Cautiously optimistic about nickel price

Base metals have enjoyed a solid 2016 so far with only lead (-3%) in negative territory for the year. While the likes of zinc (+28%) and tin (+16%) have rallied and steelmaking raw materials iron ore (+24%) and coking coal (+12%) have come back strongly, nickel remains stuck in the doldrums.

On the LME nickel jumped back above $9,000 on Wednesday, but hasn't been in five-digit territory for nearly a year and is worth half of what it was early in 2014 when Indonesia's ban on ore exports led many to believe the volatile metal is entering a bull market.

The subdued pricing environment has mostly been blamed on elevated inventories and both the LME and particularly in Shanghai although stock levels at the former has recently been falling.

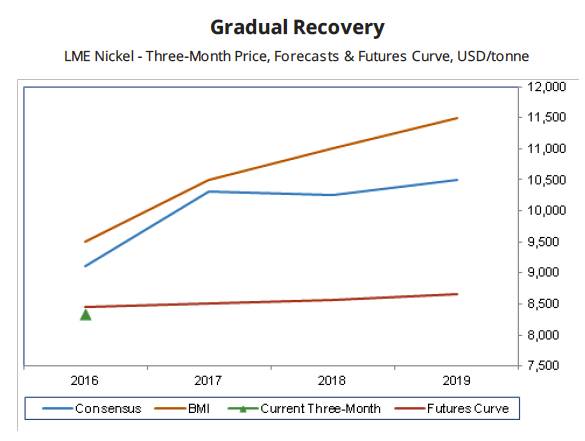

Source: BMI, Bloomberg

In a new report on the prospects for the steelmaking ingredient BMI Research says "the market will gradually begin to tighten as elevated Chinese imports start to erode global stockpiles" but the firm also warns "investor sentiment towards industrial metals will remain cautious as Chinese economic data will continue to disappoint."

BMI expects strengthening fundamentals in the nickel market and a more general bounce in metal prices for the second half of the year which "will start to push nickel prices towards $10,000 per tonne."

Longer term there is further upside although the frothy days of 2007 when nickel peaked at more than $50,000 look forever gone.

BMI is of the view that Indonesia will relax in part its ore ban but with Indonesian nickel pig iron smelters coming online by 2017 there won't be supply-crunch in the refined market.

That would keep a lid on the price which BMI forecasts to average $9,000 per tonne and $10,500 a tonne in 2016 and 2017, edging up to $11,500 a tonne by 2019. BMI's predictions are also above consensus.