Canadian Gold Miners Looking Strong

Gold is doing its seasonal thing, up from $1,200/oz in Q4 2018 to its current price of $1,314/oz.

Further, gold miners, particularly 3 Canadian developers: Pure Gold Mining, Marathon Gold, and Sabina Gold and Silver have outperformed not only gold but the mining ETFs, GDX and GDXJ, ytd.

The outperformance of the aforementioned Canadian developers are worth tracking as they could be signaling that interest in the gold sector on the whole is returning and M&A season is nearing.

Yes, it's true that the price of gold has rallied so far this year, which for anyone who has tracked the sector for any extended length of time knows that this is a common occurrence for the yellow metal. However, for speculators, what is by far of more interest is the question if whether or not this early strength displayed by gold to start off 2019 is precluding the beginning stages of the next bull market in precious metals, or if this is just another one of those seasonal fake-outs that is due to fizzle out shortly?

Looking back, the spot price of gold fell below $1,180/oz in August 2018 and hit an interim low of $1,200/oz in November, before rising to its current level of $1,314/oz.

Although there are many indicators one can use to try and determine if the stars are aligned for another major move up in gold ala the beginning of 2016, it's certainly not an exact science and more times than not the market tends to do something that hardly anyone anticipated it doing. As someone who became deeply interested in precious metals sector back in the summer of 2015, I can say from my own experience that during the January 2016 run-up in both gold and the mining stocks that it was a most shocking event to be a part of and witness in real-time. I still vividly recall having conversations with many skeptics and non-believers, particularly on January 19, 2016 (the darkest day before the dawn), when most everyone dabbling in the space was bracing for (much) more impact to the downside. As it turns out, the tides turned (for whatever reason) and by the summer of 2016, it was "happy days" again, and tremendous returns were had by many speculators who got into the gold trade before the unexpected turn up.

Gold Miners vs. Physical Gold

There is a common belief among analysts that the mining stocks lead the way, so if they are showing relative strength to the performance returns of physical gold, it's an encouraging sign for the health of the overall sector. To expand even further on this point, personally, I like to also track many of the more advanced-stage gold developers, particularly names operating in Canada, as an additional barometer to try and measure the interest in the gold mining sector.

Year-to-date (ytd), we have the following return for the following gold mining stocks:

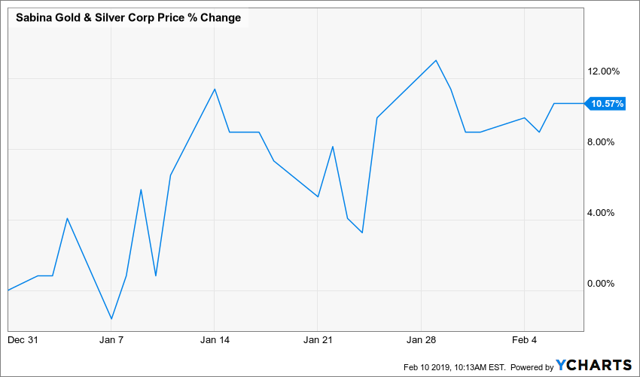

Pure Gold Mining (PGM.V/OTCPK:LRTNF) is up 21.54%, ytd. Marathon Gold (MOZ.TO/OTCQX:MGDPF) is up 27.27%, ytd. Sabina Gold and Silver (SBB.TO/OTCPK:SGSVF) is up 10.57%, ytd. VanEck Vectors Gold Miners ETF (GDX) is up 5.93%, ytd. VanEck Vectors Junior Gold Miners ETF (GDXJ) is up 6.98%, ytd.

Pure Gold Mining (PGM.V/OTCPK:LRTNF) is up 21.54%, ytd. Marathon Gold (MOZ.TO/OTCQX:MGDPF) is up 27.27%, ytd. Sabina Gold and Silver (SBB.TO/OTCPK:SGSVF) is up 10.57%, ytd. VanEck Vectors Gold Miners ETF (GDX) is up 5.93%, ytd. VanEck Vectors Junior Gold Miners ETF (GDXJ) is up 6.98%, ytd. The clear stand-outs from the cherry-picked list above are Pure Gold Mining and Marathon Gold. Additionally, it is worth noting that so far this year, the junior gold miners ETF, GDXJ, is outperforming the more senior gold miners ETF, GDX, which is typically what one would expect to happen when market sentiment turns positive towards the gold sector; the gap tends to widen more and more, peaking in the heat of a bull market.

