chooses to leave the EU

British citizens have dealt the world's political, financial and business scenes quite a blow by voting to leave the European Union, a historic decision set to bring uncertainty as it reverses all past efforts of integration on which the old continent's stability has rested upon in recent years.

The unexpected 52% to 48% result of the referendum in favour of the exiting option drove Prime Minister David Cameron, who led the "Remain" campaign, to resign. It also pushed the world's financial markets to the brink, in a turmoil not seen since the financial crisis of 2008.

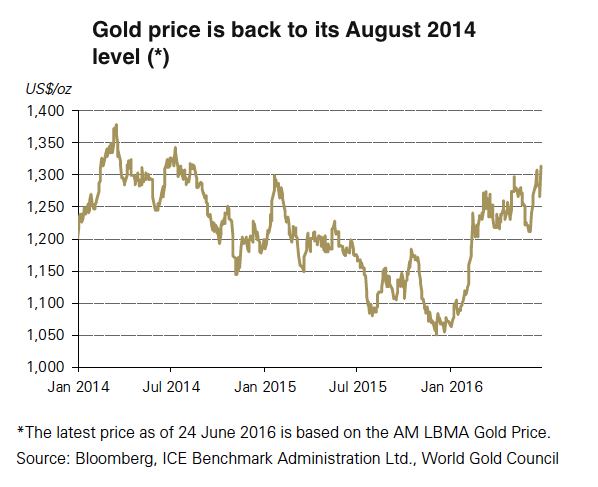

Gold prices soared the most in eight years as the metal holds a value as safe haven.

Oil, copper and other metals were struggling this morning as a sea of red swept across global markets Friday.Spot gold was trading 5.5% higher at $1,358.20 an ounce at noon in London, after rallying as much as 8.2% to $1,358.20, the most it has gained since March 2014. The last time the precious metal had experienced such a strong rally was in in September 2008, when it gained nearly 11% in a day.

Gold bars and coins dealers in London reported even higher demand for their products Friday than in previous days among retail investors, with some saying stocks were tight.

Provided by: The World Gold Council.

US gold futures for August delivery were up $65.60 an ounce at $1,328.70, off an earlier high of $1,362.60 an ounce.

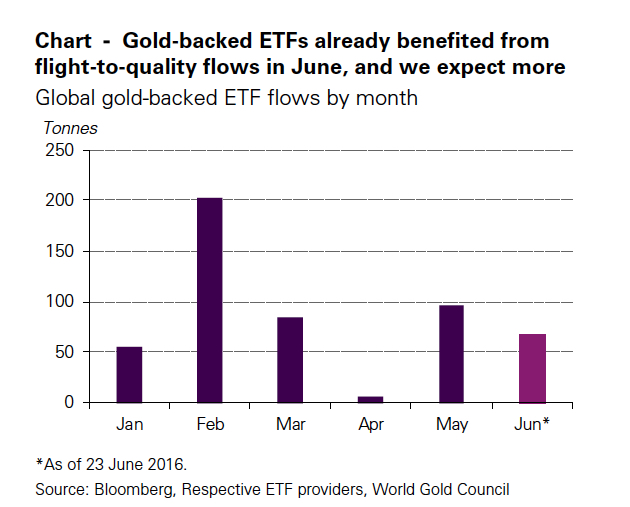

Gold ETF holdings have also been increasing sharply, a trend the World Gold Council expects to see accelerate, as both retail and institutional investors re-allocate funds to bullion, the body, which represents the global gold industry, said in a market update.

Provided by: The World Gold Council.

Silver followed bullion and gained 3.7% to trade at $17.91 an ounce, while platinum was 2.7% higher at $985.05 an ounce.

Oil, copper and other industrial metals were struggling this morning as a sea of red swept across global traders' screens on Friday, in a situation only comparable to the financial shock brought by the 2008 crisis.

US oil prices recently lost $2.21, or 4.4%, to $47.90 a barrel on the New York Mercantile Exchange, after dropping as low as $46.70 a barrel in overnight trading. Brent, the global benchmark, traded as low as $47.54 a barrel and was just down $2.36, or 4.6%, to $48.55 a barrel on ICE Futures Europe.

European crash

The news brought the pound down to a 31-year low, its biggest fall in history, while British banks took a $130 billion hit, with giants such as Barclays and Lloyds down more than 30%.

Neighbours were immediately affected:

Spain's IBEX index plunged more than 11%.France's CAC-40 was off by almost 9%.Germany's DAX was down by more than 7%.Italy's main stock index dropped 10%.Outside of Europe, the US Dow Jones Industrial Average dropped more than 400 points at the open, before paring some losses to trade almost 3% lower. The S&P 500 traded 2.6% lower.

Asian stocks had also tanked earlier, with the Japanese benchmark Nikkei 225 closing 7.9% down.

"Investors hate uncertainty and the result of the referendum gives rise to a surfeit of it," said The Economist in its Friday editorial. "But the falls in Asia's equity markets are also in large part an early judgment about the impact on the world economy."

Such a kick in the teeth to global confidence could prevent the US Federal Reserve from hiking interest rates as planned this year, analysts quoted by Reuters believe. They noted the vote might even trigger a new round of emergency policy easing from all the major central banks.

Britan's official split from the rest of Europe would take at least two years. But EU president Donald Tusk has warned that the whole process of negotiating trade and immigration deals with a non-EU Britain could take seven years in all.