Buy Calls Now to Play Tech Stock's Next Pop

MongoDB just pulled back to a bullish trendline on the charts

MongoDB just pulled back to a bullish trendline on the charts

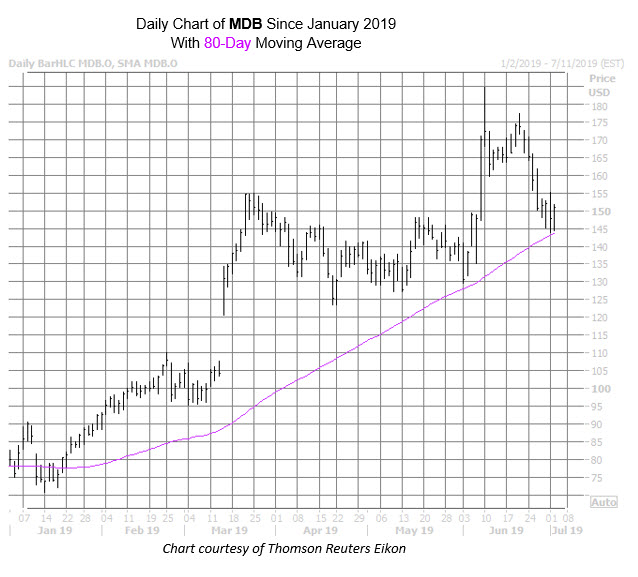

Database concern MongoDB Inc (NASDAQ:MDB) has been trending higher all year, but caught a real shot in the arm from last month's earnings report that propelled it toward a record intraday peak of $184.78 on June 10. While it's pulled back from those lofty heights,a historically bullish signal just sounded on the charts that suggests MDB could be headed back to all-time highs soon.

Specifically, MongoDB closed Monday's session within one standard deviation of its supportive 80-day moving average, after a lengthy period atop the trendline. Similar pullbacks have occurred five times in the last couple of years, according to Schaeffer's Senior Quantitative Analyst Rocky White. Following these prior signals, the stock has averaged a five-day return of 10.2%, and a one-month return of 17.94%, ending higher after each signal. From its current perch at $151.28, similar returns this time around would place the stock at $166.71 in one week, andat $178.42 in the course of a month -- in striking distance of last month's record peak.

While short interest has begun to unwind, down 8.1% in the last reporting period, the 6.65 million shares sold short still represent a healthy 21.8% of the stock's available float. What's more, it would take almost a week to cover all of these bearish bets at the stock's average daily trading volume, which could put some wind at MDB's back as even more shorts begin to jump ship.

Now is an opportune time to bet on MongoDB's next short-term pop with options. The equity's Schaeffer's Volatility Index (SVI) of 53% sits in the 18th percentile of its annual range. This means near-term options traders are pricing in relatively low volatility expectations.

What's more, MDB has had a tendency to make bigger moves than its options premiums were pricing in over the past year. The stock's Schaeffer's Volatility Scorecard (SVS) sits at a relatively high 82, which could make calls an even more attractive choice.