Bubble Watch: We've Passed 2007 and Are Closing In on 2000

We continue to see articles and comments in the financial media proclaiming that stocks are not in a bubble.

The people claiming this are either delusional or intentionally lying.

Most people would argue that Warren Buffett knows a thing or two about investing. He's possibly the single most famous investor of all time and is widely thought to be one of the greatest, if not THE greatest investor in history.

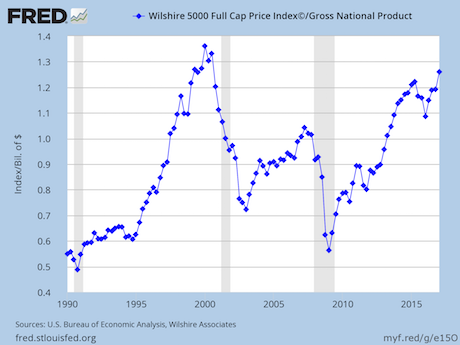

Buffett's favorite metric for measuring the pricey-ness of stocks is the Stock Market Capitalization to Gross National Product ratio. This was one of the key metrics Buffett cited when he arguing why the Tech Craze in the late 90s was a mania to avoid.

Below is this metric running back to the early 90s. As you can see, today this ratio is above its 2007 peak: a period that is widely known to have been a massive bubble.

Indeed, the last time the ratio was this high was in the fourth quarter of 1998... right before stocks went completely parabolic in the single largest stock market bubble of all time.

Put simply: the only other time stocks have been more expensive based on Buffett's favorite valuation metric was during the single largest stock market bubble of all time: a period that everyone now acknowledges was utter insanity.

This bubble will burst just as the Tech Bubble and the Housing Bubble did.

And smart investors will use it to make literal fortunes from it.

To pick up a FREE report outlining three investment strategies that could pay you a TON of money when the stock bubble bursts...

Best Regards

Graham Summers

Chief Market Strategist

Phoenix Capital Research