Canadian Mining Eye index drops 29% in Q1 - report

Canadian Malartic mine in Quebec is currently on care and maintenance. Image from Agnico Eagle.

Canadian Malartic mine in Quebec is currently on care and maintenance. Image from Agnico Eagle.

Wordwide, mining companies are facing disruptions in supply chain, parts and consumables as a result of near-global government directives to contain the covid-19 pandemic.

Suspension or reduction of mining activity isexpected to lead to lower guidance from companies, according to EY's Q1 miningperformance and future outlook, but the scale of the impact remains unclear asthe pandemic continues.

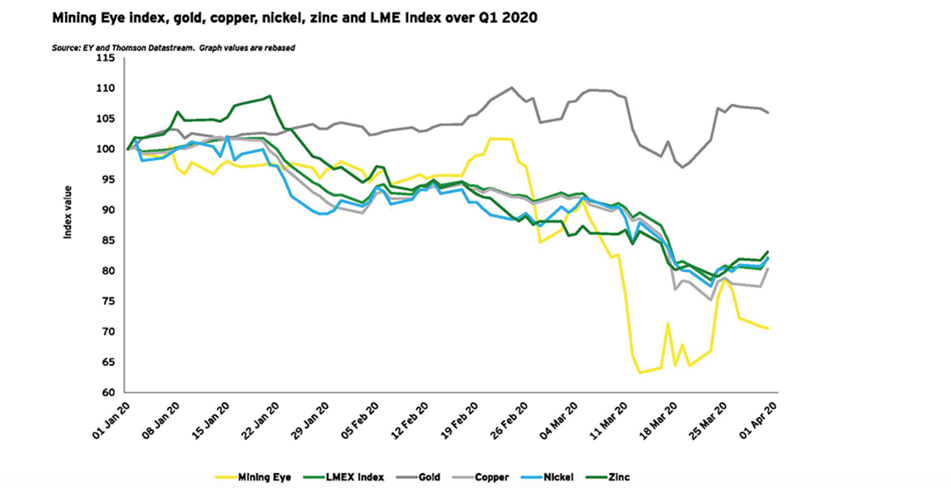

EY's Canadian Mining Eye index declined by 29% in Q1 2020, as compared to an 11% gain in the prior quarter.

Source: EY

Source: EY"The mining and metals sector continues to grapple with the impact of government covid-19 mandates on supply chains, parts and consumables," said Jay Patel, EY Canada Mining & Metals Transactions Leader.

"Companies are implementing their own measures toprotect their employees and ensure business continuity by placing mines intocare and maintenance, reducing operations or shutting down altogether, which ishaving a major impact on supply," Patel added.

Canadian mining companies have taken a numberof measures to both protect their employees and to ensure business continuity.

"The mining and metals sector continues to grapple with the impact of government covid-19 mandates on supply chains, parts and consumables"

Jay Patel, Canada Mining & Metals Transactions Leader, EYAgnico Eagle and Yamana Gold's Canadian Malartic mine, the country's largest gold mine, has been temporarily shut down to reduce the spread of the virus.

Newmont and IAMGOLD have put their Musselwhite, Cerro Negro and Westwood Gold mines into care and maintenance, and First Quantum Minerals and Teck Resources have been operating with reduced workforces.

Despite Canadian Mining Eye index declines, goldprices continued upward with a 6% increase following a 3% gain in Q4 2019 -following a common pattern seen when currency declines in a crisis, EYreported.

"Though prices have been volatile, gold reached aseven-year high in Q1 2020 and is expected to maintain growth momentum,supported by the slowdown in global markets and declining interest rates."

Base metals, on the other hand, haven't fared aswell in the current landscape. Nickel prices decreased a further 18% after a19% decline in the previous quarter. While copper and zinc prices witnessedrespective declines of 20% and 17%.

"Thesuspension or reduction of global business activity in automotive andconstruction sectors is lowering demand and pegging uncertainty on the outlookfor copper, nickel and zinc," said Jeff Swinoga, EY Canada Mining & MetalsCo-Leader.

"Base metals, for the most part, are expected to remain under pressure in short-term, but the full scale of the impact remains unclear as the pandemic continues."

Read the full report here.