Central bank gold buying surges to 50-year high

Against a backdrop of continued stock market volatility and geopolitical risk, gold demand surged in Q4 of 2018, according to a new report released today from the World Gold Council.

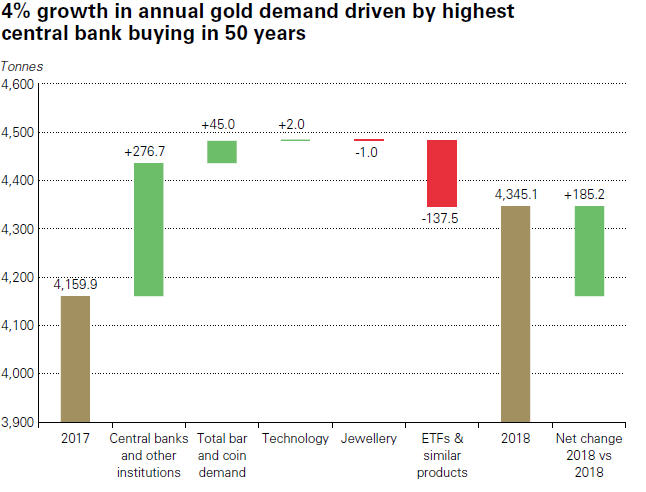

Annual gold demand increased 4% on highest central bank buying in 50 years. Gold demand in 2018 reached 4,345.1 tonnes, up from 4,159.9 tonnes in 2017. Central banks' demand for gold soared to the highest level since the dissolution of Bretton Woods.

Central banks' demand for gold soared to 651 tonnes in 2018, 74% higher year over year -the highest level since the dissolution of Bretton Woods and the US eliminated the gold standard.

Net purchases jumped to their highest since 1971, as a greater pool of central banks turned to gold as a diversifier.

Russia, Turkey and Kazakhstan remained key buyers throughout the year, while Russian gold production rose 10% year-over-year.

Central bank buying, Q4 2018, World Gold Council.

World Gold Council analysts assert that central banks reacted to rising macroeconomic and geopolitical pressures by actively increasing their gold reserves.

Stock market weakness in the fourth quarter helped fuel inflows into gold-backed exchange traded funds, which resulted in 3.4B of inflows. The report reveals annual inflows into gold-backed ETFs slowed to 68.9 tonnes, 67% lower than the 206.4 tonnes in 2017.

Sizable annual flows into European-listed funds (+96.8 tonnes) drove growth in the sector, the report reads. And while North American funds experienced heavy outflows for part of the year, strong global Q4 inflows propelled total assets under management to 2,440 tonnes by year-end, up 3% year -over-year from 2,371 tonnes. For the first time since 2012, the value of total gold-backed ETF holdings finished the year above $100B.

Read the full report here.