Can Gold Ignore A Rising Dollar For Long?

The dollar's best performance in two years is an obstacle for gold.

Global trade worries and interest rate factors should mitigate this.

Continued strength in gold stocks supports gold's rising interim trend.

Even as the dollar strengthens, gold has retained its buoyancy thanks to the high levels of fear and uncertainty surrounding the upcoming U.S.-China trade deadline. In today's report I'll ask the question, "Can gold continue to ignore a rising dollar without any adverse consequences?" The answer to this question would have to be "no" based on past precedent, although there is a proviso: gold's safety and competition (versus Treasury bonds) components will likely keep its intermediate-term (3-9 month) upward trend intact.

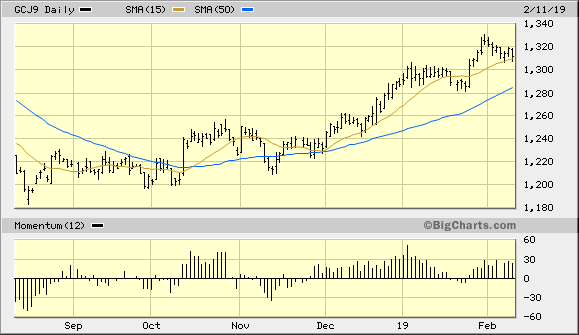

Even as global equities finished last week on a down note, the price of gold continued to be a beacon of strength in an otherwise sluggish market environment for other major assets. As can be seen in the graph shown below, the April gold futures price finished the latest week above its 15-day moving average, which technically confirms that the immediate-term (1-4 week) trend for gold remains up. It also finished yet another week above its popular 50-day moving average, which confirms that gold's intermediate-term trend remains up. Significantly, the gold price has remained above the 50-day MA since late November.

Source: BigCharts

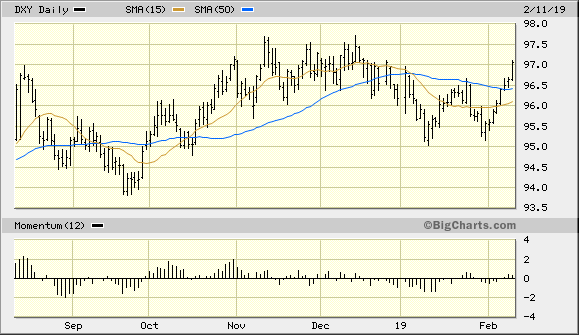

The tenacity of gold's rising trend, however, is a reason for believing that a test of the 50-day MA is likely coming up soon. That gold has risen for nearly two-and-a-half months without even so much as touching its 50-day MA is unusual, and a case can be made that gold is overdue a test of this widely watched trend line. It should be obvious what would likely trigger such a test, namely the recent strength of the U.S. dollar index (DXY). The dollar has risen for the last eight trading sessions and is very close to its 2018 high (below). Since gold is priced in dollars, the metal's currency component is widely regarded as being one of the most important determinants of its intermediate-term direction. It's indeed a rare event when gold can shrug off sustained strength in the dollar for more than a few consecutive days.

Source: BigCharts

For this reason, if the dollar index continues its advance in the coming days and ends up rising above its previous high from last November, gold investors can expect a pullback in the gold price. How much of a pullback is, of course, open to conjecture. My best guess in view of gold's current fear component strength would be a pullback that takes the gold price down to around the $1,280 level. Not only is this gold's nearest pivotal point, based on the previous test of this level in late January, it's also around the point where the 50-day moving average can be seen in the daily chart above. However, even if gold declines from here, as long as the metal price remains above the 50-day MA on a weekly closing basis, we can continue to assume that gold's intermediate-term recovery is still alive.

Investors are clearly growing ever more worried about the looming trade tariff deadline between the U.S. and China. With just a couple of weeks to go, no trade deal has been made and the tariff truce between both nations will be over if an agreement to lower tariffs hasn't been made by March 1. This would amount to a tariff increase of around $200 billion worth of Chinese imports. The looming trade deadline resulted in another increase in stock market volatility last week, as well as a small rally in the gold price, as investors expressed their apprehension over the lack of a deal.

