Can Gold's Rally Survive Without The Trade War?

Progress on the U.S.-China trade front is worrisome to gold investors.

Yet despite the loss of safety demand, gold still has plenty going for it.

Increased demand from China, emerging markets will pick up the slack.

Now that the March 1 trade tariff deadline on Chinese goods has been extended, investors can finally breathe a sigh of relief. More importantly for gold, however, the trade deadline extension will test the metal's support. If gold's rally over the last few months was the result of safe-haven demand, as some believe, then a pullback in gold's price would likely follow. In today's report, however, I'll make the case that gold's intermediate-term (3-9 month) recovery will continue even without safety-related demand. Instead of global trade fears, relative strength factors and returning Asian demand should fuel the gold bull's continuation.

The news that President Trump plans on extending the March 1 trade deadline for increasing tariffs on Chinese goods was greeted with a tepid response in the financial market. Stocks barely budged on Monday while the U.S. dollar index (DXY) was virtually unchanged. Evidently, the financial market had already discounted the likelihood of a temporary trade tariff truce and investors were therefore hardly surprised at the latest announcement.

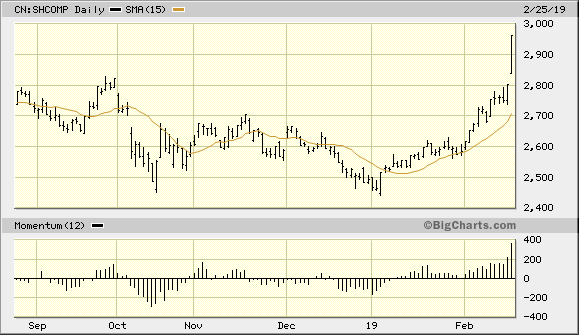

If U.S. markets were uninspired by the news, China's equity market was nothing less than elated. China's Shanghai Composite Index rose by an extremely impressive 5.60% in the latest session and reached its highest level since the trade war first began last summer. The implication of this rally was clear: China stands to benefit from the tariff delay than the U.S.

Source: BigCharts

As encouraging as this was to investors in China's equities, the U.S.-China trade deadline extension is causing many gold investors to question the bullish case for the metal. After all, without the continued support of a strong safety component (in the form of trade war fears), there is a reason to wonder if gold can continue to rally. Safe-haven demand from investors who feared a China-led global economic slowdown was undoubtedly a big component of gold's appeal in recent months. Without that looming threat, gold will now have to find other ways of appealing to investors.

Fortunately for the gold bulls, the yellow metal has more than a few channels of demand to keep its recovery intact. One of those sources of demand is likely to come from China itself. As one of the world's biggest gold consumers, China has long been a significant support for bullion's relative price strength in recent years. As China's economic prospects improve with the diminishing trade war threat, so too will its gold consumption.

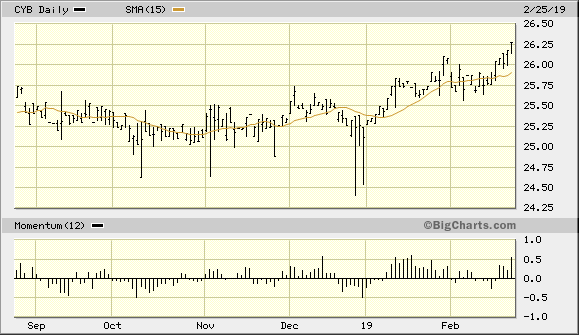

One reflection of investors' increasingly optimistic outlook of China's economy can be seen in the following graph. This shows the recent performance of the WisdomTree Chinese Yuan Strategy Fund (CYB), which can be used as a proxy for the yuan currency. A rising yuan is a good measuring stick for China's projected economic strength, and the rising trend in the yuan ETF can be taken as a sign of returning confidence in China's all-important manufacturing sector. China's manufacturing health, moreover, is a bellwether for the overall strength of the global economy.

Source: BigCharts

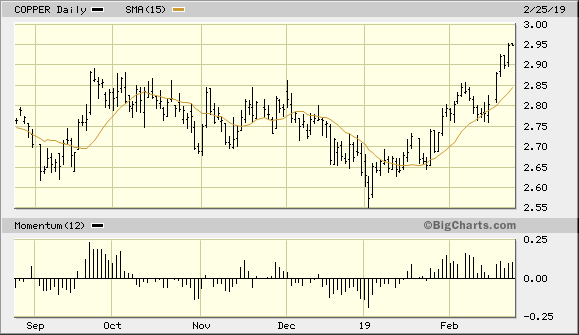

Another sign that the global economic outlook is on the mend is clearly visible in the recent performance of the copper price. Known affectionately as "Dr. Copper" by many economists, a rising copper price is often a precursor for strength in the economies of industrial nations which heavily consume this metal, including China. Copper's recent upward surge is timely in more ways than one: not only does it suggest that a global recession will be dodged, but it also provides a basis for gold's continued recovery. For there is a long-term correlation between rising copper prices and higher gold prices. Copper's rally can therefore be considered as a leading indicator of gold's intermediate-term outlook.

Source: BigCharts

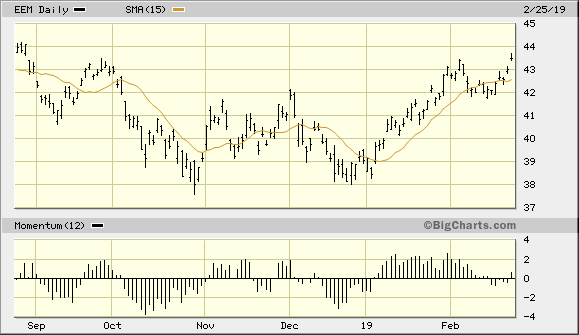

It's not just China that stands to benefit from a favorable resolution to its trade war with the U.S. Other emerging markets will also benefit from an improved global trade outlook, and this is another reason why the loss of safe-haven demand won't necessary hinder gold's recovery. Other emerging industrialized nations like India are also heavy consumers of gold, both in terms of jewelry consumption and industrial demand. A positive trade war resolution would likely increase gold consumption in the emerging markets, thereby further extending the gold price rally. Growing optimism for a rebound in the emerging nations can be seen in the following graph of the iShares MSCI Emerging Markets ETF (EEM). While EEM hasn't rallied to the same extent that China's stock market has, it has nonetheless recovered all of its lost ground since last summer's setback.

Source: BigCharts

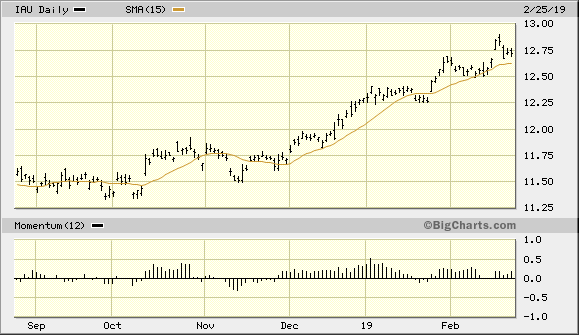

Turning our attention to the gold ETF outlook, the iShares Gold Trust (IAU) is still in a position of technical strength after flashing a buy signal per the rules of my trading discipline in October. While there has been a noticeable slowdown in IAU's price momentum (see chart below), the most important consideration is that the ETF continues to make higher highs and lows and remains above its rising 15-day moving average. As long as IAU remains above the $12.50 level on an intraday basis (the nearest short-term pivotal level), I recommend that we maintain a long position in this ETF.

Source: BigCharts

Gold's intermediate-term outlook is still favorable despite the likelihood of a positive resolution to the U.S.-China trade dispute. While an end to the trade war would undermine gold's safe-haven demand, it would also likely increase demand from gold-consuming nations such as China. Evidence from the economically-sensitive copper price, which is largely determined by China's industrial demand, supports this outlook. Investors are therefore justified in maintaining a bullish bias on gold.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts