Cameco Crash, Uranium Sector Won't Catch a break / Commodities / Uranium

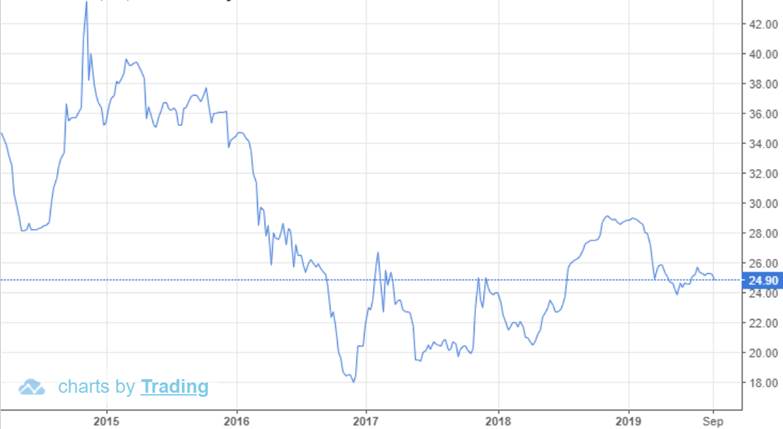

One weekago Cameco announced it will maintain low output levels until uranium pricesrecover. The Canadian uranium miner also said it might cut production further, having already closed four mines in Canada and laid off2,000 of its workers in the uranium mining hub of Saskatchewan.

Cameco share price

Newslike this has stalked the uranium market for years, and while 2018 was a greatyear for the nuclear fuel, hope for a price pick-up is dim; once an importantcommodity at resource investing shows, uranium is now mostly ignored. Uranium bullsare as rare as white unicorns, having switched allegiance to metals thatsupport Ahead of the Herd’s electrification of the transportation systemthesis, like lithium, nickel and cobalt.

Fortunately,there is a way to be both a supporter of nuclear energy - still one of thesafest and most efficient means of baseload power generation - and ditchuranium, which is quickly becoming a dinosaur of a commodity we think best leftalone. We’ve been banging the drums of thorium-based nuclear reactors for awhile.In this article we present thorium’s case viz a viz a sick and dying uraniummarket.

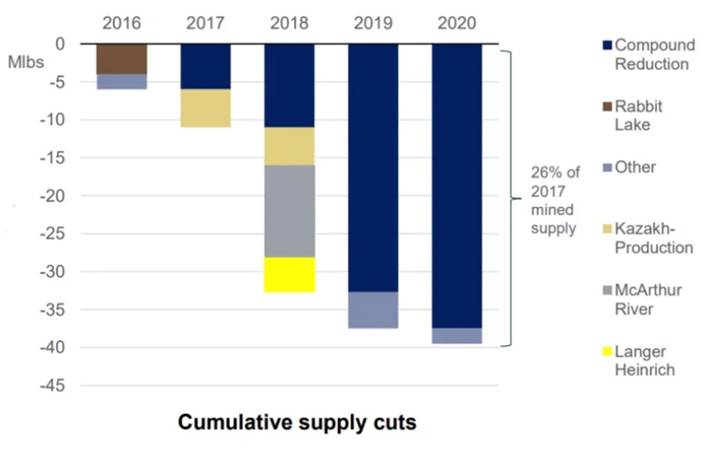

No end to supply glut

“Weare not restarting mines until we see a better market and we may close morecapacity, although no decision has been taken yet,” Cameco CEO Tim Gitzel told Reuters recentlyat the World Nuclear Association’s annual conference.

Justover a year ago Cameco made the difficult decision to close its MacArthur Riverand Key Lake mines, in response to low uranium prices, leaving the company’sflagship Cigar Lake facility as its only operating mine left in northernSaskatchewan, home to the world’s highest grade uranium deposit.

The mine closures by Cameco were preceded by 20% production cutsin Kazakhstan, the number one uranium-producing country. The former Soviet bloccountry has said 2020-21 output will not rise above 2019 levels. In Canada, thesecond largest U producer, 2018 production was cut in half to 7,000 tonnes.