Consequently, in a bear market, GDXJ can usually be found to underperform GDX, with the gap widening greatly as sentiment shifts from negative to even more negative towards the gold sector.

Canadian Gold Miners

So, why fixate on Canadian gold developers?

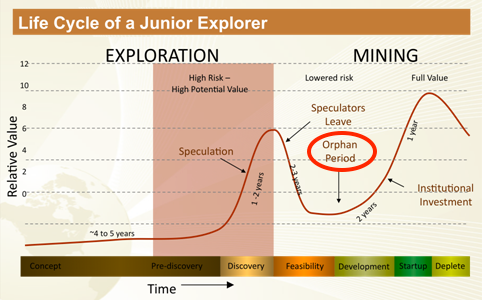

For starters, there is some truth to the following Lifecycle of a Junior Miner chart, which is often referenced when discussing the share price variation experienced by gold stocks as individual companies inevitably transition from explorer -> developer -> producer.

In the case of advanced-stage developers, when sentiment towards the gold sector is generally negative/bearish (perhaps even neutral), the share price performance of many companies should more or less coincide with the "Orphan Period", regardless of the jurisdiction where these projects reside.

Source: Google Image Search

On the flipside, when the gold sector returns en vogue and sentiment becomes positive/bullish, my own assumption/belief is that some (or many) advanced-stage gold developers, especially ones located in what is perceived to be "safe, secure, and stable" first world jurisdictions will start to buck the above trend and begin to climb steadily higher in share price.

Why is that?

Although it's true that "a rising tide will lift all boats", and this was especially true during the euphoric gold bull market of early-mid 2016, I found last time around that there is a degree of latency that manifests with these mining stocks, and they won't all start their respective turns at the same time. In other words, I would expect certain stocks (i.e. Canadian developers) to "lead the charge" before many other companies in the sector (especially those companies working on projects in perceived "non-safe/secure/stable" jurisdictions) to get the memo and begin to play catch up.

To try and figure out if the events above are news release driven, anomalies, or something else altogether, let's now take a closer look at the individual Canadian gold developers.

Pure Gold Mining

Pure Gold Mining is advancing their Madsen Gold Project, located in Red Lake, Ontario, through the development phase and a Definitive Feasibility Study (DFS) is due out sometime this month, along with an additional Preliminary Economic Assessment (PEA) for the company's satellite gold deposits: Wedge, Russet South, and Fork.

As it pertains to Pure Gold Mining, shares of PGM.V bottomed out in Q4 2018, and the share price started advancing on the heels of an announcement that test mining returned an estimated 56% more gold than predicted by the resource model.

Shares of PGM.V are up 31.67% since the November announcement.

However, as can be seen from the chart above, the share price appreciation of PGM.V has more or less been gradual, and although it certainly looks very favorable, we haven't seen an outright spike up higher (yet) that would be a hallmark attribute of a return to a full-fledging bull market in gold.

However, as can be seen from the chart above, the share price appreciation of PGM.V has more or less been gradual, and although it certainly looks very favorable, we haven't seen an outright spike up higher (yet) that would be a hallmark attribute of a return to a full-fledging bull market in gold.

Pure Gold is a developer especially worth monitoring closely because as already mentioned, the company has upcoming catalysts that could (should?) drive the share price materially higher if the news flow is positive (which from the recent share price performance suggests that expectations are growing). The actual degree of the move (along with volume traded) should give clues as to how much interest there exists from the marketplace for "safe and stable" advanced-stage gold developers, and subsequently for gold in general.

My own thoughts are this -- If the impending Pure Gold DFS + PEA errs more on the side of being positive than neutral/negative, it will be a huge statement made by the market if shares of PGM.V proceed to close on the day the news piece hits trading up in the double digits; to me, this would loudly suggest that Mergers and Acquisitions (M&A) season would be fast approaching and something on the near-term horizon.

On the other hand, if shares of PGM.V trade neutral/flat, or even reverse course and there is a stampede event to get out the door (due to what should be an increased liquidity event), it would be "more of the same" and what has become the defining characteristic for many gold developers these past few years.

