Capital allocation: Canadian miners' top priority for 2017

Capital allocation will be the top priority for Canada's large mining companies going into 2017, as they'll have to focus on directing money to the right projects and advancing them with the necessary funding in place, a new report released by PwC Wednesday shows.

The mine of the future will embrace innovation and non-traditional ideas to overcome challenges and achieve success, the document says, adding that companies among the top 25 have already made significant changes to the way they conduct business.

Sector may see new players from other industries enter the mining business, trying to take over and redefine mining in segments such as lithium.Those innovations, the study says, include the use of an electricity and battery-powered underground fleet to eliminate all greenhouse gases, and the reduction of energy and water consumption through improved mineral recovery processes.

The sector may also see new players from other industries enter the mining business, trying to take over and redefine mining in segments such as lithium.

The key to success, according to Liam Fitzgerald, PwC's Canadian Mining Leader, will be miners' ability to retain lessons learned over the last few years about prudence, resilience and financial discipline.

A growing commitment to sustainability and engaging in strong and meaningful community relations is key to redefining the identity of an industry, which is in the midst of transformation as it strives towards a more certain future, he says.

The recent and prolonged economic downturn has lessened the tolerance level for risk in the industry at the same time as geopolitical volatility has been on the rise. As a result, many mining companies are looking to diversify their portfolios, adding assets in markets considered relatively stable-such as North America and parts of South America-to offset the risks of projects in more troubled locations, including many regions of Africa, the analyst explains.

Source: Beyond the downturn: A focus on financial discipline and innovation in Canadian mining. PwC, Dec. 2016.

Some mining companies that still face weak commodity prices continue to focus on consolidation, he adds.

"Whether Tesla Motors or other non-mining companies make a bigger play in the mining sector...that'll be the key indicator of whether the incumbents will still rule the mining sector in 15 years' time," Fitzgerald notes.

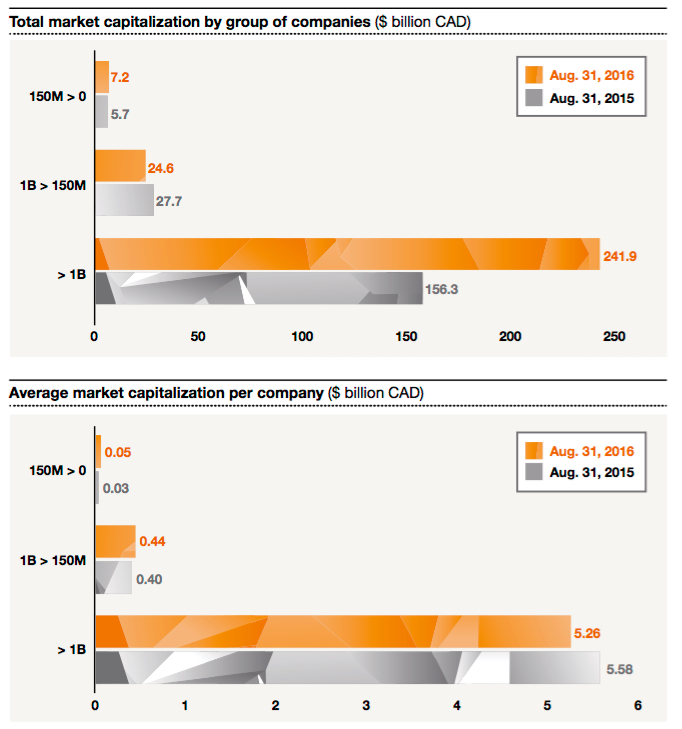

According to the expert, miners are waving 2016 goodbye in a stronger position than it began the year - the 230 mining companies listed on the TSX comprised 11% of the market's $2,596 billion market capitalization, a 3% increase of the sector from the previous year.

____

The full report Beyond the downturn: A focus on financial discipline and innovation in Canadian mining, which includes the latest industry figures and insights from mining sector leaders, can be downloaded here.

Watch Liam Fitzgerald, PwC's Canadian Mining Leader, discuss the findings of the study: