Canadians spent over $32bn in mining acquisitions in first half of 2016

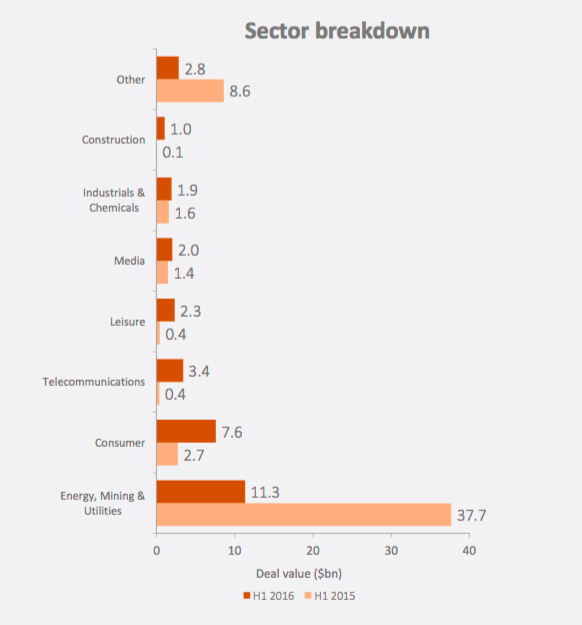

Canadian companies paid a total of US$32.6 billion for foreign businesses in the Energy, Mining & Utilities (EMU) sector during the first half of the year, which represents a 100.6% rise in value over the total paid in the same period last year, a new report released Tuesday shows.

The volume of deals, however, dropped by nearly half in the first six months of the year from 31 transactions in 2015, according to The Mergermarket Group.

Overall, Canadian deal-making in the first half of the year fell in line with the global cooling down trend that has followed the record valuations of 2015, the report says.

Courtesy of Mergermarket.

The top two acquisitions in the period were of US-based power and utilities targets, including TransCanada's (TSX, NYSE:TRP) $12bn bid for Columbia Pipeline Group and Fortis' (TSX:FTS) $11.3bn bid for ITC Holdings. Together, the two deals were responsible for 31.9% of Canada's total outbound activity, which overall fell 7% to $ 73.1bn from $ 78.6bn in H1 2015.

While the figures show that energy and other resource companies have begun taking advantage of firmer commodity prices to raise equity, they also prove firms have been cautious on acquisitions.