Marathon Gold

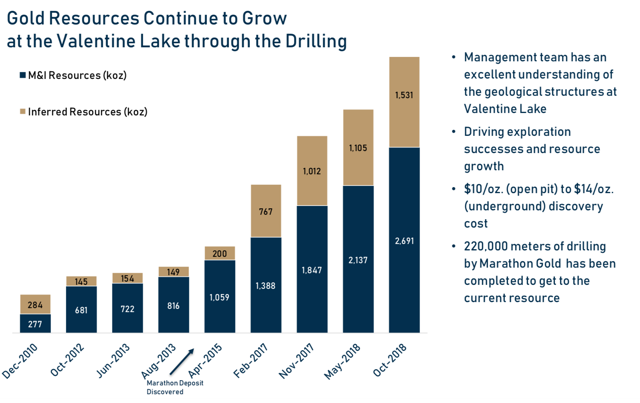

Another Canadian gold developer (arguably less advanced-stage than say Pure Gold Mining, but still very much proven) is Marathon Gold, working on drilling + growing their flagship Valentine Lake Gold Camp in Newfoundland.

Although the company has been very successful in growing the total resource base in recent years, because market sentiment towards gold and gold miners has fluctuated in a range of being negative/neutral, the share price of MOZ.TO hasn't responded favorably.

Source: Marathon Gold February 2019 Corporate Presentation

Actually, the share price of MOZ.TO has been going in the opposite direction of Valentine Lake's resource growth, falling -33% in 2018 alone, despite two significant resource revisions.

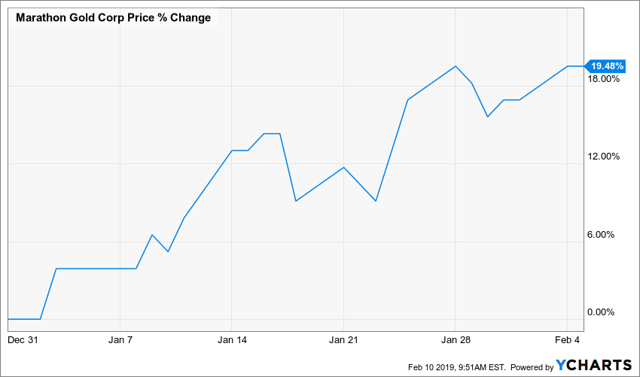

However, the trend has recently started to reverse, as shares of MOZ.TO rose 19.48% to start the year (From January 1, 2019 to February 5, 2019).

Interestingly enough for this "boring" gold developer, the share price was going up despite no material (noteworthy) news being reported to the market from the company.

Interestingly enough for this "boring" gold developer, the share price was going up despite no material (noteworthy) news being reported to the market from the company.

In fact, it wasn't until February 6 when infill drilling results came back confirming continuing of high-grade gold between adjacent drill holes.

The share rice of MOZ.TO has continued climbing since the February 6 news release, and as noted earlier, shares are now up 27.27% for the year.

The share rice of MOZ.TO has continued climbing since the February 6 news release, and as noted earlier, shares are now up 27.27% for the year.

Granted, Marathon Gold simply provides another datapoint, but this stock will be noteworthy to track as the year unfolds to see if shares can continue their torrid pace of ascent; also as mentioned earlier, it is somewhat "abnormal" for such a mature gold developer undergoing the "Orphan Phase" to experience such rapid share price appreciation. Perhaps, we have an additional sign that is suggesting that sentiment towards gold and gold miners is indeed starting to shift to positive?

Sabina Gold and Silver

The last advanced-stage gold Canadian gold developer that I would like to discuss now is Sabina Gold and Silver, which is working hard to advance its Back River Project, located in Nunavut, through to production.

Shares of SBB.TO are up 10.57% ytd, despite the company only having released a single news release, so far this year.

