Canada's First Cobalt buys US explorer, creates key supplier outside Congo

Canada's First Cobalt Corp. (TSX-V:FCC) (ASX:FCC) is strengthening its position in the cobalt market by acquiring explorer US Cobalt and so create a pure-play North American-focused miner of the metal, a key component in computer chips, mobile phones and lithium-ion batteries that power electric vehicles (EVs).

The blended company will have projects in Ontario and Idaho which, once in operations, could be major cobalt suppliers for EVs makers, which now depend mostly on the Democratic Republic of Congo.

The African nation, responsible for about two thirds of global cobalt output, approved late last week a new mining code, which qualifies the coveted metal as a "strategic" commodity. The legislation clears the way for royalties on the metal to rise as much as fivefold to 10%.

Cobalt prices have more than tripled in the last 18 months amid fears of a looming shortage.First Cobalt noted the all-stock deal, which has an implied equity value of about Cdn$149.9 million ($116 million), would position it as a leading non-DRC cobalt company with North American projects located in proximity to infrastructure as well as electric vehicle and technology hubs, such as Michigan and California.

"We foresee a shortage of cobalt over the next five years yet there are few companies doing significant work to identify new sources of supply," chief executive Trent Mell said in the statement. "This transaction creates a larger platform to discover and develop cobalt projects for the growing electric vehicle market by combining high quality North American assets in two of the best cobalt jurisdictions outside the DRC."

As part of the deal all US Cobalt shares will be exchanged for First Cobalt shares, at a ratio of 1.5 First Cobalt shares for each US Cobalt share. That represents a premium of about 62% to US Cobalt's closing price on the Toronto Stock Exchange.

First Cobalt is looking to develop 50 historic mines in Ontario, while US Cobalt has the Iron Creek Cobalt Project in the US.

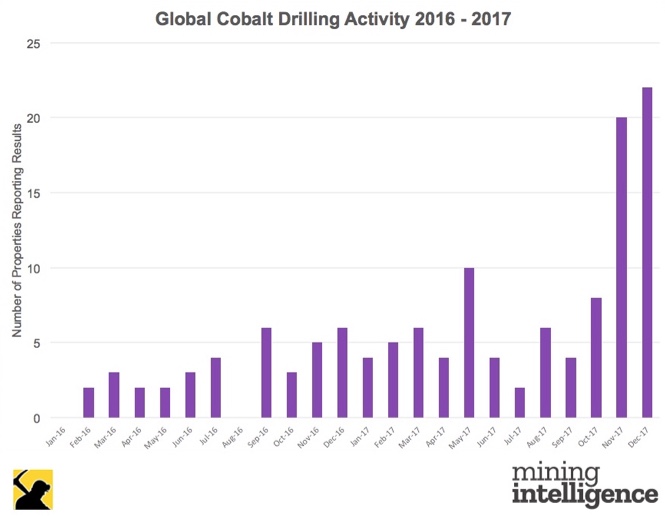

The number of companies exploring for cobalt has skyrocketed in the alst two years.

The Canadian miner also has the only refinery in North America capable of producing battery materials.

Cobalt prices went ballistic last year, with the metal quoted on the London Metal Exchange ending 2017 at $75,500, a 129% annual surge sparked by intensifying supply fears and an expected demand spike from battery markets.