Buy Gold While The Market Is Risk-On

Risk sentiment in the market has improved remarkably in a short span of time.

Productive US-China trade talks, strong corporate earnings, and a UK-EU Brexit deal have brought back investor risk appetite.

Gold is firmly bullish, with its technical charts flashing strong Buy signals.

An attractive buy entry point into gold would be now, when the market has turned risk-on and when complacency might just be creeping in.

In a span of two weeks, investor sentiment has turned decidedly positive. The S&P 500 (SPY) now trades within touching distance of fresh all-time highs, and the VIX (a measure of volatility) has fallen back to sleepy (read: complacent) levels.

There are three main catalysts for investors throwing caution to the wind. First, US and China have relented and agreed on Phase 1 of a trade deal. I have written before that Trump might be aiming to time a trade consensus with China to boost his election chances. That seems to be his plan - with other phases in the trade deal likely to materialise in regular intervals going into the November 2020 election.

Regardless, productive trade talks in Washington last week let loose a bout of animal spirits in the markets, and global equities rightly moved higher in response.

The second catalyst has been a very decent set of earnings so far in corporate America. So far, more than 76% of the companies in the S&P 500 have topped analyst expectations, according to FactSet. Banks - with the exception of Goldman Sachs (GS) - have had a strong run. JPMorgan (JPM), in particular, reported record revenues, and the bank looks to be growing from strength to strength. Even Netflix (NFLX) managed to jump more than 5% higher despite announcing slower subscriber growth.

The third catalyst is the EU and the UK agreeing on a Brexit deal. Boris Johnson now has to go where Theresa May had failed thrice before - to get the deal ratified by a divided UK parliament this Saturday. If parliament rejects the deal, the UK will most likely have to turn to a Brexit deadline extension - with the slated 31 October hard cut-off looking extremely ominous.

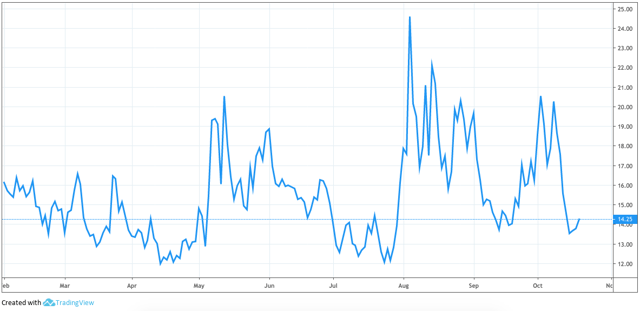

These three catalysts have worked in tandem to bring volatility back down to suppressed levels. At the start of October, the VIX was at 22. In a couple of days, it is now below 14. While equities have climbed and fear has receded in the marketplace, safe haven gold (GLD) has remained stoic and staunchly firm.

VIX Chart

XAU/USD Daily Chart

Gold has surprisingly turned in a positive return since the month of October, which is strange considering the rampant risk-on environment. This relative strength is not to be ignored, and with pro-risk news now making headlines, it increases the attractiveness for investors to buy into gold now. The last two weeks have provided a very good example of how sentiment can turn at a toss of the dime, and gold should benefit if sentiment reverses once more. Imagine if the Brexit deal fails at parliament for the fourth time this weekend!

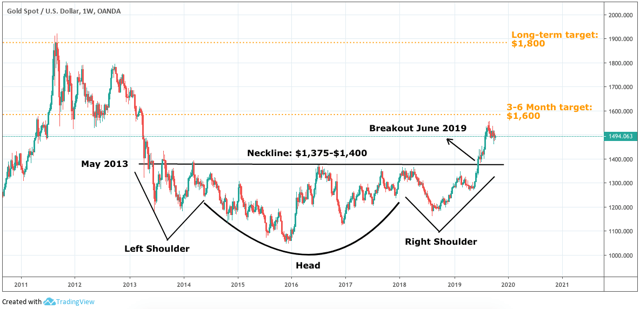

XAU/USD Weekly Chart

On the long-term technical chart, XAU/USD has broken out of a bullish pattern. Since May 2013, $1,375-1,400 have provided stern resistance, but that neckline of an inverse head and shoulders pattern has been broken in June 2019. I now see gold prices moving towards $1,600 within the next 6 months and $1,800 in the months to come.

The key question is whether gold can go higher alongside equities. Yes, that is possible. In fact, we have been seeing that since the start of 2019, with global central banks taking turns to cut interest rates - led by the US Federal Reserve. Lower interest rates push gold prices higher and support equities. Gold plays a secondary function too in an investor's portfolio - providing insurance if volatility creeps higher or if risk sentiment sours.

An attractive buy entry point into gold would be if complacency takes root in the markets, and this may be what is happening now. I would suggest buying gold now, as it is trading below the $1,500 level, with the 6-12 month target at $1,600 and with a stop loss below $1,450. We have seen investors cheer the US-China preliminary trade deal, a Brexit compromise between the UK and the EU, and decent corporate earnings thus far in the US.

With all these positive news out in the open, the markets may be blindsided by the UK parliament rejecting Boris Johnson's deal and the prospect of a hard Brexit on October 31, or Trump stoking tensions between the US and China (again), as well as key US bellwethers reporting weaker-than-expected earning numbers towards the later stages of the earnings season.

If you like what you read and want high-conviction trading calls delivered straight to your inbox, do check out my Marketplace Service The Naked Charts, where I identify mature technical chart patterns that are on the cusp of huge, profitable, sustainable breakouts. The core aim of my service is to be both profitable and educational for you, such that over time you will be able to identify similar breakout patterns for yourself.

Disclosure: I am/we are long XAU/USD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Greenwood Investments and get email alerts