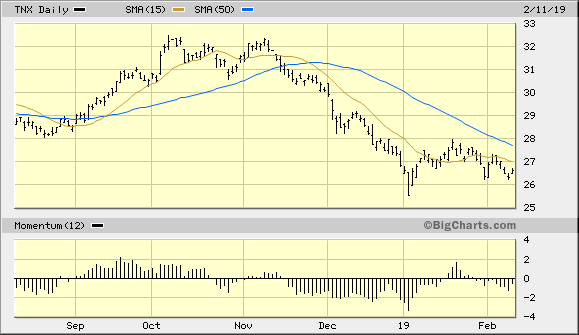

The widespread worries over the U.S.-China trade situation are helping gold by encouraging safe-haven buying among jittery investors. This fear is one of the major elements behind gold's continued relative strength despite a rising dollar index. Also serving to support the gold price is the recent pullback in U.S. Treasury yields, as discussed in the previous report. There is an inverse correlation between the gold price and the moves in the 10-Year Treasury Note Yield Index (TNX). As the following graph shows, TNX remains below its downward-trending 50-day moving average and is near a 6-month low. This is in marked contrast to the rising Treasury yields of last year, which in turn put downside pressure on gold prices due to competition from rising interest rates. Gold hasn't had to worry about this competition for several months, which is also supportive of gold's continued recovery.

Source: BigCharts

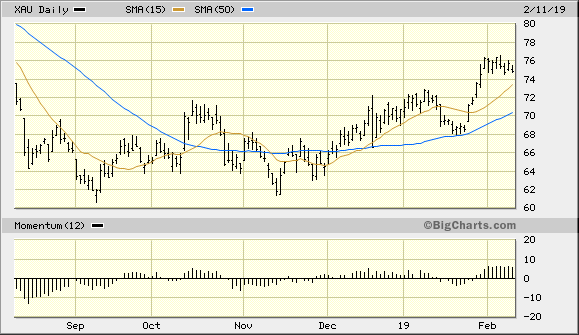

It's also encouraging for gold's interim upward trend that the stock prices of gold mining and exploration companies continue to confirm gold's relative price strength. Shown here is the PHLX Gold/Silver Index (XAU), which is still benefiting from increasing safe-haven demand for gold and gold mining shares. Due to the greater volatility of gold mining equities, the XAU index is usually the first to reverse a rising trend whenever the gold market is threatened (e.g. by currency strength, rising interest rates, etc.). The continued push forward in the XAU is an important confirming indicator for bullion and suggests that the bulls still have control of gold's intermediate-term trend.

Source: BigCharts

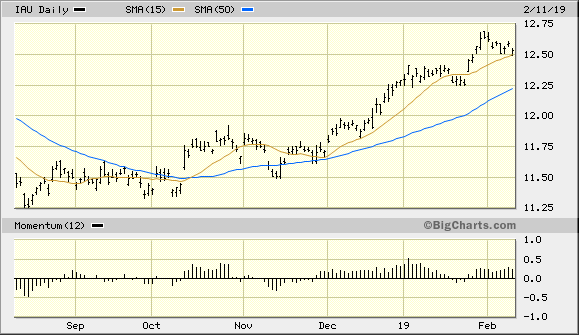

On the ETF front, the iShares Gold Trust (IAU) continues to track the gold price and also remains above its 15-day and 50-day moving averages. IAU is my preferred trading vehicle for gold and I've had a buy signal on this ETF since October. For now, that buy signal remains intact as long as IAU remains above the $12.35 level on an intraday basis. In the event that this level is violated in the coming days, I'll advocate a return to cash for short-term ETF traders based on the conservative rules of my trading discipline. For now, though, a bullish stance is still warranted.

Source: BigCharts

With the dollar index recently posting its longest rally in two years, gold investors are right to be a bit nervous about the growing possibility of a pullback in the metal's price. However, even if the gold price dips and tests its 50-day moving average within the next few days - and it probably will - the yellow metal will still enjoy the benefit of a strong "fear factor" as the U.S.-China trade war still has no resolution. What's more, low Treasury yields and a more lenient Federal Reserve interest rate policy should also help bolster gold's price and allow its 6-month-old turnaround to continue.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts