British Columbia mining revenue was up $1B last year

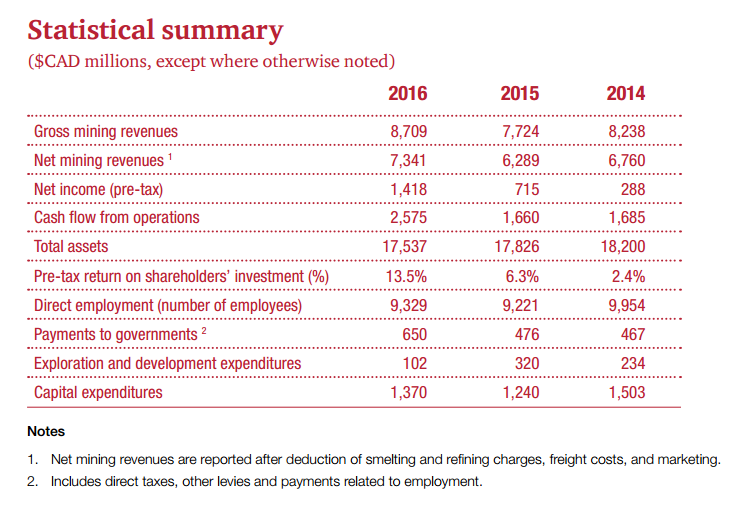

Net mining revenues in British Columbia came in at $7.3 billion in 2016 up from $6.3 billion in 2015 driven by an increase in gross mining revenue and a decrease in costs for smelting, refining charges, and freight costs, says PWC in its BC mining report it released today.

Authors of the report say that the BC mining industry is cautiously optimistic as prices of key metal and resource commodities either rose or stabilized in 2016. (Table below is from PWC's Building for the future: The mining industry in British Columbia 2016.)

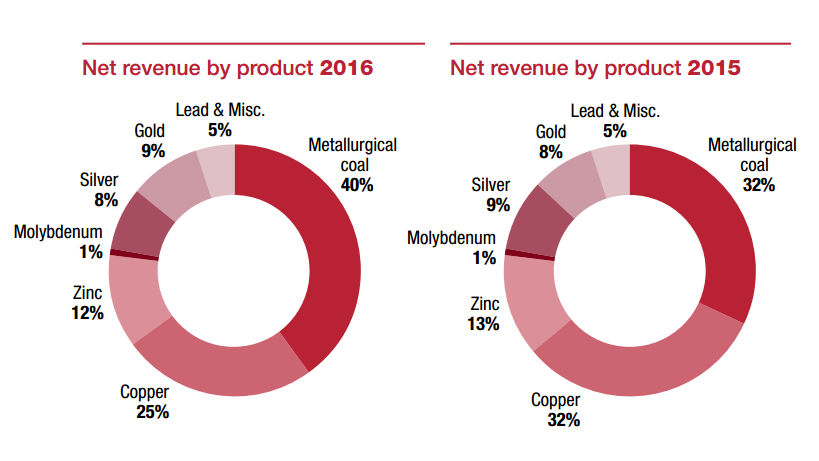

The increase in revenues was helped by a recovery in metallurgical coal prices, which made up 40% of total net revenue.

The report authors note that metallurgical coal prices below averaged US$115 per tonne in 2016, up from US$101 per tonne in 2015 and down from US$126 per tonne in 2014.

Coal prices surged last fall amid supply shortages. Prices retreated as more supply came on the market, but then spiked again in early 2017 after a cyclone hit Australia at the end of March, damaging infrastructure and disrupting global supply.

Exploration spending was down markedly in 2016, $102M in 2016 compared to $320M in 2015.

Jobs came back as mines advance, open or restart across the province. The report indicates the number of jobs directly related to the survey participants increased to 9,329 in 2016, up from 9,221 in 2015. Northern BC was one of the bright spots with the reopening of two metallurgical coal mines and a third set to open this summer.

According to the report, gross mining revenue increased to $8.7 billion in 2016 from $7.7 billion in 2015. Cash flow from operations and capital expenditures also showed encouraging improvement year on year. The price of global commodities, in particular coal and copper, started to pick up again towards the end of year and held their ground into the first part of 2017, which augurs well for the BC mining industry in 2017.

"The last year was another challenging year for the BC mining industry due to the continued volatility in global metal and mineral prices. However, since the end of 2016, we've seen an upward trend in prices of the commodities that are key to BC's mining results," said Mark Platt, BC Mining Leader and Partner, PwC Canada. "BC mining companies continued to work hard to keep their costs under control."

Creative Commons image by Stewart Butterfield. Piece was written with large excerpts from the PWC news release.