Call Buyers Place Bets During Revlon Sell-Off

Revlon has landed on the short-sale restricted list today

Revlon has landed on the short-sale restricted list today

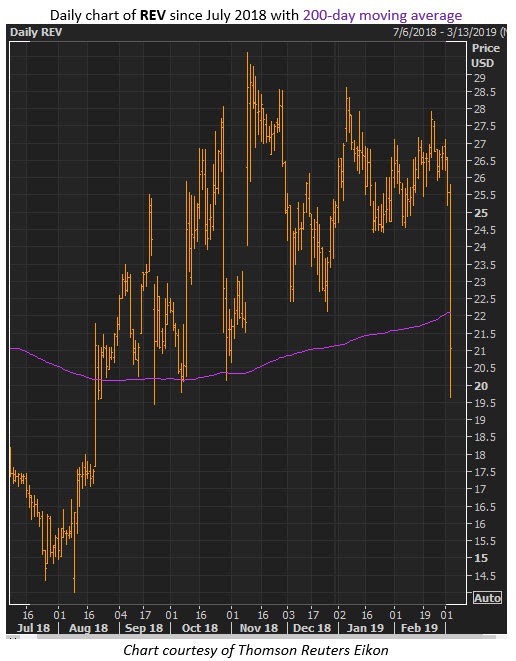

Revlon Inc (NYSE:REV) stock is selling off today after brokerage firm Jefferies pointed out data from Nielsen showing worsening sales for the cosmetics company. REV shares are trading down 17.7% at $21.05, set for its first close below the 200-day moving average since August, and options volume is running at an accelerated pace.

At last check, it was actually call volume that was leading the way, with roughly 800 contracts crossing so far, compared to an average daily volume of just 54. Most popular by a mile is the April 22.50 call, where data points to buy-to-open activity. If so, these traders would be betting on a rebounding from REV stock in the weeks ahead.

One group that's certainly cheering today's sell-off is short sellers. These bears control one-third of Revlon's float, and it would take them almost eight weeks to cover their positions, based on average daily trading volumes. Of course, today's sell-off has REV on the short-sale restricted list.