Buffett's Indicator tells him to buy GOLD / Commodities / Gold & Silver 2020

Warren Buffett did whathe said he’d never do, and that is buy gold - not the physical metal, nor anETF, but a gold mining stock. Buffett and/or his holding company's managers choseABX, as it is known in Toronto, or GOLD, on the New York exchange. Thesurprising trade is highly symbolic given Buffett’s previous ferventlyanti-gold public statements.

Last Friday the Oracle ofOmaha’s Berkshire Hathaway (NYSE:BRKB) picked up about 20 million shares ofBarrick Gold (TSX:ABX), presumably on the strength of the second largest goldcompany’s growthpotential, and the fact it pays a $0.08/share dividend.

“If you own one ounce ofgold for an eternity, you will still own one ounce at its end,” the Oraclefamously wrote in a 2011 annual shareholder letter, joking about a big pile ofgold that “you can fondle the cube, but it will not respond.”

But Buffett also pointedout in the same letter,“what motivates most gold purchasers is their belief that theranks of the fearful will grow.”

It now appears Buffett isscared too, of where current US stock markets are heading, and is buying goldas insurance.

Currently there is a majordisconnect between what is happening in US stocks versus the American economy,and that is worrying investors.

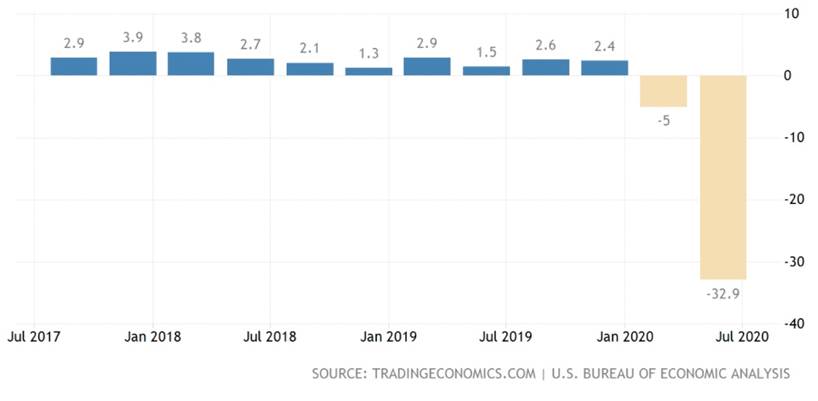

Despite US GDP plummetingmore than 30% in the second quarter, the worst contraction ever, the main stockmarket indices have nearly fully rebounded from their March crash.

There are concerns abouta second wave of coronavirus cases further crippling the economy, about thelack of agreement on a major $1 trillion stimulus plan from Washington, and theUS-China trade war seems to be back on the boil. Inflation is also rearing itsugly head, mostly in the form of increasing food and gasoline prices, withworries about more to come. The US Federal Reserve has signaled near 0%interest rates until 2022, and has taken on trillions of dollars in new debtthrough money-printing. The Fed is mandated to control inflation, and will tryto do so by raising interest rates - bad for stocks but good for preciousmetals.

Fed officials see the USeconomy shrinking 6.5% this year.

Shares of Barrick Goldsoared 11.3% on Monday, to within a quarter of 40 dollars a share. Year todate, the Toronto-based gold miner has gained 65%, tracking gold prices which earlierthis month surpassed $2,000 an ounce for the first time ever.

Gold and silver have beenon a tear since mid-March. The usual suspects behind the surges of both metalsare worrisome covid-19 infections, geopolitical concerns especially US-China tensions over trade and the SouthChina Sea, inflation expectations on the back of (seemingly) unlimited monetarystimulus, and low interest rates worldwide.

Bullion prices haveclimbed 34% year to date, as investors choose gold as a safe haven amidwidespread economic uncertainty created by the pandemic. They believe gold willhold its value better than other assets such as stocks and bonds.

Silver in July gained anastonishing 35%, as investors sought shelter from pandemic turmoil and low ornegative interest rates, while industrial demand for the metal recovered insome parts of the world.

The Buffett Indicator

To us at AOTH, it isn’tonly the fact that Buffett is investing in gold (via stocks) and seeminglyditching a long-held philosophy favoring quality companies over bullion, whichdoesn’t generate earnings or revenue. The timing is equally if not moreimportant.

Buffett reportedly referenced a2001 article in ‘Fortune’ that described “probably the best single measure of wherevaluations stand at any given moment.”

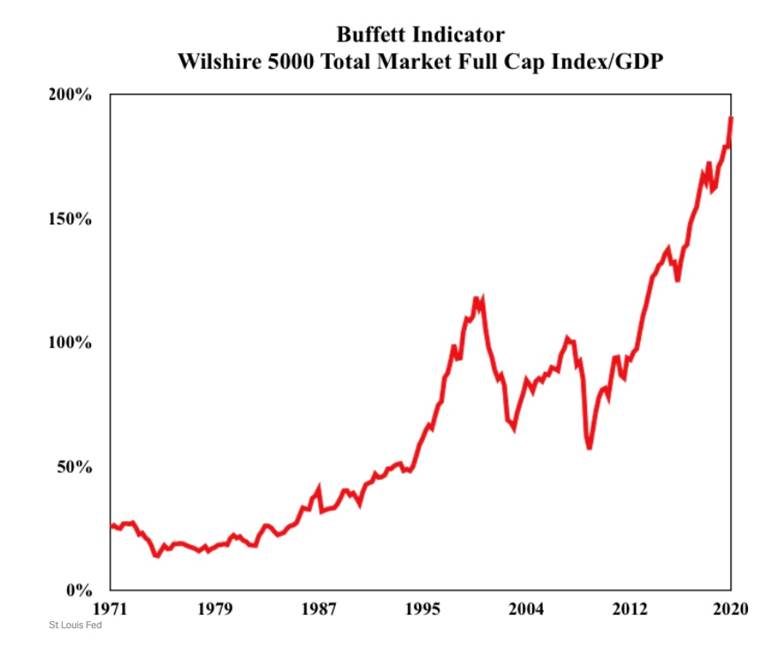

Known as the “BuffettIndicator,” the measure takes the total market cap of all US companies anddivides it by the country’s GDP. When the Buffett Indicator is at 70-80%, it’stime to invest. When it moves above 100%, investors should take their foot offthe gas pedal and consider less risky assets. Like, um, gold?

As the chart below show,we are currently way past 100%. We can use the Buffett Indicator to gaugewhether US stocks, or indeed global stocks, are undervalued relative to thesize of the economy.

At the end ofJuly, Buffett’s favorite market indicator hit a 30-month high. Take the Wilshire 5000Total Market Index, valued on July 29 at about $33 trillion, and divide it bysecond-quarter US GDP of $19.4 trillion. That leaves aBuffett Indicator of 170%, a record high. It indicates the economy is wellinto bubble territory, and likely close to a pop.

The global version of theBuffett Indicator looks equally bubbly, revealing that worldwide equities areway overpriced.

On Aug. 11 Markets Insiderreported the value of the world’s stocks to global GDP raced past 100%for the first time since February 2018. Over the past two decades, the ratiohas only broken into triple digits on three occasions - in 2000, 2008 and againin 2018. Recessions followed in 2000 and 2008.

Back in 2001, Buffettwarned that when the indicator hit a record high in the months before thedot-com crash, it “should have been a very strong warning signal.”

Markets Insiderstates,

The indicator'scurrent level underlines the striking gap between sky-high stock valuations anddepressed economic growth in countries around the world due to the coronaviruspandemic.

Stocks havebenefited from aggressive intervention by governments and central banks to bailout companies and shore up markets.

Meanwhile, theglobal economy has suffered from authorities' efforts to combat the virus,including closing nonessential businesses, restricting travel, and encouragingpeople to stay at home.

Will investors heed theOracle’s warning this time and exit risky stock positions in favor of safehavens like precious metals?

It certainly appears thatBerkshire Hathaway is. As the multi-national conglomerate holding company wasbuying Barrick, it was also selling, or had sold, its positions in blue-chipbank stocks, credit card companies and airlines.

Earlier in the quarter,Buffett’s BKRB, market cap $509 billion, exited its position in Goldman Sachs,and reduced its 22.2-million share stake in JP Morgan. The firm is sitting on$146 billion in cash.

According to its latestregulatory filing with the SEC, Berkshire trimmed its stock holdings inJPMorgan Chase (JPM), Wells Fargo, PNC (PNC), Bank of New York Mellon (BK), USBancorp (USB) and M&T (MTB).

The company also paredback stakes in credit card giants Visa (V) and MasterCard (MA), and no longerowns shares of Southwest (LUV), Delta (DAL), American (AAL) or United (UAL).

Conclusion

In a 1997 speech at HarvardUniversity, Warren Buffett had this to say about gold:

“(Gold) gets dug out ofthe ground in Africa, or someplace. Then we melt it down, dig another hole,bury it again and pay people to stand around guarding it. It has no utility.Anyone watching from Mars would be scratching their head.”

Or how about this gem,from a 2009 interview with CNBC:

“I have no views as towhere it will be, but the one thing I can tell you is it won’t do anythingbetween now and then except look at you. Whereas, you know, Coca-Cola will bemaking money, and I think Wells Fargo will be making a lot of money, and therewill be a lot — and it’s a lot — it’s a lot better to have a goose that keeps layingeggs than a goose that just sits there and eats insurance and storage and a fewthings like that."

As gold continues itsnext leg up after falling briefly to $1,921 last week, it appears that evensages like Buffett need to occasionally adjust their portfolio in ways theynever thought possible. It goes to show that even the most staunch opponent ofgold is sooner or later, when conditions dictate, going to come to gold.

As comedian Rodney Dangerfield used to say, “I don’t get norespect”. The same might be said of the gold market.

Gold is often criticized by Wall Street as kind of a uselessinvestment.

Institutional investors prefer assets thought to contain thepotential for growth, or “sprouts”. An investment has to produce a growingrevenue stream - if it doesn’t grow it doesn’t compound. Gold is rejected as aninvestment because it doesn’t produce sprouts, meaning without a dividend oryield, the steady income and systematic growth sought after by institutionalinvestors isn’t there.

Gold, through major gold miners such asBarrick, is clearly centerstage.

When the facts change, Ichange my mind, so does Buffett.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.