Buy the Dip on Skechers Stock

Skechers has pulled back from its late-July post-earnings peak

Skechers has pulled back from its late-July post-earnings peak

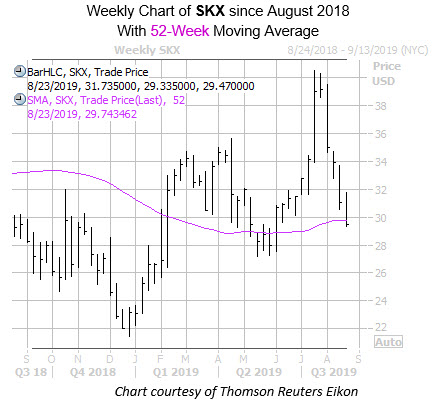

Sneaker name Skechers USA Inc (NYSE:SKX) is moving notably lower this afternoon, last seen down 5.4%, at $29.46 -- falling in step with Foot Locker (FL) and Nike (NKE). Skechers stock has been on a downtrend for quite some time, but things may be looking up for the security, as data from Schaeffer's Senior Quantitative Analyst Rocky White suggests SKX may be readying for its next jump higher.

Specifically, Skechers stock has pulled back to long-term support at its 52-week moving average. Per White, there have been 13 other times the equity has come within one standard deviation of this trendline after a lengthy stretch above it, resulting in an average three-month gain of 16%, with 77% of the returns positive. A surge of this magnitude would put SKX above $34 by Thanksgiving.

Skechers stock has had a volatile run on the charts this year, last month seeing a post-earnings bull gap that sent the shares to an annual high of $40.50 on July 19. And while the equity has pulled back in recent weeks, it remains 27.7% higher year-to-date.

Short interest has rolled back on SKX, down nearly 26% during the past two reporting periods. These bearish bets now account for over 5% of the stock's total available float, and it would take short sellers just three days to buy back their bearish bets, at the average daily pace of trading.

Those wanting to bet on another SKX stock rally off its 52-week moving average may want to consider a premium-buying strategy. The equity's Schaeffer's Volatility Index (SVI) of 35% ranks in the bottom 6th annual percentile. In other words, the equity's front-month at-the-money options have priced in lower volatility expectations just 6% of the time over the last year.