Bullish Options Trading Picks Up on Twitter Before Earnings

TWTR stock tends to make big moves after earnings

TWTR stock tends to make big moves after earnings

With Twitter Inc (NYSE:TWTR) set to report fourth-quarter earnings ahead of open tomorrow, Feb. 7, call volume is accelerated on the social media stock today. At last check, around 40,000 calls have traded on TWTR stock -- two times what's typically seen at this point -- with the weekly 2/8 options series in focus.

More specifically, the weekly 2/8 35-strike call is most active, with 6,452 contracts on the tape. It looks like some speculators may be buying to open these calls for a volume-weighted average price of $1.82. If this is the case, breakeven for the call buyers at the close this Friday, Feb. 8, is $36.82 (strike plus premium paid).

This bullish positioning is hardly new for Twitter options traders. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day call/put volume ratio of 3.79 ranks in the 88th annual percentile, meaning calls have been bought to open over puts at a faster-than-usual pace.

Elsewhere on Wall Street, though, 18 of 25 analysts maintain a "hold" or "strong sell" rating on Twitter. Plus, the average 12-month price target of $34.45 is roughly in line with the stock's current perch.

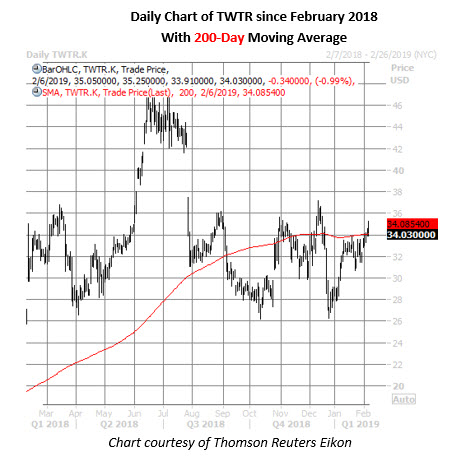

Short interest, meanwhile, plunged 44.3% during the Dec. 15 and Jan. 15 reporting periods, which likely helped fuel the stock's strong rally off its Dec. 24 low of $26.26. Whatever the reason, TWTR stock is up almost 30% since finding a familiar floor in this region, and is testingits 200-day moving average today -- up 0.03% at $34.40.

For tomorrow's trading, the options market is pricing in a post-earnings move of 19.5%, more than the 12.9% next-day move TWTR stock has averaged over the last eight quarters. Four of those earnings reactions have been positive -- including a 15.5% jump last quarter and 12.2% pop this time last year -- and four have been negative, including a 20.5% plunge last July.