An estimated 35% of uranium supply has been stripped fromthe market since Kazakhstan’s supplyreductions in December 2017.

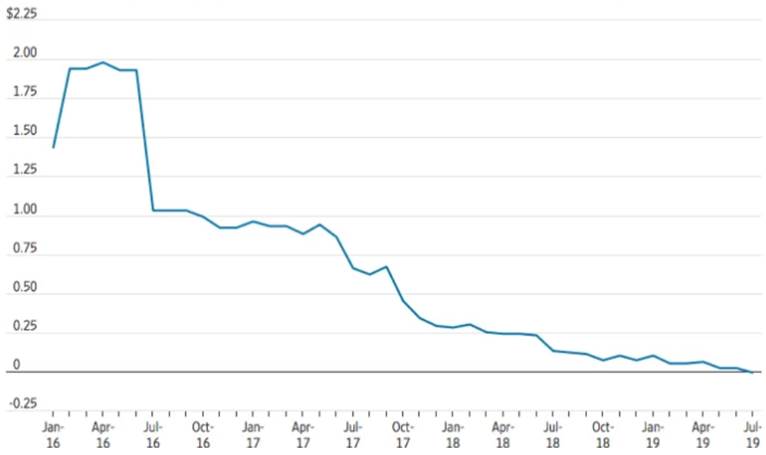

Uranium spot price

While the mine closures kicked up the price of uranium in 2018,they haven’t been enough to build momentum. Spot uranium finished last year upjust over 20%. Year to date 2019, triuranium octoxide, or U3O8, is down adisappointing 11.9%, trading at $25.10 per pound, as of Sept. 11.

Thedownward spiral of production and prices can be blamed on a supply glut. Whenuranium crashed after the 2011 nuclear meltdown at Fukushima, Japan, producersthought they could weather the storm by producing more to compensate for lowerprices. The unsurprising result was to create a supply glut that pushed spot toa record low of $17.75 a pound on Nov. 28, 2016. By 2018 the price hadrecovered to around $20, but that meant around 95% of producers were operatingat a loss. Uranium miners were left with a grim choice: go bankrupt, orsignificantly cut production, until prices return to a profitable level. And sowe wait.

According to the World Nuclear Association Kazakhstan’suranium production went from 5,000mt in 2006 to over 24,000mt in 2016. Thatcountry is now the leading low-cost producer. Renownedinvestor Marin Katusa believes uranium will stay low because the world’slargest uranium producer, Kazatomprom, will continue to produce at high levels- the Russians and Kazakhs plan to position themselves as the dominant sourceof uranium over the next 20 years.

Uranium demand and China

Inresponse to the supply glut/ low price argument, uranium bulls like to presentChina as the country that will save the day and float everyone’s long-sunkenuranium stock boats. It’s true that, of 453 operating nuclear reactors and 55new reactors under construction, globally, China has the most reactors in thepipeline including 43 operating, 15 under construction and 179 planned orproposed.

Chinathen, will demand millions of tonnes of yellowcake, that it will have to import,right, pushing up the price? In fact, China has been working to reduce itsdependence on imported uranium, and fossil-fueled power generation, bydeveloping domestic uranium deposits and either partnering with or buying mineproperties overseas. The Asian superpower has started building its own uraniumsupply chain, such as starting the Husab mine in Namibia. In November 2018,China National Uranium Corp bought the Rossing mine in Namibia from Rio Tinto.

Accordingto the World Nuclear Association, China has become self-sufficient in most aspects of thenuclear fuel cycle: China aims to produceone-third of its uranium domestically, obtain one-third through foreign equityin mines and joint ventures overseas, and to purchase one-third on the openmarket.

TheChina Nuclear International Uranium Corporation (SinoU) set up the Azelik minein Niger and has agreed to buy a 25% stake in Paladin’s Langer Heinrich mine inNamibia for $190 million. In 2007 SinoU bought a share in the Zhalpak mine inKazakhstan, through a joint venture with Kazatomprom.

Prospectsin Kazakhstan, Uzbekistan, Mongolia, Namibia, Algeria and Zimbabwe, Canada andSouth Africa are also seen as potential suppliers for SinoU, writes WNA.

