Brutal Gold Futures Action Explains Last Week's Big Price Decline

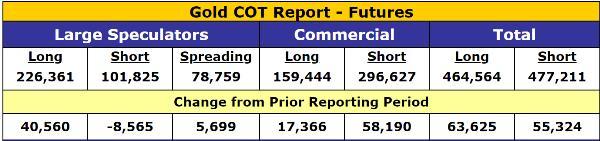

Last week's Commitments of Traders report revealed that commercial traders had gone massively short, while speculators went aggressively long.

On Thursday and Friday, gold fell from $1,294 to $1,277.

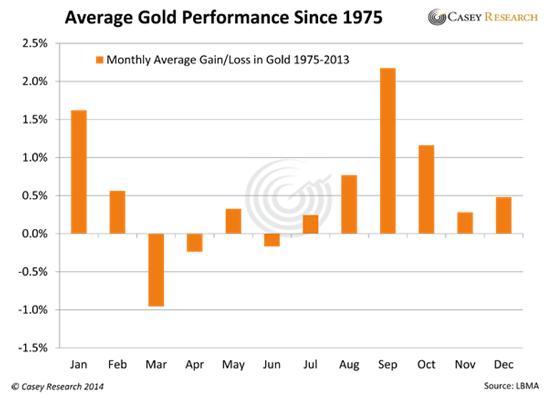

Meanwhile, gold seasonality has another couple of negative months to run.

Just when it looked like gold futures - which still, unfortunately, dictate the price of physical precious metals - were ready to turn bullish, last week's Commitments of Traders report (COT) revealed that commercial traders (usually right at big turns) had gone massively short, while speculators (usually wrong at turning points) went aggressively long.

That kind of action usually precedes a price drop, and this time was no exception. On Thursday and Friday, gold fell from $1,294 to $1,277.

Presumably, this flushed a bit of the bearish imbalance out of the futures market by forcing some speculator longs to cut their losses and allowing some commercial shorts to book profits. But it probably didn't send the structure of the market all the way back to bullish. That will take another couple of weeks like the last one.

Meanwhile, gold seasonality has another couple of negative months to run. The following chart shows the average price action by month from 1975 through 2013. Note that June is the third-weakest month, but that in July the trend turns positive and stays that way through February, mostly thanks to Asians buying precious metals for Spring wedding gifts.

So, assuming no external shocks - admittedly a big assumption in a world of trade war with China and possible shooting wars in Iran, Syria, and Venezuela - history predicts at least one more boring month for gold.

Which is another way of saying June might offer some good entry points for precious metals and oversold mining stocks. The following table shows some high-quality miners and streaming companies getting cheaper in the past few months. They might become cheaper still in June:

The story, by the way, was pretty much the same at this time last year. See "When Will Gold's 'Summer Doldrums' End? History Says Pretty Soon."

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Follow John Rubino and get email alerts