CEF: Beneficial Gold And Silver Developments

The world's central banks have been ramping their purchases of gold recently, including purchases by a few banks that have previously ignored gold.

The United States continues to run an enormous deficit that shows no possibility of going down in the future.

There are signs that foreign investors are no longer willing to keep financing this deficit, which could ultimately lead to money printing.

Demand for solar power is likely to increase sharply next decade, pushing up demand for silver.

CEF allows investors to have exposure to both gold and silver bullion in one fell swoop.

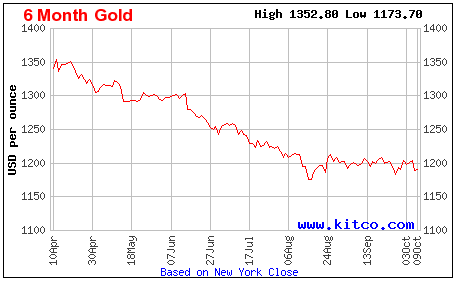

The past several months have certainly been unpleasant ones for precious metals investors as the price performance of both gold and silver have disappointed. This is at least partly due to the U.S. dollar, which has seen its value driven upward over the past year because of the Federal Reserve's tightening policy. However, there are some fundamental factors in play for both gold and silver that could ultimately have a beneficial impact on the price of both metals, which will be discussed in this article. Many of the world's greatest financial minds recommend having at least some allocation to precious metals in your portfolio as a hedge against various factors and it may prove prudent to do this. One easy way to do so is to purchase units of the Sprott Physical Gold and Silver Trust (CEF).

Central Banks

Over the past few years, I have discussed how some of the world's nations, most notably China and Russia, have been aggressively stockpiling gold, despite some price disappointment. In fact, the only impact that gold's price seems to have had on these buyers is that it has made it easier to acquire larger quantities of the metal.

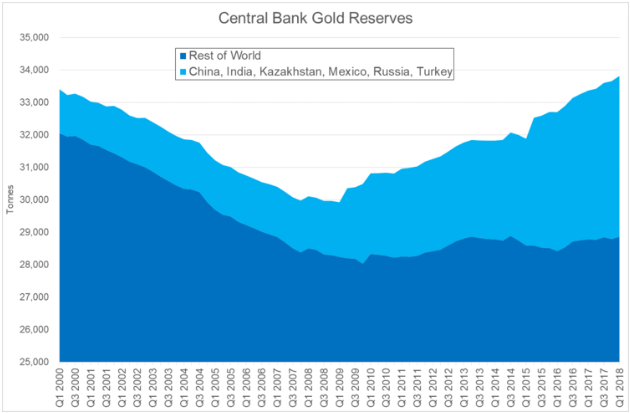

Recently however, we have seen an increasing number of countries purchase gold. For example, back in February, Poland became the first European Union member to purchase gold since 1998. In addition, Jordan, Mongolia, and Egypt have all been adding to their holdings over the past few years, although it has been somewhat sporadic. All in all, we can see here that the total gold reserves held by the world's central banks have been climbing since 2008 and today stands at higher levels than it did back in 2000:

Source: Gold Industry Group

Source: Gold Industry Group

The fact that the global reserves of gold at the world's central banks is higher than in 2000 is an important milestone. This is because it shows us that a handful of emerging nations have now more than made up for the rash of Western central bank selling over the years.

It is also worth noting that this chart was constructed using officially published data. As many of my long-time readers on this topic are undoubtedly aware, I have long speculated that China has holdings that are well in excess of its official figures, due to the fact that gold inflows have greatly exceeded outflows from the nation for many years. As the country rarely publishes reserve data, we have no way of knowing for certain. It seems quite possible that it is specifically avoiding publishing data in order to avoid impacting the market as gold prices may surge upward if this information were known, but this is merely speculation on my part.

Fundamentally the entry of new central banks into the gold buying market, such as Poland's, should be seen as a bullish sign. This is because it increases the demand for the metal. There have been no notable supply increases to meet this new demand, therefore it should exert some upward pressure on the price. That has thus far not happened.