Inother words, China is well on its way to figuring out how it will supplyuranium to all the new nuclear reactors it plans to build; it probably doesn’tneed the West to discover new uranium deposits and ink more offtakeagreements.

Anotherexpert body, the Nuclear Energy Agency, states that an expected increase indemand for U3O8 needed for competitively priced baseload electricity derivedfrom nuclear power plants, particularly in developing countries, willadequately be met by current uranium supplies.

Ina bi-annual report known as the ‘Red Book’, the NEA points to the public’s fear of nuclear powerpost-Fukushima, and low-cost natural gas, as the two main factors that havedampened the prospects for growth in nuclear generating capacity, and arelikely to keep uranium prices depressed:

[T]he Fukushima Daiichi accident has erodedpublic confidence in nuclear power in some countries, and prospects for growthin nuclear generating capacity are thus being reduced and are subject to evengreater uncertainty than usual. In addition, the abundance of low-cost naturalgas in North America and the risk-averse investment climate have reduced thecompetitiveness of nuclear power plants in liberalized electricitymarkets…

“The currently defined resource base [6.1million tonnes of recoverable insitu uranium] is more than adequate to meethigh case uranium demand through 2035, but doing so will depend upon timelyinvestments to turn resources into refined uranium ready for nuclear fuelproduction. Challenges remain in the global uranium market with high levels ofoversupply and inventories, resulting in continuing pricing pressures.

Nuclear demand shrinking

Of course the entire investment case for uranium is anchored onthe idea of healthy demand for nuclear power especially as the world moves offfossil-fueled power generation to cleaner forms of power like hydro-electricand renewables.

A key piece of that argument has been Japan re-starting itsnuclear reactors that were shut down for safety checks and refurbishment followingFukushima. Before the 2011 earthquake and tsunami caused three reactors atTokyo Electric Power’s Fukushima plant to overheat, Japan was the world’s thirdlargest consumer of nuclear power, behind the US and France, operating 54nuclear reactors.

Eight years later, only nine of 33 remaining reactors have beenre-started, and Japan’s nuclear operators are reportedly starting to sell their uranium fuel, as the chances fade of more reactors coming online, andadding to the six currently operating. Long-term contracts are also beingcanceled.

Inanother blow to the industry, Japan’s new environment minister, ShinjiroKoizumi, has said he wants all reactors shuttered to avoid a repeat of the Fukushima catastrophe that leakedradiation and forced 160,000 people to flee the area, many of whom have notreturned.

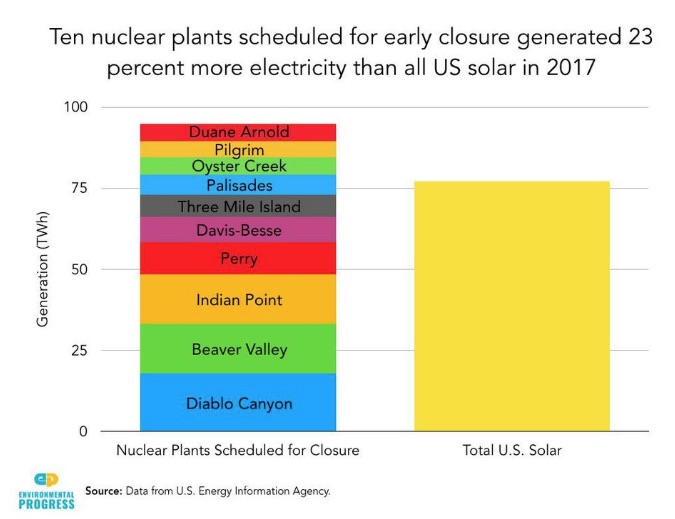

Asreactors close in the United States, Germany, Belgium and other countries, “tradersand specialists say the market is likely to remain depressed for years,” Reuters reported in August.

Germanyhas pledged to shut down all its reactors by 2022 and the Belgian governmenthas agreed to a new energy pact that will see nuclear power phased out over the next seven years. Germany currently gets nearlyhalf (47%) of its energy from renewable sources, although 30% is generated fromcoal - needed to replace the gap in the energy grid left by nuclear power plantclosures.

Whenthe Duane Arnold nuclear plant in Iowa shuts down in 2020, and assuming other planned closures occur, itwill mean 10 less reactors in the United States - from 99 to 89 - by 2025. Toput that into perspective, the energy lost from those 10 reactors amounts to23% more than all the solar electricity generated by the United States in2017.

Uranium/ nuclear consequences

Nobodyneeds to warn the Japanese about the potentially deadly impacts ofuranium-fueled nuclear reactors if something goes wrong. Nor the good people ofChernobyl, Russia, many of whom are suffering the long-term effects ofradiation exposure.

Russianswere reminded in August of what can happen, after a failed missile test resulted in an explosion that killedfive scientists. The scientists werereportedly working on a small-scale nuclear reactor, located on an oil platformin Russia’s White Sea near the Arctic Circle, when the blast occurred.

While“only” 31 people were directly killed in 1986 at Chernobyl, the United Nations predicts another 4,000 couldeventually die from diseases such asthyroid cancer linked to radiation exposure.

The Guardian reports there was in fact an epidemic of thyroid cancer after Chernobyl, while in Japanfollowing Fukushima, children screened for radioactive iodine were found tohave been exposed to dangerous levels of radiation:

An initial ultrasound survey of thyroidglands two years after the accident – well before any cases of thyroid cancerfrom radiation would be expected to show up – found large numbers of cysts andnodules on thyroid glands. There were 113 cases of thyroid cancer, comparedwith the four that doctors would expect to diagnose in a normal population ofthe same size without screening.

Nuclearaccidents not only hurt people, but the environment.

AfterFukushima, millions, perhaps billions, of tonnes of radioactive water -generated in a process to cool melted nuclear fuel at the three damagedreactors - flowed into the Pacific Ocean, putting fisheries and other marinelife at risk.

Theutility in charge of the complex, Tokyo Electric Power Company Holdings, triedto block contaminated water from entering the ocean, by building an undergroundice wall. However, the wall has only managed to reduce the flow of groundwaterfrom about 500 tonnes a day to about 100 tpd.

Lastyear, a study found that radioactive water continued to flow into the ocean ata rate of about 2 billion becquerels a day. While that sounds bad, it is infact a dramatic improvement from 2013, when 30 billion bequerels a day leakedcesium 137, a radioactive isotope.

Arate of 0.02 bequerels per liter of seawater, considered safe for the localfishing industry, was measured in samples collected from a coastal town 8 kmfrom the Fukushima No. 1 plant, Japan Times reported.

Butthe plant continues to have problems dealing with contaminated water. The Guardian reported on Thursday that Tokyo Electric Power will have to dump a huge amountof contaminated water that has been accumulating, into the ocean.

Overa million tonnes is being stored in close to 1,000 tanks but the utility haswarned it will run out of space by 2022. According to one study, it could take17 years to safely discharge the water, after it has been sufficientlydiluted.

The case for thorium

Fukushimahas soured the world on nuclear, and started scientists looking more closely atthorium as a “greener” alternative. Some scientists believe thorium is key todeveloping a new version of cleaner, safer nuclear power.

Whileconventional nuclear power plants are only able to extract 3-5% of the energyin uranium fuel rods, in molten salt reactors (MSR) favored by thoriumproponents, nearly all the fuel is consumed. Where radioactive waste fromuranium-based reactors lasts up to 10,000 years, residues from the thoriumreaction will become inert within 500.

Akey advantage of MSRs is the reactor cannot melt down, as we saw in Japan’sFukushima when electric pumps were inundated by the tsunami, failing to coolthe fuel rods, which overheated and caused radiation emissions. MSRs can alsobe made cheaper and smaller than conventional reactors, since they do not havelarge pressurized containment tanks, meaning they could be used in factorysettings.

