Call Buying Stays Hot On First Solar Stock

FSLR short sellers could be staring at huge losses

FSLR short sellers could be staring at huge losses

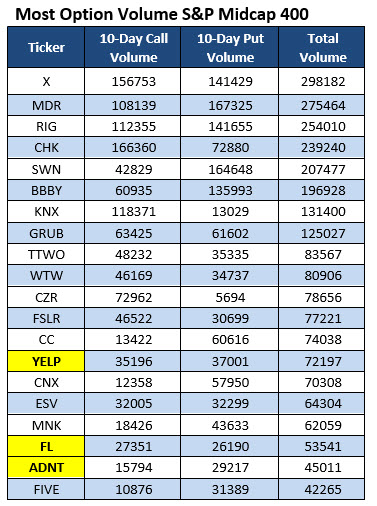

Looking at the most recent list from Schaeffer's Senior Quantitative Analyst Rocky White showing S&P 400 Midcap Index (MID) stocks that have seen the most options activity during the past 10 days, one name that stuck out was First Solar, Inc. (NASDAQ:FSLR). Call activity has remained popular on the energy name, with data from the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) confirming unusual interest in long calls. Specifically, the 10-day call/put volume ratio at these exchanges is 4.69, and ranks in the 87th annual percentile.

From a broader standpoint, peak open interest sits at the August 70 call, where almost 10,800 contacts are sitting, compared to just 3,130 at the next closest option. In today's trading, however, puts are unusually popular, driven by heavy attention at the weekly 8/23 57- and 61.50-strike puts, with new positions opening at each.

Meanwhile, short interest remains very high on FSLR stock, accounting for 14.4% of the float -- or 9.9 times the average daily trading volume. In fact, another study done by White suggests that the average First Solar short seller is sitting on a loss of 27.5%.

This suggests the shares could benefit from short-covering tailwinds. They're already up almost 44% in 2019, though they've dropped 3.8% today to trade at $61.06 due to broad-market headwinds, and are set for their first close below the 80-day moving average since early January.