Cenovus Energy starts to run circles around oil patch rivals

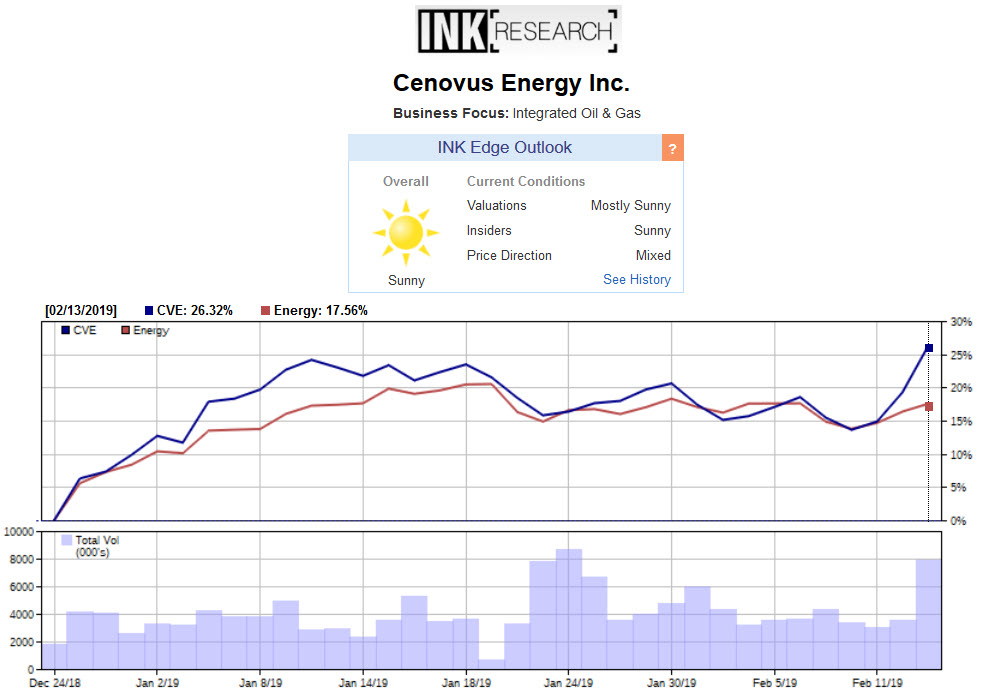

We will be releasing our Energy Top 30 later tonight, and given that Cenovus Energy (CVE) continues to have a sunny INK Edge outlook we expect it will remain near the top of the charts. The company made some waves in the oil patch last year by backing the Alberta government's plan to curtail oil production, even as some key rivals such as Suncor (Mixed; SU) knocked the plan. While we are no fans of government intervention in the oil patch, CEOs need to play the hand they are dealt. The Canadian oil patch world is more complex than ever. CEOs have to navigate around both technological and political forces which often work in conflict.

So far, Alex Pourbaix who has been at the helm of Cenovus since November 6, 2017, seems to have found his groove. Late last year, the company came out on the winning side of the Alberta production cut political debate. Now, with rivals fretting over the impact of narrowing Canada-US crude price spreads on oil-by-rail economics, the Cenovus leader is making a strategic move to secure more oil-by-rail capacity to deal with an expected widening of the spread differential.

Although the moves might be leaving some heads spinning, investors have been warming up to Cenovus. Since the Christmas Eve lows, the stock is outperforming the broad sector by more than 8% as of February 13th. While companies can always surprise on the up or downside, based on our rankings Cenovus is emerging as the new leader in a sector dominated by science and political meddling. Given the importance of the Energy sector in the Canadian market, the Cenovus CEO's agility is turning out to be a welcome development. We will have to see if some of the company's larger rivals also show they can dance to the brave-new-world oil patch beat.

This post first appeared on INKResearch.com.