Caterpillar soars as first quarter sales jump for first time in over two years

Shares in world's largest heavy machinery maker Caterpillar (NYSE:CAT) jumped Tuesday as it reported a first quarter profit that far exceeded estimates thanks to a long-awaited pick up in sales and improved demand.

For the first time in more than two years, the Peoria, Illinois-based company registered an increase in sales in several of the industries it serves, which boosted its revenue and profit forecasts for the year.

Despite the improved sales and revenue outlook for 2017, Caterpillar continues to see uncertainty across the globe, potential for volatility in commodity prices and weakness in key markets.The news sent CAT's stock up more than 6% to $102.78 in premarket trading in New York. By late afternoon, it was up 7.49% to $104 and if such gains hold, the equipment maker alone will add more than 40 points to the Dow Jones industrial index for the day.

"Our team delivered outstanding operational performance and, for the first time in more than two years, same quarter sales and revenues increased," chief executive Jim Umpleby said in a statement. "We're also benefiting from our significant cost reduction and restructuring actions, which have improved cash flow and further strengthened an already healthy balance sheet."

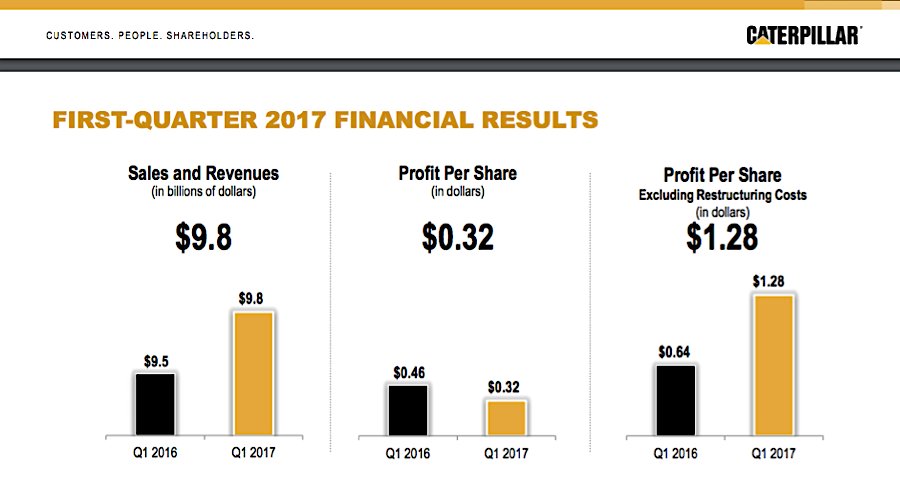

Caterpillar said it now expects 2017 adjusted earnings of $3.75 per share, up from the $2.90 it had previously forecast. But first quarter earnings per share fell to 32 cents from 46 cents per share a year earlier.

In the first three months of the year CAT's sales and revenues reached $9.8 billion, compared with $9.5 billion it logged a year earlier. The firm also raised its forecast of full year sales and revenues to a range of $38bn to $41bn, up from $36bn to $39bn previously forecast.

The executive noted that despite the improved sales and revenue outlook for 2017, the company said it continues to see uncertainty across the globe, potential for volatility in commodity prices and weakness in key markets.

Caterpillar's performance is often seen as a gauge of the health of the global economy, as its machines are huge, expensive, and used in different kinds of projects to which companies and governments are only likely to commit if they're confident in the economic outlook and their financial standing.

Taken from Caterpillar's Q1 2017 Results Presentation.