Whereradioactive waste from uranium-based reactors lasts up to 10,000 years,residues from the thorium reaction will become inert within 500. Nuclear waste(ie. plutonium) from uranium fueled reactors can be recycled to recover thefissile materials needed to create the nuclear reaction. In this way, thoriumreactors not only generate less waste than conventional reactors, but also helpto rectify the nuclear waste disposal problem.

Importantly,because plutonium is not created as a waste product in a thorium reactor, itcannot be separated from the waste and used to make nuclear weapons.

Theportability of MSRs is another major advantage over the capital-intensive,permanent nuclear power plants we currently have.

Tolearn about the fascinating history of thorium and its potential for nuclearpower generation, read Uranium’s ugly stepsister

Otherthan the fact that uranium is better than thorium in building nuclear weapons,how do the two nuclear fuels stack up against one another? According to the Royal Society of Chemistry, thorium’s benefits include:

Thorium is three to four times more abundant than uranium. Thereis estimated to be enough thorium on the planet to last 10,000 years.Thorium is more easily extracted than uranium.Liquid fluoride thorium reactors (LFTR) - a type of molten saltreactor - have very little waste compared with reactors powered by uranium.It is more efficient. One tonne of thorium delivers the same amountof energy as 250 tonnes of uranium.LFTRs run at atmospheric pressure instead of 150 to 160 times atmosphericpressure currently needed for water cooled reactors.Thorium is less radioactive than uranium.Asfar as disadvantages, thorium takes extremely high temperatures to producenuclear fuel (550 degrees higher than uranium dioxide), meaning thorium dioxideis expensive to make. Second, irradiated thorium is dangerously radioactive inthe short-term.

Detractorsalso say the thorium fuel cycle is less advanced than uranium-plutonium andcould take decades to perfect; by that time, renewable energies could make thecost of thorium reactors cost-prohibitive. The International Nuclear Agencypredicts that the thorium cycle won’t be commercially viable while uranium isstill readily available.

Arguablythough, the technology exists, so why not develop it?

Examplesof companies and countries that are testing thorium’s viability as a nuclearfuel keep growing. In 2017 a Dutch nuclear institute started experimenting withMSRs. NRG, the name of the facility, on the North Sea coast of the Netherlands,launched the Salt Irradiation Experiment in collaboration with the EU. New Scientist reports the researchers will use thorium as the nuclear fuel for the reactor where boththe reactor fuel and the coolant are a mixture of molten salt. The experimentwill also examine how to deal with the nuclear waste.

InNorway, Thor Energy started producing power from thorium at its Halden testreactor in 2013, with help from Westinghouse. The third phase of a five-year thorium trial operation got underway in 2018.

India’sthorium program is well advanced. The country envisions meeting 30% of itselectricity demands through thorium-based reactors by 2050. With largequantities of thorium and little uranium, India wants to use thorium forlarge-scale energy production. It plans to construct and commission a fleet of500 sodium-cooled fast reactors - which burn spent uranium and plutonium - inorder to breed plutonium to be used in its advanced heavy water reactors thatemploy thorium as the nuclear fuel.

Indonesia,which has a large amount of thorium contained within monazite, signed an agreement with US company ThorCon Power, to develop molten salt reactors. A 1,000-megawattthorium-based reactor would be used for base-load power and produce 5 gigawattsa year. The country wants around 20% of its energy mix to come from thoriummolten salt reactors by 2050.

Inthe United States, the Department of Energy is partnering with TerraPower,Vanderbilt and the Oak Ridge National Lab, among others, to build a moltenchloride fast reactor - a type of MSR - Oilprice.com reported.Southern Company in 2016 was the second firm to receive a grant from the DOE.

China,seemingly always on the leading edge of new energy, has put aside US$3.3billion to build two molten salt reactors in the Gobi Desert, to be up andrunning by 2020, the South China Morning Post said. The reactors could spawn new uses for the radioactiveelement, including applications in warships and drones.

Closerto home, the New Brunswick government has committed $10 million towardsbuilding a “nuclear research cluster” that includes a demonstration Stable SaltReactor - Wasteburner (an SSR-W is suitable for grid-scale power, between 300megawatts and 3GW) to be powered by spent uranium. SSRs can also use thorium asthe nuclear fuel. A full-sized SSR-W is planned for 2030.

