Castle Silver should be called Castle Cobalt

Lately I have read dozens of pieces speculating on the timing of a transition of automobiles from human-driven oil based combustion engine-powered to computer-controlled battery-powered machines. We know it will happen and the guesses as to timing are getting closer and closer. What should be obvious is that one of the most important technological advances in history is taking place right under our noses.

When the gasoline-powered automobiles first came out few could recognize the impact they would have on the world. While Ford and Lincoln and Rolls made money, buggy-whip manufacturers went out of business. It's called creative destruction. Ross Perot used to say that every business should burn itself down once a year or so. There is some truth to that; every business needs to reinvent itself on a regular basis.

For now, lithium batteries seem to be the power source in the highest demand. That, too, shall change no doubt. The inputs to lithium batteries include naturally lithium, graphite and in most designs of batteries, cobalt.

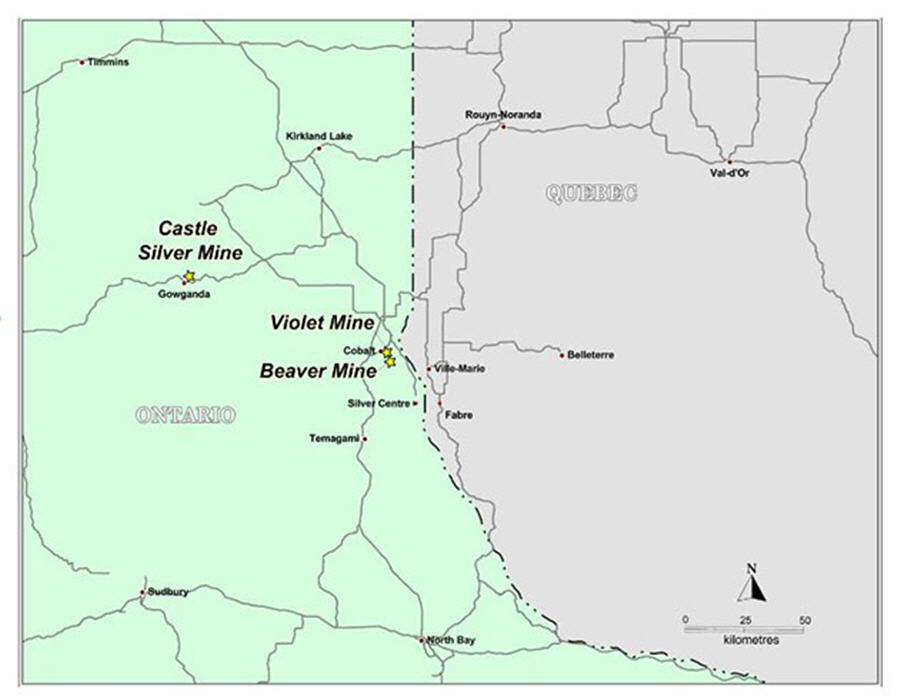

Castle Silver Resources Inc. (CSR:TSX.V) is the spawn of a company that used to be known as Gold Bullion Development, now known as Granada Gold Mine. In 2010 Gold Bullion Development made a significant discovery at the Granada Mine and that project became their primary focus. They spun off the Castle Silver Mine and all their non-gold assets into a wholly owned sub in 2011. In 2012 they bought the Beaver and Violet silver/cobalt properties and put them into the subsidiary.

In 2015 Gold Bullion Development completed an RTO and took Castle Silver public by taking over a public vehicle. The company has about 39 million shares outstanding and 53 million on a fully diluted basis.

The Castle Silver mine began production in 1917 and produced 22 million ounces of silver and 300,000 pounds of cobalt until final production ceased in 1989 due to low prices for silver and cobalt. During most of that time, cobalt was regarded as a negative product and was only produced because they wanted the high-grade silver.

How thing change. In just over a year the price of cobalt moved from a record low price of $9.82 a pound in February of 2016 to a high of $25.40 a pound in April of 2017. It's important to understand that while the price of cobalt, lithium and graphite have gone up, the overall cost of lithium batteries has declined due to manufacturing cost efficiencies. Reports show that electric vehicle batteries have declined by 80% in six years.

The best place to ever find a deposit is said to be in the shadow of an old head frame. With the Castle Silver Mine that seems to be true. While past mining focused on the production of silver, many of the adits contain visible cobalt veins and at least a bulk sample for testing purposes would be easy to mine and permit.

Cobalt is primarily produced as a by-product of nickel and copper production, some 94% of the total. So no one is going to expand their copper or nickel mine just to get more cobalt at any price. About 54% of today's cobalt comes from the DRC with all the attendant legal and social issues. Battery manufacturers want legally sourced and socially responsible cobalt in today's "Green" world.

Castle Silver intends to work on advancing a drill hole plan in mid-2017 and has planned a major drill program for the fall of 2017. In addition, Castle owns the Beaver silver/cobalt mine and the Violet silver/cobalt mine in the Cobalt Mining Camp of Ontario. The company plans on a program to test tailings and dumps from the Beaver and Violet Mines to determine potential recovery of material left from prior mining operations.

Castle Silver is not some one trick pony. They have an interesting process up their sleeve called Re-2OX. It's a 100% owned hydro-metallurgical process developed in conjunction with the National Research Council (NRC) of Canada. It's a way of treating various feeds chemically for high recovery and the output can be specific high-purity powders for client specific requirements such as lithium battery manufacturers.

The company is still very cheap compared to their peers. Over the next few months' investors can expect a variety of news developments as progress is made. The company will be drilling, doing bulk samples and testing their cobalt feed with the Re-2OX process. With about 13 million warrants outstanding with prices between $0.10 and $0.20 the company should be able to self-finance from here. The $0.20 warrants can be accelerated should the price of the stock go over $0.30 for a ten-day consecutive period and that would bring in about $1.25 million in cash.

I am a big fan of solar and wind power and I think I see the massive changes coming. When I was contacted with the story of Castle Silver I went out and bought some shares in the open market and I have participated in the latest private placement. Naturally I am biased. Castle Silver is an advertiser.

The company is excellent at communication and any potential investor should peruse their company presentation. Do your own due diligence.

Castle Silver ResourcesCSR-V $.24 (May 23, 2017)TAKRF-OTCBB 38.9 million sharesCastle Silver Resources website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Castle Silver. Castle Silver is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.2) The following companies mentioned are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.