Buy This Blue Chip While It's Still On Sale, Says Signal

The stock just pulled back to a historically bullish trendline

The stock just pulled back to a historically bullish trendline

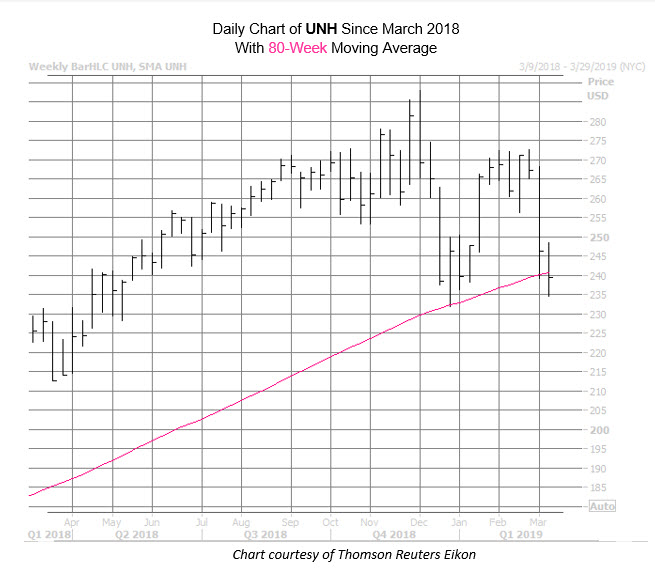

UnitedHealth Group Inc (NYSE:UNH) stock has taken a beating, after last week's Medicare-for-All bill was introduced by House Democrats -- wreaking havoc on the health insurers and helping to drag down the Dow on Monday. However, it appears the stock has found some support in the $235 area, which is around where it bottomed in late December and early January. What's more, UNH just flashed a historically bullish signal on the charts, suggesting the blue chip could be a bargain right now.

Specifically, the stock just came within one standard deviation of it's 80-week moving average after a lengthy period above the trendline. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, this signal has appeared 11 times in the past 15 years. UNH stock averaged a 9% gain three months later, and was higher 80% of the time after these signals. From its current perch at $239.65, a move of similar magnitude would put it at $261.22 -- right around where UNH sat prior to the Medicare-bill plunge.

UNH stock's sell-off hasn't deterred analysts, who are still resoundingly optimistic on the insurance concern. Fourteen of the 17 analysts following the stock give it a "strong buy" rating, only one says "hold," and there isn't a single "sell" to be seen. What's more, the consensus 12-month target price of $307.17 is a 29% premium to current levels.

Options traders have remained bullish on the equity, too. On the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) 1.87 calls have been bought to open for every put in the past 10 days. This ratio sits in the 83rd percentile of its annual range, meaning there's been a healthier-than-usual appetite for bullish bets of late.

Looking at today's trading, it appears to be business as usual, with calls still slightly outnumbering puts. There does appear to be some activity on both sides of the weekly 3/8 series, though, with 237.50- and 235-strike puts and 240-strike calls being bought to open.

That being said, it might be a good time to speculate on more upside for UNH with options. The equity's Schaeffer's Volatility Index (SVI) of 23% stands in the 38th percentile of its annual range. This means that near-term options are pricing in relatively modest volatility expectations right now.