Central Banks Do Gold Another Favor

Gold price hits 10-month high as global growth concerns abound.

Dovish stance among world's leading central banks has boosted gold.

Expect a move to the $1,400 soon before the next short-term top.

Gold started the latest week with a bang and gave the bulls something to cheer. Gold's latest move higher confirms what we've discussed in recent reports, namely that even a strong dollar won't undermine its intermediate-term bull market. After the metal's latest blow-out session, we're getting closer to the point where we can likely expect to see the retail crowd jumping onto gold's bandwagon. In today's report, I'll make the case that gold will soon reach its high from last April before attracting attention from momentum traders and posting a short-term top. We'll also discuss the positive impact that central banks continue to have on the market.

Tuesday's trading session answered some questions for the gold bulls. Specifically, the question of whether or not the metal could continue its intermediate-term (3-9 month) recovery in the face of a strong U.S. dollar was weighing on participants' minds. Gold prices hit a 10-month high on Feb. 19 as a combination of a weaker dollar and continued concern over the global economy boosted its safety appeal. The spot gold price rose 1.1 percent to $1,341, while April gold futures added 1.70 percent to close at $1,344.

Indeed, things just keep looking up for the yellow metal as the intermediate-term rally continues apace. A confluence of factors stimulated the latest move to multi-month highs, with concerns over a weakening global economy foremost among them. The World Trade Organization warned on Tuesday that its leading indicator of world trade in goods fell to its lowest level in nine years. The WTO's quarterly outlook indicator is comprised of seven components of global trade and flashed a reading of 96.3, the weakest since March 2010 and down from 98.6 in November. A reading below 100 is regarded as a sub-optimal growth in trade levels.

Many economists believe the WTO's latest indicator signal could be a precursor of a major slowdown in the global economy, with possibly negative repercussions for the U.S. economy. It also underscored the continued trade dispute between the U.S. and its chief trading partner, China.

Another headline which encouraged investors to buy gold was the news that the Bank of Japan (BoJ) is considering additional easing of its monetary policy. Gold demand was in evidence after this statement as many traders regarded this as a sign that global weakness is a serious enough threat to warrant central bank stimulus.

The BoJ isn't the only central bank considering a more accommodative monetary policy. The chief economist for the European Central Bank (ECB), Peter Praet, has stated that the bank may hold off on raising its benchmark interest rate in the face of a slowing eurozone economy. He also said he expected the ECB's economic forecasts to be cut again next month. These statements were interpreted by market participants as supporting the bullish safe-haven case for gold.

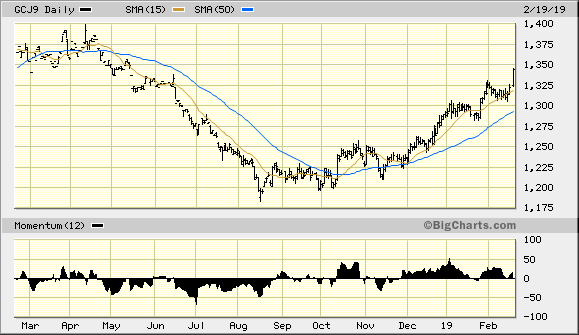

With a confluence of international economic developments supporting a higher gold price, let's turn our attention to the yellow metal's latest performance. Shown here is the 1-year graph for the April gold futures price. As you can see, the gold price is quickly on its way toward last April's high at approximately the $1,400 level. This is the nearest round-number benchmark price of any consequence, and as such it carries a psychological significance. The legendary trader Jesse Livermore believed that markets are attracted to big round numbers. If Livermore is to be believed then gold should soon arrive at the $1,400 level, perhaps even by the end of this month.

Source: BigCharts

Looking further ahead, once the $1,400 level is tested again we could see a temporary pullback or "pause that refreshes" before gold continues its rally. Regardless of whether there is a pause at the $1,400 level or not, however, I anticipate that once the gold price rallies decisively above this level, we'll begin to see a steady increase in mainstream interest in the metal. Small-time traders and momentum chasers are likely to enter the market once a new 52-week high is achieved in the gold price.

This is when the intermediate-term gold recovery will likely face its greatest test of strength, for until now, gold's bull market has been controlled by informed investors and institutional players. Collectively, these stable elements have kept gold's price steady and volatility has been below normal. Volatility in a bull market typically increases when higher prices start attracting the fickle retail trading crowd, which results in price instability. For now, though, gold's low-volatility rising trend is likely safe until the $1,400 level is reached.

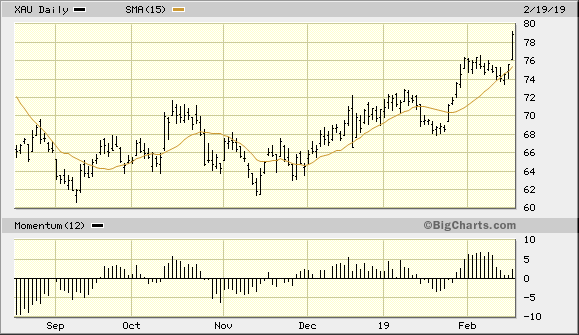

Providing some additional confirmation for gold's near-term strength is the latest rally in the PHLX Gold/Silver Index (XAU). In a bull market, gold mining stock prices often significantly outperform the gold price on upside days for bullion. That was certainly the case on Tuesday as the XAU rose 4.20 percent (compared to gold's 1.70 percent gain). Moreover, with gold mining and exploration shares on a major upswing right now, the odds have increased that the momentum-chasing crowd will soon enough enter the gold market and create more volatility for the metal's price. In the meantime, gold bulls should be encouraged by the leadership and relative strength in the XAU.

Source: BigCharts

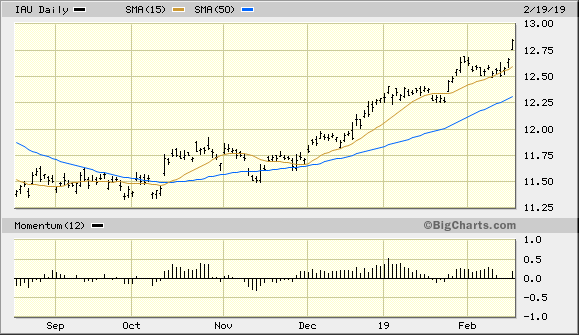

On the ETF front, the iShares Gold Trust (IAU) remains in excellent shape technically based on the rules of my trading discipline. IAU is still making steady upward progress on a weekly basis and is above its rising 15-day and 50-day moving averages - the latter trend line being the one most commonly watched by retail traders and institutional investors alike. This confirms that IAU's intermediate-term rising trend is still technically intact.

Source: BigCharts

In light of IAU's latest rally to a new multi-month peak, I recommend that we raise the stop-loss on this open trading position to slightly under the $12.50 level on an intraday basis. In the event that this level is violated in the coming days, I'll advocate a return to cash for short-term ETF traders based on the conservative rules of my trading discipline. For now, though, a bullish stance on the gold ETF is still warranted.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts