Bull Trap

Michael Ballanger of GGM Advisory Inc. defines "bull trap" and explains his thoughts on the current state of the market.

Michael Ballanger of GGM Advisory Inc. defines "bull trap" and explains his thoughts on the current state of the market.

After 48 years in and around the capital markets, I vividly remember two of three major stock market crashes in my career, plus one just as nasty in the precious metals. The October 1987 Crash was the first one since 1929 and caught everyone off balance. It came out of the blue on a Friday afternoon but ended with a great deal of red on the following "Black Monday," dropping 23.8% in a single session.

The 2001 Dotcom crash wasn't really a crash per se, but rather a popped bubble that was pretty much contained to the dotcom stocks. The 2020 Covid Crash was maddening beyond belief because it came out of Asia and was accompanied by the most inept government response imaginable as they shut down the world supply of everything while dumping helicopter loads of freshly-inked cash into any bank account that would take it (and then wondered why there was 9% inflation one year later). Those three involved massive stock losses followed by relatively rapid recoveries, but the one that sticks in my mind is the Great Financial Crisis (nee "Bailout") of 2007-2009.

Also called "the sub-prime meltdown," I recall speaking with a novice institutional trader with one of the boutique hedge funds located in downtown Toronto as this fuzzy-cheeked kid was asking me with a quivering voice: "What are you going to do for a living, now, Mike?"

You see, he was leveraged out the ying-yang and was being forced by the prime broker to liquidate a bunch of securities upon which there were virtually no bids. Junior technology issues that were trading at $10.00 a share doing a couple of millions shares a day volume that went to $0.50 and stayed there for most of the final quarter of 2008. The poor child had never gone through anything like this before because, you see, nobody had explained to him after he had written the Canadian Securities Course that stocks could actually go down instead of up.

Terribly upset verging on breaking down, he kept asking me how I was going to survive when I finally decided on a "tough love" approach to whining and said: "Ben, what were you doing in October 1987?" to which he replied "I was four years old, how should I know?"

I said "the first thing you do is put on your Big Boy pants and suck it up!" and then described the Crash of '87 to him and how I was asking everyone around me 20 years earlier what I should do and who I should call and reminded him that about a year later, the markets recovered pretty much everything that they had lost.

Needless to say, there was a muffled "thanks," after which I heard a "click" and then nothing for about a month.

If there is one thing I know to be true about the investment business, it is that the longer you are in it, the less impact events have on your behavior. In October '87, I was jumping around like a scalded cat; in 2008, I was an offended victim; in 2020, I was simply annoyed; and in the recent "Liberation Day Crash," I was bemused. Trading acumen is like a fine bottle of wine; the longer it sits idle, the better it goes down.

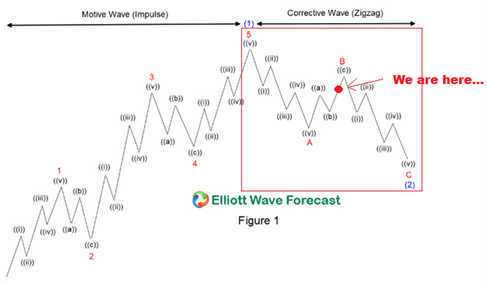

The markets are now in the midst of the dreaded and highly dangerous "B Wave" relief rally. History has taught me with sadistic emphasis that the first rally in a secular bear market is always the most dangerous, and it is so for a number of reasons. For the perma-bull, "buy-the-dip" youngsters programmed by Fed manipulation to always expect an institutional rescue package whenever the CNBC anchors start to whine, it is usually short, sharp, and alluring beyond one's rational control. They buy into the bounce and keep buying until it enters the exhaustion gap, and then into massive FOMO with the masses clamoring to get "long and longer."

It is also referred to as a "bull trap" and is defined as follows:

A bull trap is a false signal, referring to a declining trend in a stock, index, or other security that reverses after a convincing rally and breaks a prior support level. The move "traps" traders or investors who acted on the buy signal and generates losses on resulting long positions. A bull trap may also refer to a "whipsaw" pattern.

The spring of 2008 was particularly memorable because stocks took off on a 23.8% advance between March and June with then-Fed chairman Ben Bernanke standing in front of the podium and smiling into the cameras that were beaming his professorial visage across the global airwaves telling all that would listen that "the subprime crisis is contained."

"Contained, I tell you!" Those words were almost as disingenuous as Dr. Fauci in 2020, standing in the same spot and demanding that we all "Trust the science!"

Here is 2025, the new narrative is that there has been a "Zweig Breadth Thrust" which, while sounding like a phrase from an XXX-rated movie, joins the "China deal" narrative, and the "Everything is fine!" narrative completing a near-perfect triad of bullish commentaries that are deemed responsible for this recent advance.

What I urge all readers to remember is that it is not the tariffs that is causing the furor; it is the simple fact that the U.S. is broke. Now, "broke" is not to be confused with "insolvent" because their trading partners are still accepting the greenback in its perpetual state of debasement but with $36 trillion in IOU's lodged in its windpipe (ex-entitlements), a few percentage points shaved off the Mexican or Canadian tariffs means little when one considers the dreadful state of the American balance sheet. As always, the major theme always comes back around to one word - D-E-B-T. Too much and too late to handle. . .

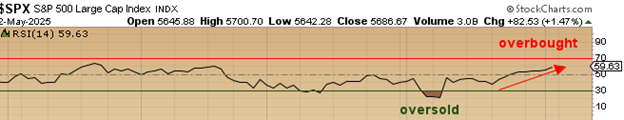

Equity markets can rally for a few more days and a few more percentage points as relative strength for the S&P 500 is still in the "neutral" zone with a reading of 59.63. After covering all hedges after Liberation Day sent stocks crashing, I have already started rebuilding the hedge position in the SQQQ:US failing to remember at my own financial peril that the first rally after a secular peak in prices is always the one that fakes you out. As a card-carrying bear on stocks, it was easy to become enchanted by the whining and wailing in the financial media and in the Twitterverse and Blogosphere. So be it. New lows by summer, that's my call.

Gold (and Silver)

There is a phenomenon that occurs whenever I am on the public record as a near-term bear on gold and a devout cynic on silver. My inbox becomes deluged with "hate mail.

If I read or hear the phrase "You just don't get it" one more time, I am going to start hitting the "Block Sender" button on my Outlook tab. A few weeks ago, I went on the record in writing:

"The trend line for gold has indeed moved from 'gradual' to 'vertical' and is now approaching the terminus of the advance. Now, it doesn't provide me with any clues as to what the exact price will be the top of the advance; it only tells me that in terms of the X-Axis time a near-term top is close." Since I tend to "eat my own cooking," as they say, I began building a short position in gold via the GLD May $300 puts which I sold on Friday taking a decent profit and then legged out to the GLD June $290 puts.

From the chart posted above, you can see that the low that gold touched in late 2015, around $1,045, marked the start of this grand bull market that until recently was off most portfolio managers' radar screens. However, since the arrival of 2025, gold has moved from "most hated" to "most loved" in terms of sentiment. The CNBC crowd are now calling gold the "most crowded" of all the trades out there but a four-month bull market cannot possibly be seen as "crowded" when we are coming off four years of Mag Seven dominance that included the creation of several dozen "leveraged NVidia" and "triple-leveraged MicroStrategy" ETF's that everyone and their freckle-faced nephew just had to own.

Since 2015, there have been four corrections in gold of between 13.3% and 18.9%, with one min-bear decline of 21.9% in 2020-2021. If I take $3,509.90 as the near-term top, a correction of 21.9% takes gold down to $2,741.23 while a 13.3% correction takes it to $3,043.08.

Midpoint between those two corrections is $2,892.15. with June gold closing the week at $3,247.40, it is $262.50 off the April 22 high. The trend line is no longer moving in a vertical blow-off direction; it is correcting the excesses of the prior move. The metamorphosis from "gradual" to "vertical" was the signal resulting in the "terminus" of the move.

The big news event on Thursday was that the PBOC sold one million ounces exactly one week after making the purchase, and while the two price points are unknown, it was a profitable trade and one that would make the bullion bank behemoths over at J.P. Morgan extremely proud, verging on insanely envious. So much for the Chinese "never selling" . . .

For the silver market, all that needs to be watched is the GSR ("Gold-to-silver ratio"), which stands at end-of-week at 101.21, which confirms the corrective phase we are in and keeps me from engaging in any silver shenanigans in either futures or options. I remain a longer-term bull on silver, but I will refrain from entering into any major positions until after gold completes this corrective move, which I would guess will be the end of May. If it fails to grab by then, I will look to mid-August as my possible entry level.

I am in the process of accumulating positions in a couple of junior silver explorer/developer names with one that stands out because of it management team. If the final wave that takes the precious metals bull market to its final terminus kicks in by mid-year, I believe that silver and the junior gold-silver developers will lead the advance.

I want to be positioned before the rally begins because once silver becomes topical and "in favor," it morphs into the mania phase far faster and more violently than crypto could ever dream to. (Only subscribers get the first kick at the silver chalice, I might add. . .)

