Calls Pop After DOCU Stock Nabs New High

DocuSign is finishing the month out strong, and options players are paying attention

DocuSign is finishing the month out strong, and options players are paying attention

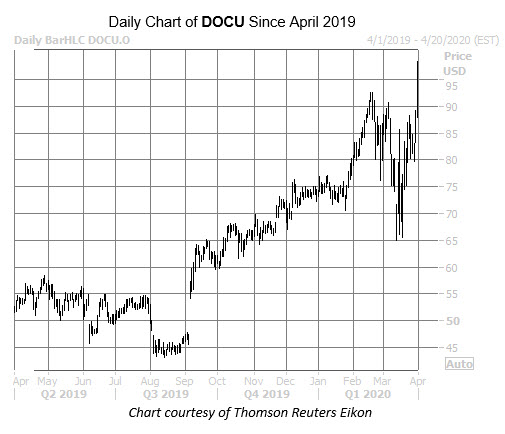

While a large portion of the broad market is still struggling to recuperate from this month's violent selloff, DocuSign Inc (NASDAQ:DOCU) has recovered from its mid-March plummet and then some. In fact, the equity broke through recent pressure at the $90 region to nab a new all-time high of $98.38 earlier today, and is now up 5.9% to trade at $93.35.

DocuSign's options pits have been busy in response. So far 17,000 calls and 4,824 puts have crossed the tape -- four times the average intraday amount. The April 110 call is the most popular, with positions being opened here. Positions are also being opened at the April 100 and 105 call contracts, suggesting these traders are eyeing even more upside for DOCU in the coming month.

This tendency towards bullish bets isn't out of the norm for DOCU. In the last 10 weeks, 3.93 calls have been picked up for every put at the the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio sits higher than 88% of all other readings from the past 12 months, suggesting this appetite for long calls is unusual.

That being said, DOCU calls can be had at a bargain right now, especially considering recent market volatility. The security's Schaeffer's volatility index (SVI) of 61% stands in the relatively low 28th percentile of its annual range. This means options players are pricing in relatively low volatility expectations at the moment.

Shifting focus, it looks like a round of upgrades could push DOCU stock higher. While 10 of the 13 analysts covering the equity consider it a "buy" or better, three stalwarts still say "hold." Plus, the consensus 12-month price target of $86.46 is a 7.6% discount to current levels.