Canadian Wealth Minerals to acquire Chile's Laguna Verde lithium project

Canadian junior Wealth Minerals (TSX-V:WML) said Monday it has signed a letter of intent to acquire one of Chile's attractive lithium projects located in the country's north, known for its vast salt flats under which experts say there is enough of the commodity to supply the world for decades.

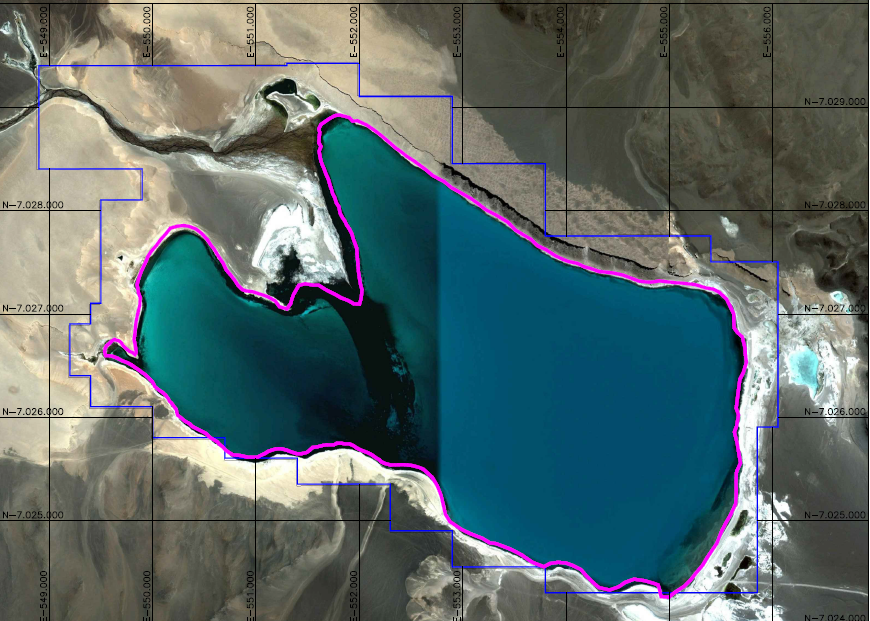

The project, known as Laguna Verde, comprises 23 concessions for a total of 2,438 hectares, with total inferred resource of 512,960 tonnes of lithium carbonate equivalent and 4,223,123 tonnes of potassium chloride equivalent, based on a technical report from 2010, the Vancouver-based company said.

If the transaction goes ahead, Wealth Minerals will pay $5 million in cash and deliver 7 million common shares to the current owners of the concession, located in a closed basin, surrounded by volcanic cones.

Until recently, Chile only allowed two companies to mine the increasingly popular metal. But the current leftist government has changed the rules and put some deposits up for tender.

The project, known as Laguna Verde, comprises 23 concessions for a total of 2,438 hectares, with total inferred resource of 512,960 tonnes of lithium carbonate equivalent and 4,223,123 tonnes of potassium chloride equivalent.The first one was awarded to US specialty chemicals firm Albemarle Corp, which earlier this year signed a deal with the country's economic development agency Corfo promising to help triple Chile's lithium output.

Michelle Bachelet's administration has said it sees public-private partnerships as the way forward and, in April, unveiled it was planning to open up more lithium deposits to foreign investors.

Earlier this month, a group of Chinese and Korean investors began talks with the Chilean government to open up a $2 billion mega-lithium batteries plant in the country's north, close to where Wealth Minerals already has the exclusive right and option to acquire a 100% royalty-free interest in 144 exploration concessions.

Lithium, frequently referred to as "white petroleum," drives much of the modern world, as it has become an irreplaceable component of rechargeable batteries used in high tech devices.

The market, while still relatively small - worth about $1bn a year - is expected to triple in size by 2025, according to analysts at Goldman Sachs.

That should be great news for Chile, as the country contains half of the world's most "economically extractable" reserves of the metal, according to the US Geographical Survey (USGS). It is also the world's lowest-cost producer, thanks to an efficient process that makes the most of the country's climate.

Chile is essentially "the Saudi Arabia of lithium," according to Marcelo A. Awad, executive director of the Chilean brand of Wealth Minerals, Canadian company that also has interests in Mexico and Peru.

The country, he said in a recent interview, is perfectly positioned, with ports across the Pacific from the world's largest car market, China, which is expected to increase electric vehicles production in years to come. There, lithium is also used to manufacture rechargeable -batteries that power hundreds of millions of smartphones, digital cameras and laptops.

Laguna verde area. (Image courtesy of Wealth Minerals)