Source: Kitco

Source: Kitco

Government Deficits and the National Debt

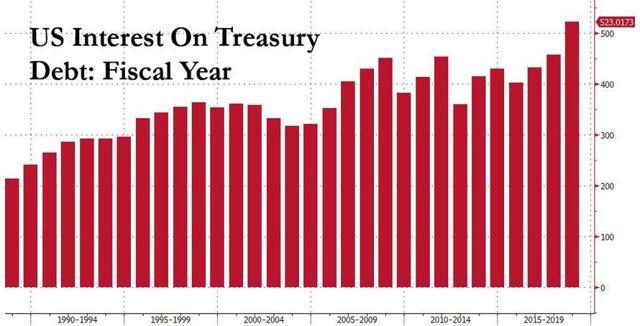

The U.S. government ended its budget year at the end of September. One of the more interesting facts is that a total of $523 billion was spent on interest alone during the fiscal year, which was its highest level ever:

Obviously, the reason for this is rising interest rates combined with a growing national debt. It is unlikely that this problem is going to get better anytime soon as recent projections foresee annual deficits exceeding $1 trillion going forward. When we pair this with the likelihood of higher interest rates going forward, we see that the strain on the nation's finances is likely to get worse and worse.

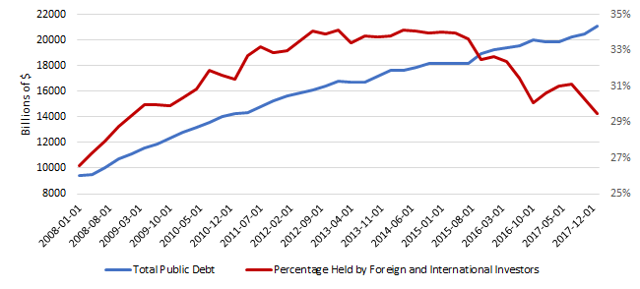

Thus far, there has been little concerted effort on the part of either of the major political parties to get this spending problem under control. One likely reason for this is that foreign investors and central banks have been largely willing to finance the spending addiction of the United States. There are signs though that this is beginning to change. According to the St. Louis Federal Reserve, foreign investors and central banks have been steadily reducing their holdings of U.S. Treasuries since 2015, with another large decline last year:

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

This is putting an increasing demand on domestic investors and savers to finance the ever growing deficits. When we consider that the Baby Boomer generation has begun to retire and is no longer in the asset accumulation phase of their lives and the still very low yields on Treasuries, this seems somewhat unlikely to occur over a sustained period.

Ultimately, this could force the Federal Reserve to begin monetizing the deficit, which would prove negative for the U.S. dollar. As gold prices somewhat move inversely of the U.S. dollar, this could prove good for gold.

Solar Panels and Silver

Now, onto silver, which is the other precious metal held by the Spott Gold and Silver Trust. First of all, silver is a precious metal just like gold is. As such, it is positively impacted by many of the same factors that positively impact gold. It is, however, also an industrial metal, which will likely result in it seeing growing demand going forward. This is due to the growing prevalence of solar power in the American market.

Back in May, the California state legislature mandated that all new homes built in 2020 or beyond be equipped with solar panels. As California is currently the nation's most populous state and largest housing market, we can expect this requirement to increase the demand for solar panels. This increased demand for solar panels will by extension greatly boost the demand for silver.

As I discussed in an earlier article, silver is used for a variety of things, although its use in electronics and electrical goods are currently the largest. Solar panel construction could easily exceed this though. According to Casey Research, it requires approximately 200-300 milligrams of silver to construct a cellular telephone and 750 milligrams to 1.25 grams of silver to construct a laptop computer. It requires approximately twenty grams of silver to construct a photovoltaic cell. Thus, we can see how a surge in the demand for solar panels, such as that caused by the California mandate, will cause growth in silver demand. All else being equal, the law of supply and demand would tell us that the price of silver should surge upward.

About The Trust

The preferred method to invest in all of these trends at once is the Sprott Gold and Silver Trust due largely to the fact that it invests in both gold and silver bullion in London Good Delivery bar form. These bars are held in custody by the Royal Canadian Mint in Canada, which offers a nice alternative to the London vaults that other bullion funds use.

One of the nicest features of this trust addresses some of the concerns that some people have about things like the SPDR Gold ETF (GLD). That concern is that the ETF does not actually have enough gold in its vaults to back all of its outstanding shares. CEF addresses these concerns by making all of its units fully redeemable for physical gold and silver. As CEF is a closed-end trust rather than an exchange-traded fund, it does make it much easier for it to actually own all of the precious metals that it needs to fully back its units. In addition, this feature should improve the ability of the trust's unit price to track the actual price of the metals as arbitrageurs would likely take advantage of pricing differences.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Power Hedge and get email alerts