Thinkabout British Columbia’s energy needs. Instead of meeting them with the Site Cdam, which comes with its own environmental problems - flooding a 100-kmstretch of the Peace River Valley - how about deploying thorium reactors?

TheSite C dam is slated to provide 1,100 megawatts of capacity - enough to powerhalf a million homes.

New Brunswick’s planned SSR and BC’s Site C are ofequivalent size; $10.7B Site C has a design capacity of 1.1GW compared to 1GWfor the $2B SSR.

Thelevelized cost of energy (the price a power station must receive over itslifetime to break even) of an SSR is one third the cost of coal, natural gasand conventional nuclear power - $45 a megawatt-hour.

Thatmeans New Brunswick’s plan for future emissions-free, green power is 80% cheaper,in terms of capital costs, than BC’s Site C hydroelectric dam, and 87.5% thecost of Site C plus LNG Canada tax breaks.

Sonot only does BC’s wrong-headed energy strategy cost taxpayers eight times asmuch as New Brunswick’s, it is also a lot worse for the environment. When willthe people of BC wake up and see what a colossal mistake the province is makingin embracing liquefied natural gas, with its fugitive methane emissions and thecontinuation of fracking BC’s northeast where hundreds of natural gas well willbe drilled and fracked to supply BC’s growing LNG industry, wasting andpoisoning our fresh water, causing earthquakes, releasing cancer-causingbenzene into the water supply, and setting up a massive increase in tankertraffic, the effects of which will result in the disappearance of alreadyendangered killer whales?

Formore on the devastating impacts of LNG and natural gas, read The real price of LNG

Conclusion

Thisarticle has focused on the drawbacks of uranium and the futility of investingin uranium companies, at least for the foreseeable future. At Ahead of theHerd, we know energy markets inside and out, and we just don’t see an upside inuranium.

Yes,as the world transitions from fossil fuels to clean energy, nuclear will haveto be in the mix of alternatives, along with hydro-electric and renewables ie.solar and wind. But that doesn’t mean we are tied to uranium. Thorium is asafer, more efficient and far more cost-efficient means of achieving the sameamount of power as a hydro-electric dam - as in the Site C vs SSR example above- or a conventional water-cooled uranium-fed nuclear reactor.

Chinawill remain a big source of uranium demand, but the market for U3O8 continuesto languish as Western countries turn away from nuclear.

AtAhead of the Herd, we see thorium playing a critical role in the inevitableshift from fossil-fueled to clean (including nuclear) power generation.Electricity generated from thorium could also help to meet the extra powerloads on electricity grids, expected to be demanded by the huge increase inelectric vehicles, all needing to be regularly plugged in.

Wesee two markets for EVs during this transition. The first is fully-electricsfor urban environments, maybe plug-in hybrids for drivers with longer commutes,and the second is full hybrids for longer journeys and commutes that don’t needto depend on battery-only power or charging infrastructure.

Ifthe future is EVs, the near future is hybrids. Even a significant penetrationof hybrid vehicles into urban markets would be a great start. As drivers get morecomfortable with battery power, and technology advances, we predict a gradualshift from hybrids and plug-in hybrids to battery EVs.

Withhybrids as the bridge, we also see a path forward to helping stop the advanceof the global warming shadow. At the same time, switching from uranium tothorium is a way to bring badly needed trust back to the nuclear industry, atmuch lower capital expenditures and shorter time frames than it takes to buildconventional, uranium-based nuclear facilities.

“In the 1980s there was a new nuclearreactor commissioned every 2½ weeks, on average. Today there are just 53 underconstruction world-wide, nearly all in Asia, according to the WNA, and many ofthe world’s 448 existing plants face decommissioning.” Wall Street Journal

Uranium’sstory is not one of a shortage of supply. Rather the narrative is despite allthe primary/ secondary supply cuts the spot price only went up 20% in 2018, hasgiven back half of that in 2019 and the price is still going down. As discussedabove there are too many negatives at play.

Perhapsit’s time to ditch uranium, along with a large chunk of our fossil fuel use,and go with thorium?

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.