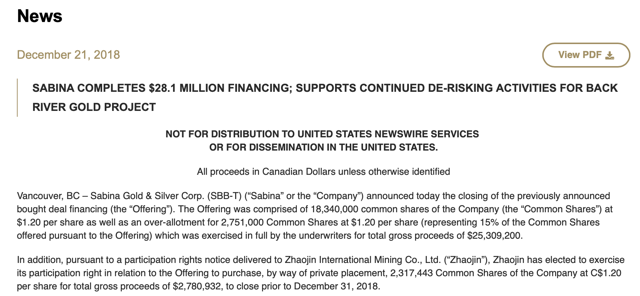

Although the press release was arguably positive, I'm not sure it provided enough of a "spark" to cause the share price 10.57% over the next month, alone. Worth mentioning, Sabina announced a financing in December 2018, and closed out the year raising an additional C$28.1 million at C$1.20/share to help advance Back River forward into the construction phase.

Worth mentioning, Sabina announced a financing in December 2018, and closed out the year raising an additional C$28.1 million at C$1.20/share to help advance Back River forward into the construction phase.

Typically, it's not uncommon to find the share price of an "orphaned" advanced-stage gold developer to languish at the same/similar share price to that of the most recent financing, but in the case of Sabina, any "down time" due to the events of an equity raise were especially short-lived. Sabina Gold and Silver has performed arguably very well so far this year, even producing returns that exceed the more general ETFs, GDX and GDXJ.

Typically, it's not uncommon to find the share price of an "orphaned" advanced-stage gold developer to languish at the same/similar share price to that of the most recent financing, but in the case of Sabina, any "down time" due to the events of an equity raise were especially short-lived. Sabina Gold and Silver has performed arguably very well so far this year, even producing returns that exceed the more general ETFs, GDX and GDXJ.

Takeover Candidates?

Although purely speculation on my part, a possible explanation for the relative strength of certain Canadian advanced-stage gold developers such as: Pure Gold Mining, Marathon Gold, and Sabina Gold and Silver is that they are prime takeover candidates for larger mid-tier/major producers, and again, because these projects are located in "safe, secure, and stable" jurisdictions, in a positive/bullish market for gold, these type of projects may be among the first to be picked off the shelf.

With all that said, by no means should it be implied that every single last Canadian gold developer is up for the year; that's simply not the case.

For example, Nighthawk Gold (NHK.TO/OTCQX:MIMZF), who is working on exploring/developing the Colomac Gold Project, located in Northwest Territories of Canada, had declined -7.95% ytd.

Granted, Nighthawk is arguably at an earlier stage of its development life cycle (having discovered over 2.6 million gold ounces but without yet having undertaken economic studies), than the aforementioned other three more advanced-stage gold developers working on projects located in Canada, which could explain the discrepancy in early year share price performance; perhaps, Nighthawk Gold may not be seen by the market to be "next in line" for a takeover bid?

Granted, Nighthawk is arguably at an earlier stage of its development life cycle (having discovered over 2.6 million gold ounces but without yet having undertaken economic studies), than the aforementioned other three more advanced-stage gold developers working on projects located in Canada, which could explain the discrepancy in early year share price performance; perhaps, Nighthawk Gold may not be seen by the market to be "next in line" for a takeover bid?

Moreover, there's another popular industry belief amongst certain analysts that for any major bull market in gold to truly begin, "the majors will lead the way."

The reason being? Large cap major gold producers have a significantly larger market capitalization which makes it much easier (increased liquidity) for big institutions to load up on.

When it comes to gold miners, the bellwether is Barrick Gold (GOLD), which is trading ~flat to start the year.

Unfortunately, for gold bugs, there's nothing noteworthy to glean from just this datapoint.

For M&A season to really heat up and for the gold rush to really be on full steam ahead, if history is to repeat, we will need to see not only the aforementioned advanced-stage gold developers rising fiercely, but also the larger cap gold producers (who will in all likelihood fund some/most/all of their purchases/acquisitions via company script).

No doubt, trying to come up with the right formula to determine when the next major turn/rally/bull market in gold miners is near imminent is not an easy task, but one datapoint that I like to look at is the share price performance (and interest) in advanced-stage Canadian gold developers. For select companies like: Pure Gold Mining, Marathon Gold, and Sabina Gold and Silver, it's been a strong (if not excellent) start to the year already, so for speculators interested in the gold mining sector, it will be worth tuning in attentively to see how these companies (and others) continue to perform as the year progresses.

For gold bulls in 2019, so far so good.

Disclosure: I am/we are long LRTNF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow FI Fighter and get email alerts