Juniors and the Need for Education

One of my many failings as I rumble through the ever-dimming twilight of what has been a wonderfully exciting career is forgetting at great peril to my reputational capital that not everyone understands mineral exploration and development. Geology-101 was a "must" for every wild-eyed speculator in the 80's and 90's but that was replaced in the post-GFC period of 2007-2009 with "Cannabis-101" and then "Crypto-101" and finally "AI-101" as new manias replaced mineral exploration as the "Speculation of Choice."

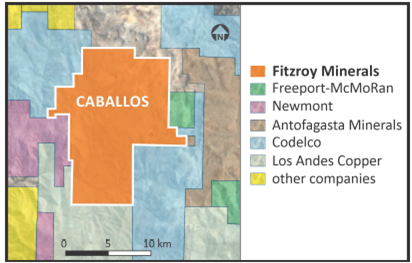

This morning I had a discussion with the Chairman of Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) (Campbell Smyth), whose recent Caballos copper-molybdenum discovery was "world-class" in calibre. It was a 200-meter intercept from surface of 0.88% Cu-Eq mineralization (with a big molybdenum credit) with an enriched 42-meter core that ran 2.31% Cu-Eq grade, a barnburner by any and all measures.

That was the topic of discussion in matters relating to both recovery rates and grade, as this clip, showing an interchange between CEO Merlin Marr-Johnson and COO Gilberto Schubert, reveals.

As I was getting more and more excited about the implications of having only one type of mineralization from surface to the bottom of the hole as in "a perfectly preserved sulphide ore body" I suddenly realized that while it is easy for me to filter through the noise and make the connection to how the absence of oxide mineralization will be of great benefit to recovery rates and ultimate mineable grade, not everyone has the background to interpret this.

By example, there is a big drill program ongoing at a second major project (Buen Retiro) where their Phase One program for 2025 is to define the oxide cap tForhat has been previously identified by way of 33,000 meters of previous drilling.

Unlike Caballos, Buen Retiro is expected to yield copper-bearing mineralization exclusively from oxide material where technologies such as heap-leaching and SX-EW (" solvent-extraction-electrowinning") can process the copper ore very economically, such that a grade of 0.2% Cu would constitute a break-even while 0.5% Cu would be considered "high-grade" and grades above 0.5% Cu deemed "spectacular."

Now, here is my dilemma. The average speculator these days is a) not well-versed in geological mumbo-jumbo such as "oxides" and "sulphides" and b) unaware of the grade requirement differential between sulphides and oxides.

So, after just getting a world-class drill hole with grades of 2.31% Cu-Eq lighting the world on fire (despite a near 50% correction due to the Tariff Tantrums that arrived two days after the news release), how might they respond if the company reports grades expected to be, say, 0.5%? The 2.31% at Caballos is a far cry from the 0.5% (or better) anticipated at Buen Retiro with my greatest fear being that the discrepancy between the two numbers will be judged as a "disappointment" when in fact 0.5% in oxides would be considered a huge "win" by most geologists experienced in the oxide copper recovery business.

I suggested a press release where management could inform shareholders of this important difference between what is going on at Caballos versus developments at Buen Retiro but with the regulators being quite sticky about "forward-looking statements" these days, it seems that the best that can be hoped for is publications like this helping to educate the masses as to the substantial potential of this two-property juggernaut called Fitzroy Minerals Inc.

A third project a gold-silver-copper project called Polimet has just completed drilling with assays pending. Recommencement of drilling at Caballos in a few more days should light the speculative lamp once confirmed. A lot going on for all shareholders. . .

Personally, I was at once both mystified and infuriated that FTZ/FTZFF sold off nearly 50% within days of the news release. Caballos drill hole CABDDH-001 was world-class in all aspects. Back in the day when traders and investors loved the mining exploration business, the stock would have (and should have) doubled to $0.75 or greater, but instead traded down to $0.20.

Now that the stock is deservedly on its way back to the $0.30's again, I guess I should be grateful for the combined ignorance of the investment community as I was able to accumulate a few large chunks of stock in the $0.20-$0.22 range while I was in the U.K. trying my damnedest to navigate the Trump-inspired crash. FTZ/FTZFF is one of those rare jewels that one encounters only from the blessings of the Two Goddesses of the Mining World - Lady Luck and Mother Nature, who decided that Caballos deserved royal anointment.

| Want to be the first to know about interestingGold,Silver,Base Metals andCritical Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.Michael Ballanger: I, or members of my immediate household or family, own securities of: Fitzroy Minerals Inc. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.