Canadian miners had a tough 2018, but optimism remains - EY

Canadian miners continued going down the slippery slope in the last three months of 2018 due mostly to weak commodity prices, triggered by a slowdown in China's economy near the end of the year, the latest report by Ernst & Young (EY) reveals.

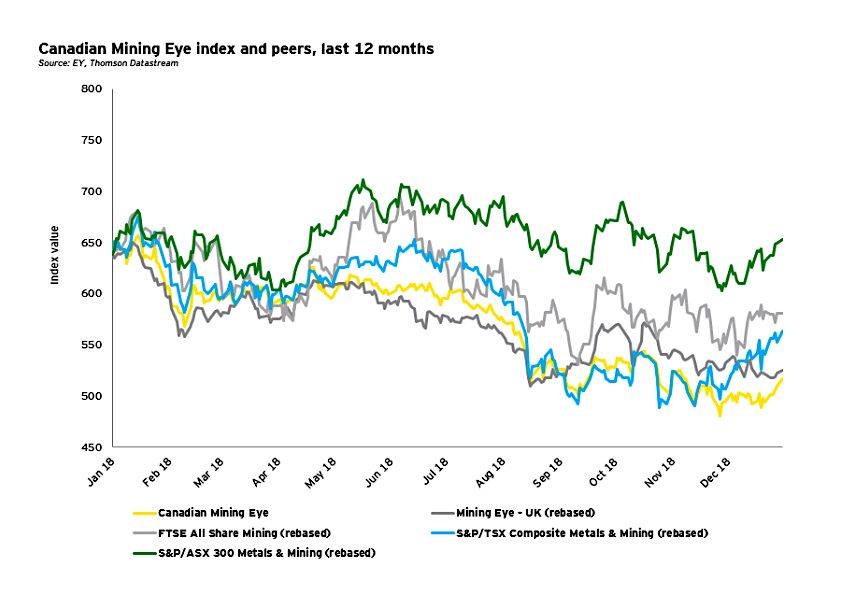

As a result, EY's Canadian Mining Eye index - which tracks the performance of 100 Toronto Stock Exchange and TSX Venture Exchange mid-tier and junior mining companies - dropped 2% in the last quarter of 2018. It had declined 12% over the previous three-month period.

"Although some commodities saw considerable volatility in 2018, we remain optimistic for the year ahead," says Jeff Swinoga, EY Canada Mining & Metals Leader. "Strategic transactions, refocusing on quality deposits and, of course, digital transformation are top of mind as the mining and metals industry continues to work toward reinventing itself this year."

Taken from EY Canadian Mining Eye Index Q4, 2018.

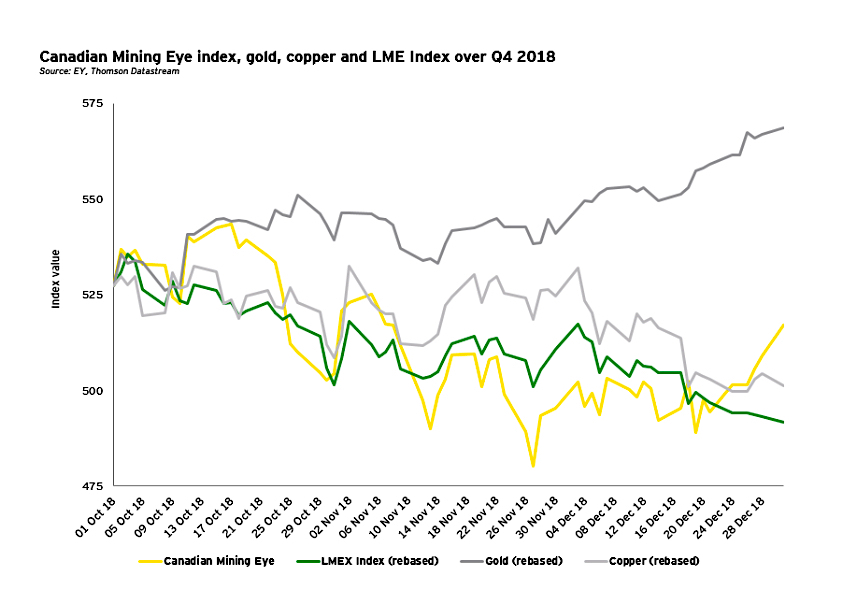

Industrial and precious commodities fell by about 12% by mid-December. In stark contrast, cobalt prices declined by 24% in the same period as compared with outstanding growth of 127% in 2017.

Copper and zinc prices both decreased by 5% in Q4 2018. Prices for gold went the opposite way, gaining 8% in the last three months of the year due to the weakness in global stock markets, uncertainty over future economic growth and a possible likelihood of fewer than three US Federal Reserve interest rate hikes in 2019.

Taken from EY Canadian Mining Eye Index Q4, 2018.

Most of the challenges faced by Canadian miners last year were partially related to China's slowdown. And while companies can anticipate more positive pricing in the near term, slower growth is expected to continue in China over the coming year, the report warns.

Commodity price volatility isn't the only consideration for mining and metals companies in the year ahead, as another EY report confirms.

"The shifting stakeholder landscape is creating mounting concerns from Canadian mining and metals companies over their license to operate," says Swinoga. "Firms must commit to being sustainable and responsible if they want to strengthen positive stakeholder relationships and attract new investment for future growth."

Looking ahead, the experts predict better metal prices driven by growing demand for nickel from the stainless steel sector and the electric vehicle battery market. They also see the copper and zinc market gaining momentum on supply constraints and tight market conditions.